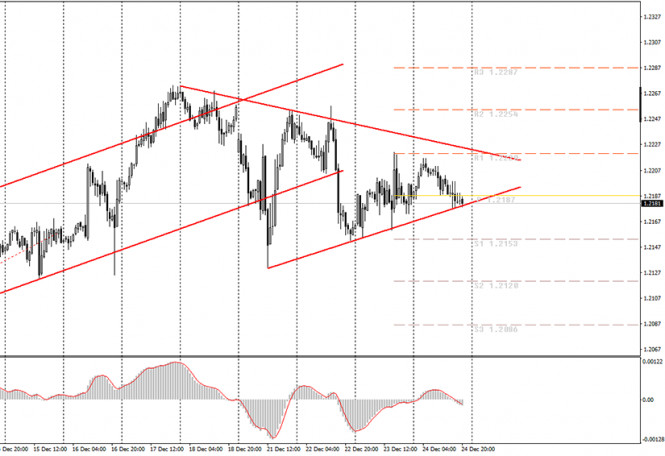

Hourly chart of the EUR USD pair.

The EUR/USD currency pair during the last working day of this week began to fall to the upward trend line, however, they did not overcome it. We still consider the downward trend line to be stronger, so we continue to recommend trading lower rather than higher. At the same time, if a rebound follows from the lower trend line, then it will be possible to open long positions, as the price can rise by 40 points. However, this will require a rebound, without false breakouts of the trend line itself. We are more inclined to the option that the upward trend line will be overcome, and the downward movement will continue. In the case of such a scenario, we recommend resuming trading on the downside. The problem with new year's week is that the flat may persist. So far, only Wednesday and Thursday can be called flat days. However, these days were pre-Christmas, and the whole next week will be new year's eve. Thus, low-volatility trading can continue, and the euro/dollar pair can continue to move sideways, so no overcoming of any trend line may not happen. The price will simply go out of the limit of these lines, moving sideways. In this case, the signal will not be generated.

On Thursday, December 24, not a single macroeconomic report was published in the European Union and America. And, in principle, there was no news, which is evident from the same volatility of the currency pair. On Monday, the situation will not change much, as the new year's week news calendars are empty. There will be only one more or less significant report on applications for unemployment benefits in the United States on Thursday. In general, the fundamental background will be empty. Based on this, novice traders will have to make decisions based on technical factors next week. If the market remains flat, we do not recommend entering the market for beginners at all, as it will be very difficult to predict the direction of the pair's movement.

On December 28, the following scenarios are possible:

1) Long positions are not relevant at the moment, as there is a downward trend line. Thus, we would recommend opening purchases only after the price is fixed above this trend line with the targets of the resistance levels of 1.2254 and 1.2287. It should also be remembered that you need to confidently overcome this line, and not gradually go beyond it through the "flat". Small purchases of the pair are also possible if there is a confident rebound from the lower trend line with a Take Profit of 30-40 points.

2) Trading on the downside looks more appropriate now. If the price overcomes the lower trend line (again, confidently and without false breakouts), then it is recommended to open new short positions with targets at the levels of 1.2153 and 1.2120. However, it should be remembered that the volatility is now low, so the pair can go no more than 40-50 points in one direction.

What's on the chart:

Price support and resistance levels are levels that – targets when opening purchases or sales. You can place Take Profit levels near them.

Red lines – channels or trend lines that display the current trend and show which direction is preferable to trade now.

Up/down arrows – show when you reach or overcome what obstacles you should trade for an increase or decrease.

MACD indicator (14,22,3) – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines (channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement.

Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com