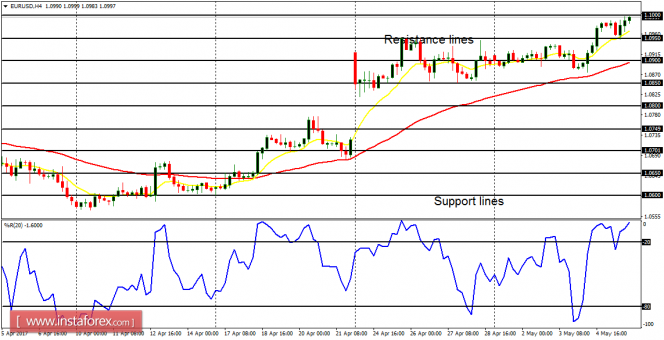

EUR/USD: The EUR/USD pair moved sideways from Monday to Wednesday and then broke upwards on Thursday. Price is now close to the resistance line at 1.1000, and once it goes above it, it would go towards another resistance line at 1.1050 and 1.1100. Along the way, any show of stamina in the USD could send the market tumbling.

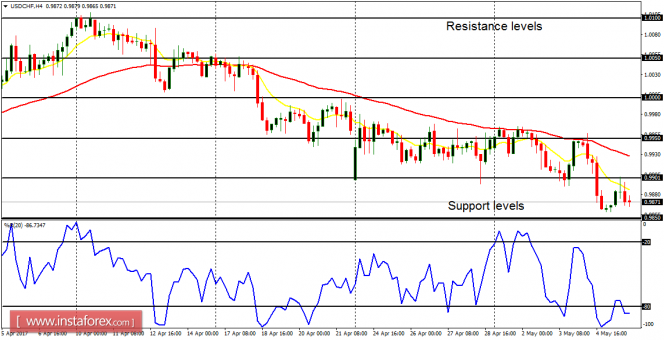

USD/CHF: This currency trading instrument moved lower last week in the context of a downtrend. Price has oscillated between the resistance line at 0.9950 and the support line at 0.9850. The market would continue to go down as long as EUR/USD goes up. However, the USD is expected to gain stamina before the end of this week or early next week. That is a factor that can reverse the movement of the market.

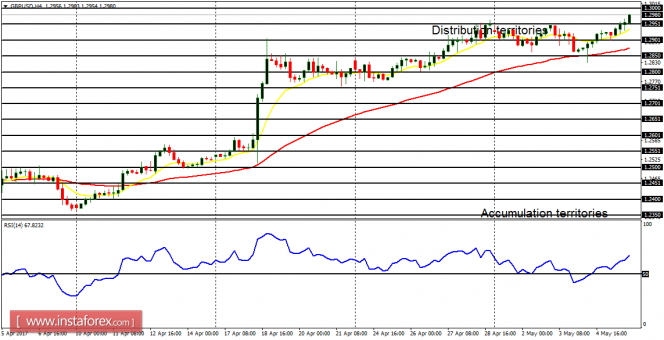

GBP/USD: The Cable consolidated from Monday to Wednesday, and then rose further upwards on Thursday and Friday. There is a huge Bullish Confirmation Pattern on the 4-hour chart, and a further bullish movement is possible this week, which would take price towards the distribution territories at 1.3000, 1.3050, and 1.3100. The outlook on the market remains bullish for the week.

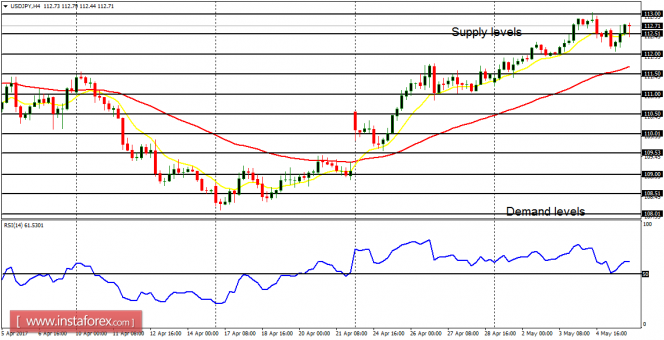

USD/JPY: The USD/JPY pair went upwards last week, testing the supply level at 113.00. The supply level would be tested again and possibly breached to the upside, as price targets other supply level at 113.50 and 114.00. On the other hand, there is also a possibility of a bearish correction this week or next, which could threaten the existing bullish outlook.

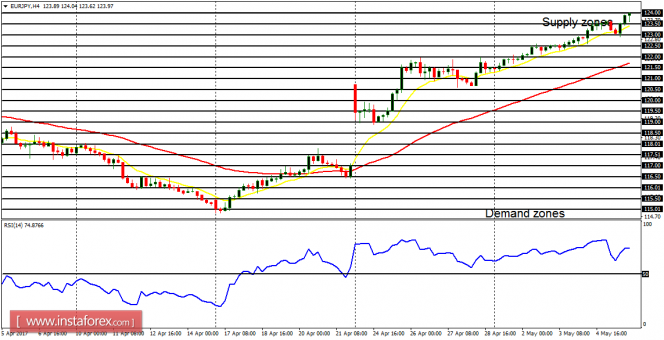

EUR/JPY: This cross gained 250 pips last week, now laying siege to supply zone at 124.00. Once that supply zone is broken to the upside, other supply zones at 124.50, 125.00, and 125.50 would be reached this week. There would be some pullbacks along the way, which are expected to be transitory. Only a pullback of about 300 pips could threaten the current bullish outlook.