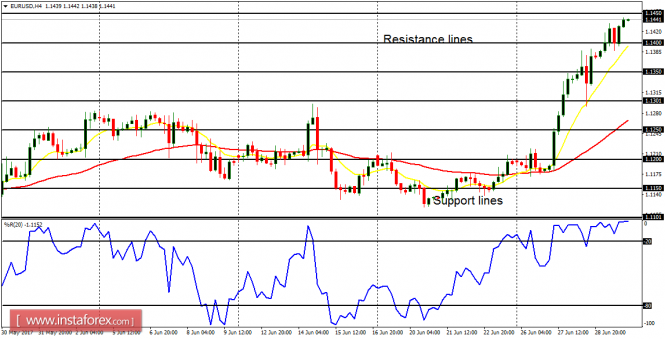

EUR/USD: The EUR/USD has gained about 250 pips this week, forming a very strong Bullish Confirmation Pattern in the market. Price is currently above the support line at 1.1400 and it would soon reach the resistance line at 1.1450 (it may even exceed that resistance line), as the buying pressure continues in the market.

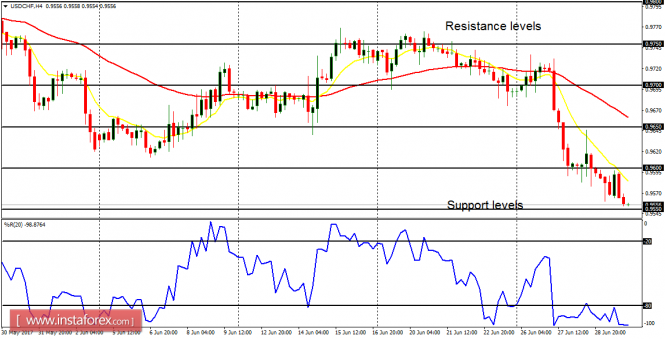

USD/CHF: The USD/CHF has lost about 160 pips this week, forming a very strong Bearish Confirmation Pattern in the market. Price is currently below the resistance level at 0.9600 and it would soon reach the support level at 0.9550 (it may even exceed that support level), as the selling pressure continues in the market.

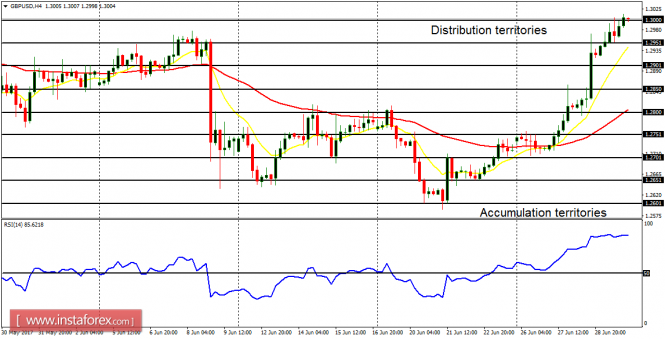

GBP/USD: The GBP/USD has also been pulled upwards by the buying pressure existing on its EUR/USD counterpart (since both of them are positively correlated). The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. This means further bullish movement is a possibility. The target for this week – at the accumulation territory of 1.3000 – has been exceeded. There is an immediate target at the distribution territory at 1.3050.

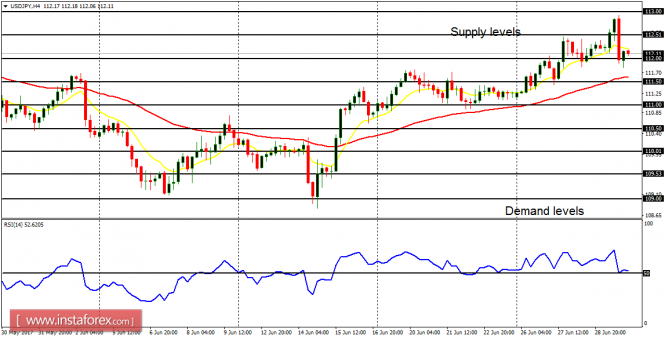

USD/JPY: Unlike certain JPY pairs, which have gone significantly upwards. This pair is simply in a bullish bias, and that is even being threatened. The EMA 11 is above the EMA 56, while the RSI period 14 is above the level 50. This shows mixed signals in the market and it would be OK to stay away from it until there is a directional movement, just as it is on the EUR/JPY.

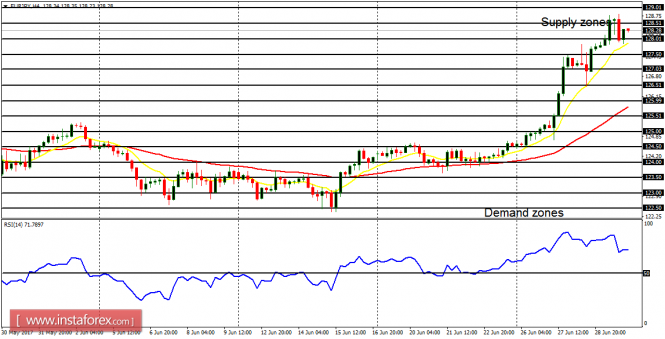

EUR/JPY: As it was forecast, the EUR/JPY has gone seriously northwards, gaining about 420 pips this week, before getting retraced below the supply zone at 128.00. The bearish retracement may give another opportunity to go long at a better price, because the price may go upwards again to test the supply zone at 128.50.