The coronavirus, or rather the fight against the pandemic, became the main driving force yesterday. The market was moving rather sluggish with no significant activity throughout the day. As a matter of fact, practically all day long, the euro was gradually growing step by step. The growth was extremely modest, but it's still growth. But a couple of hours after the US session opened, United States officials announced plans to release the coronavirus vaccine before Christmas. This was enough to start the dollar's steady growth. And quite serious. The movement was noticeably larger than all the previous days. After all, if this happens, then the United States may soon forget about all sorts of restrictions, like it was just a bad dream. Consequently, business will be able to resume full-fledged work, which will quickly bring the economy out of its stupor. So, indeed, the dollar has every reason to be optimistic.

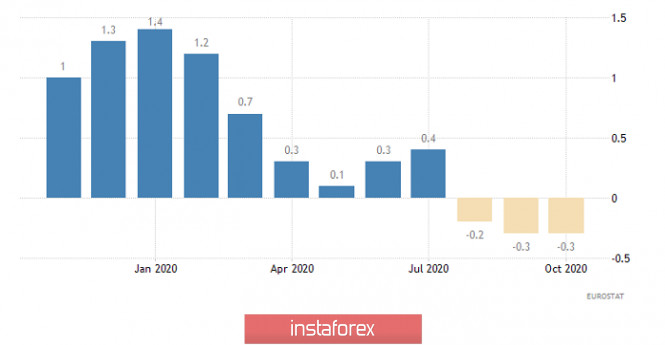

Nevertheless, we are still talking about plans and intentions, and there is no guarantee that the vaccine will actually provide the expected result. So the euro has a chance to fully win back yesterday's decline. The reason will come from the preliminary data on inflation, which should show a slowdown in the decline in consumer prices from -0.3% to -0.2%. Of course, deflation in Europe is still present, but a slowdown in its pace can seriously please investors. Moreover, it was predicted quite recently that the scale of deflation would remain unchanged.

Inflation (Europe):

After rapidly moving up, the EURUSD pair reached an important psychological level of 1.2000, where it stopped and, as a result, the price rebounded in the opposite direction.

There is an acceleration process with regards to volatility, which is confirmed in terms of speculative activity in the market.

If we proceed from the quote's current location, we can see that the 1.1920 coordinate, relative to the recovery process, has become the variable support.

Considering the trading chart in general terms (daily period), we can see that November has become a positive month for the euro as it strengthened by more than 350 points.

We can assume that if the quote stays higher than 1.1960, the recovery process may return it to the psychological level of 1.2000, where it is possible for long positions to decrease.

The alternative scenario considers price fluctuations within 1.1920/1.1950.

From the point of view of complex indicator analysis, we see that the indicators of technical instruments on the hourly and daily timeframes signal a "buy" due to a stable upward movement. Minute intervals also signal a buy through a recovery process.