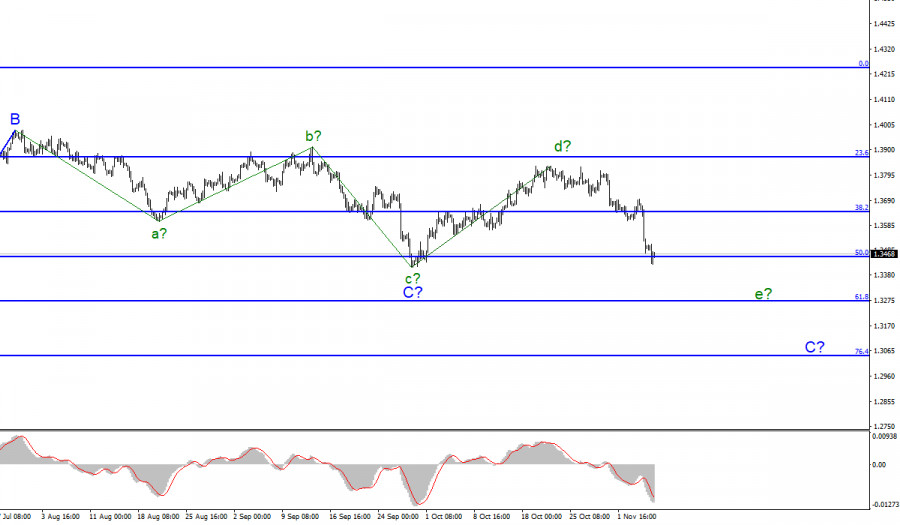

Wave pattern

The wave counting for the Pound/Dollar instrument continues to look quite complicated due to deep corrective waves as part of the downward trend section, but at the same time, it is quite convincing. Even inside the last wave C, presumably five internal waves are visible, and each subsequent one is approximately equal in size to the previous one. My assumption that wave C can already be completed has not been confirmed in practice. Most likely, this wave will still be a five-wave one. In this case, its internal wave d is completed, and now the construction of the wave e in C continues.

If this is indeed the case, then the decline of the instrument will continue with targets located near the minimum of wave c, that is, about 34 figures or lower. Two meetings of central banks supported the US currency, which was required for the current wave counting. Without this support, wave e could have been more complex.

Friday marks another bad day for the pound.

The exchange rate of the Pound/Dollar instrument decreased by another 80 basis points on Friday, but in the afternoon the markets still began to take profits on open transactions, which led to the exit of quotes from the reached lows. However, the downward wave e does not look complete yet, since it has not gone even lower than the low of the previous downward wave. Thus, the decline in the British pound's quotes may continue next week. The wave e in C can also take a pronounced five-wave form. Even if there is a pullback of quotes up, then after its completion, the decline of the instrument may resume. Friday's information background for the Pound/Dollar instrument was similar to the Euro/Dollar instrument. The unemployment rate and Nonfarm Payrolls report in the US was released, which turned out to be better than market expectations.

Thus, the demand for the dollar began to grow in the morning, before the reports were released. But upon the release, the quotes began to move away from the reached lows, since they had already been won back in advance. We can say that the "black" week for the pound has come to an end, but next week it is unlikely to have a strong recovery. At least based on the current wave counting.

I expect a decline of at least another 100 basis points, after which the construction of a new upward trend section can begin. Or at least the corrective wave D. And this wave can be at least 400 basis points in size. Thus Briton still has a good chance of certain growth in the near future. It is only necessary to identify the completion of the construction of wave C in time.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. It received a downward view, but not an impulsive one. The expected wave d has completed its construction, so I advise you to sell the instrument based on the construction of the expected wave e in C with targets located near the level of 1.3270, which equates to 61.8% Fibonacci level.

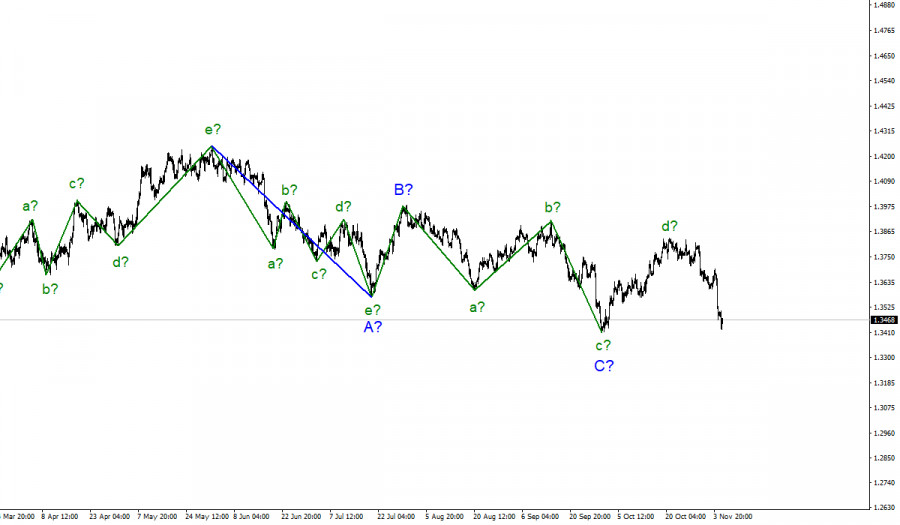

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, I'm still counting on building another downward wave, since wave A turned out to be a five-wave one. The peak of wave b has not been broken yet, so I am waiting for a decline in quotes.

The material has been provided by InstaForex Company - www.instaforex.com