Trading plan for 12/05/2017:

After yesterday's drop in GBP/USD, the market performs only a minimal fluctuations. EUR/USD remains just over 1.0850. USD/JPY is near 114.00 again. The Asian stock markets were calm at the end of the week. There is only over 0.5% on Japanese Nikkei 225 downward correction. WTI oil is priced at nearly $48 and an ounce of gold costs $1,226.

On Friday 12th of May, the event calendar is busy with important releases only during the US session. Global investors will keep an eye on Consumer Price Index data, Retail Sales data, and Prelim UoM Consumer Sentiment data. Two speeches from the Fed members are scheduled as well, firstly from Charles Evens and secondly from Patrick Harker.

Analysis of EUR/USD for 12/05/2017:

The CPI and Retail Sales data are scheduled for release at 12:30 pm GMT and Prelim UoM Consumer Sentiment data will be published at 02:00 pm GMT. The CPI is expected to increase from -0.3% to 0.3% for the reported month, At the same time, the core CPI is expected to increase from -0.1% to 0.2%. Even bigger gain is expected in retail sales that should increase from -0/2% to 0.6%. The Consumer Sentiment is likely to stay unchanged at the level of 97.0 points, so any data better than this will be a surprise to markets.

Let's now take a look at the EUR/USD technical picture on the H4 timeframe. The market is consolidating in a narrow trading range between the levels of 1.0851 - 1.0872 and is waiting for economic releases to trigger a move in either directions. The current bias is slightly bullish, mainly due to the fact the market is trading in oversold conditions. Nevertheless, the level of 1.0914 should hold any corrective pullback. In this case the market should reverse and continue to trade lower.

Sell-off in GBP/USD continues.

Yesterday's BoE interest rate decision made GBP/USD slide towards the level of 1.2859, just below the golden trend line. Currently, the trading conditions look oversold and a trend resumption might be taking place soon. Any violation of the level of 1.2900 will confirm this scenario.

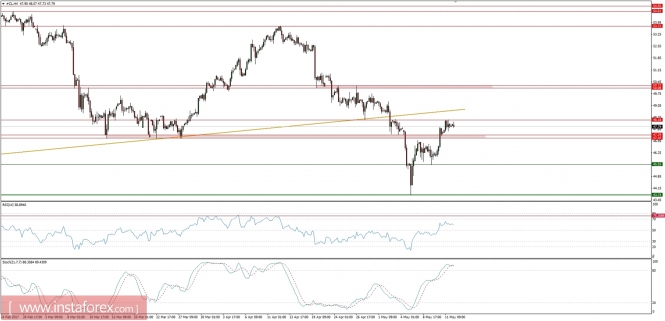

Market snapshot: Crude Oil just below the key resistance

Amid the yesterday's date crude prices rose to the level of $48.18 which is the key technical resistance on the H4 timeframe. The price is still trading below this level. Due to the overbought market conditions, the price might start to consolidate the gains and trade horizontally for some time. No bearish divergence is seen, so the bias remains bullish.