The central event of the week, which will determine the further movement of the dollar in pairs with other major currencies, not only in the short term, but also in the long term, is the Federal Reserve meeting. If we talk about GBP/USD, then another important catalyst for the movement is the Bank of England meeting. The central bank will announce its verdict on further monetary policy on Thursday.

If the Fed initially said that the rate hike is still far away, then the British central bank is more determined here. There are suggestions that the BoE will become the first central bank from developed countries to tighten policy. Such forecasts are not taken out of thin air, but dictated by representatives of the central bank. So, how big are the chances of a rate hike by the BoE?

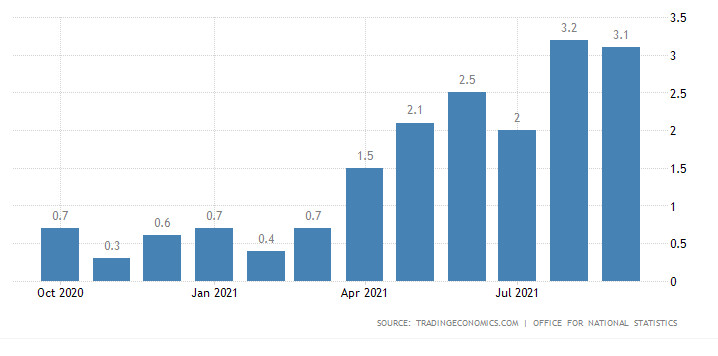

The main reason for the abrupt change in the tone of the head of the Bank of England and the signals for tightening policy that have appeared is, of course, accelerating inflation. The indicator exceeded the target almost twice. The goal is 2%, the actual value is 3.1%. At the same time, all economists' forecasts agree that this is far from the final result, the indicator will exceed 4%, and by the end of the year it will reach 4.4%.

Customs regulations due to Brexit, an energy crisis, a shortage of truck drivers are just some of the reasons that are causing inflation to accelerate in the country. Local authorities are adding fuel to the fire. The country's chief treasurer, Rishi Sunak, last week announced tax cuts for pubs and restaurants and an additional £75bn for infrastructure, skills development and support for the poor. Meanwhile, previous statements were about tax increases. This step had to be taken due to the correction of the assessment of economic growth and damage from the pandemic.

Pro-inflationary forces are looming over England and the government is increasing spending. This means that the likelihood of a rate hike by the end of this year increases significantly. Investors estimate this step at 85%. As soon as the BoE begins the process of tightening policy, the pound will receive an impetus for growth. It is possible that this will happen on November 4. If the tone of the minutes is soft, the pound will drop.

Since BoE Governor Andrew Bailey has already signaled to the markets about a possible tightening of policy, this will not come as a surprise and a big surprise. For a more tangible growth of the pound, it is necessary for the central bank to act more harshly than market players now assume.

Three high-ranking representatives of the central bank, apparently, are ready to vote for a rate hike. However, the volume of the quantitative easing program is likely to remain at the same level - 875 billion pounds. This means that there are no strong drivers for the growth of the British currency at the moment.

Technical picture

The growth of the GBP/USD pair has slowed down. As confirmation that bullish sentiment for the pound will prevail in Forex again, it will be possible to consider a breakdown of the mirror level of 1.3641. Further, the road to the levels of 1.3686, 1.3723 and 1.3758 will open for bulls.

Otherwise, the bears will have the initiative and the level of severity, pulling the pound to 1.3594, 1.3568 and 1.3546.

Scotiabank believes that the central bank at its November meeting will nevertheless leave its policy unchanged. A rate hike this year may still occur, but the BoE, analysts say, will want to limit expectations for next year's rate. It is rather difficult to do this at the same time as the rate hike.

A downward test of the GBP/USD pair at 1.3600 is possible, but it can act as a strong support, and the next one is located at 1.3585. The breakthrough will make it possible to retest the level of the end of September - 1.3450.

The pound will be completely under the influence of the dollar until the BoE meeting.

The material has been provided by InstaForex Company - www.instaforex.com