Global macro overview for 08/05/2017:

Another set of good data from the US job market was delivered on Friday. The Non-Farm Payrolls increased 211k in April compared with expectations of a gain around 190k for the month. The March data was revised to 79k from the 98k reported previously and the 3-month average was little changed to 174k from 176k.The unemployment rate decreased to fresh 10-years low, from 4.5% to 4.4%.The participation rate declined to 62.9% from 63.0%. One of the key components of the reports, the average hourly earnings, rose 0.3% in the reported month. In conclusion, due to the upbeat jobs report, the odds for June interest rate hike are at the level of 87.7%, which is almost certain.

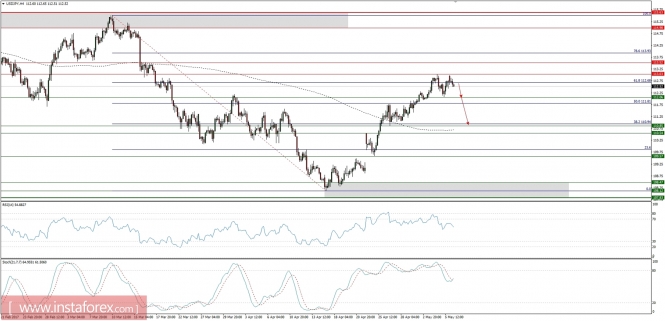

Let's now take a look at the USD/JPY technical picture on the H4 timeframe. The price is still hovering around the 61%Fibo at the level of 112.68, but the market conditions are overbought and there is a visible divergence between the price and the momentum oscillator. The next support is seen at the level of 112.06 and if violated, then the next technical support is seen at the level of 110.85.