Another vaccination born against the COVID-19 virus was raging all over the world. This time, the American company Moderna Inc. reported that the effectiveness of the drug during the final test was 94.5%. Everything would be fine if not for the cost, which, according to experts, can be more than $ 37 per injection. Not everyone will be able to afford such an expensive drug, and even if they want to buy it, they still won't be able to, since the United States itself will get it first, which played with the presidential election and missed its second wave of infections.

Thus, the United States is storming the maximum daily growth day after day according to the latest report, and the indicators have gone far beyond 100 thousand detected cases per day and now amount to about 160 thousand. The absolute maximum was set just a few days ago – 181 thousand, and the total number of people infected with coronavirus infection exceeds the mark of 11 million, and this data is only for the United States.

With such a terrifying trend and the lack of a proper deterrent tool in many states, the news about large-scale quarantines is no longer considered something surprising, there is only one question—why was it delayed so long?

The US presidential election turned out to be the most important topic for the current government than the health of its own citizens, but this is their choice.

Quarantine measures from the Atlantic to the Pacific.

Following the data received, California has announced an immediate tightening of quarantine measures since November 16, a mask regime has been introduced throughout the state, and people must wear them literally everywhere. According to the order of the Governor, the previously announced resumption of work of enterprises will be postponed, and most of the state's educational institutions will suspend training.

In turn, the Governor of New York decided on a curfew for bars and restaurants, which will have to close at 10 p.m., as well as gyms, while internal meetings should be limited to a maximum of 10 people.

The Governor of New Jersey followed the example of New York and introduced new restrictions. It is now forbidden to hold meetings of more than 10 people, previously there were 25.

The existing restrictions can only be the beginning if the upward trend fails to change to a decline in the near future.

The US dollar has yet a proper reaction to the actions of some states, perhaps this is due to the fact that investors are looking at the situation with COVID relative to the whole world.

Therefore, Europe is already in the zone of full-scale restrictive measures, and the trend of infections is still growing.

The French government says bars and restaurants will remain closed until mid-January as the government tries to quell a renewed outbreak of the virus. According to recently published data, France is working on a long-term strategy to combat the pandemic, and the tactics will be presented at the end of November. According to rumors, the strategy provides for restrictive measures until the summer of 2021.

It is now understood why investors do not suddenly run out of the US dollar, as it is not clear where it is safer to hold assets at the moment.

German Chancellor Angela Merkel was the only person who expressed optimism about the current situation. The chancellor hoped that the pace of recovery in Europe will come as soon as it is possible to control the virus (COVID-19).

Merkel noted that the German economy has recovered strongly after the collapse in activity in the spring of this year, but new restrictive measures introduced after a new wave of infections will lead to stagnation at best in the last quarter. This is despite financial assistance for the most affected sectors, such as hospitality and entertainment.

Since the market can change as quickly as there is information noise, the situation in the global economy is very difficult. Traders should think a hundred times before laying strategic positions.

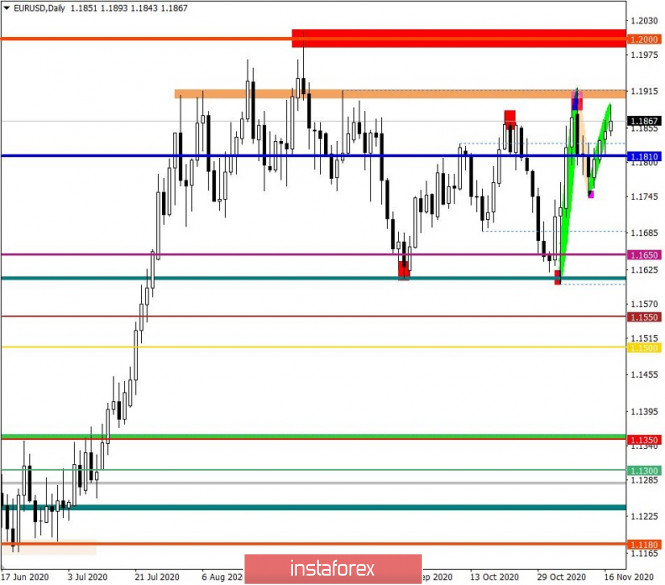

In terms of technical analysis, it can be seen that the quote in the period of November 16 tried to return to the level of 1.1810, but at the end of the day it still remained above this coordinate, which gives confidence to buyers.

Presumably, if the new restrictive measures in the United States will affect the volume of dollar positions, then the prospect of a move to the local maximum of November 9, 1.1920, does not look like something supernatural.

The bigger problem will be the fact that if the European currency manages to gain a foothold higher than 1.1920. In this case, the main psychological indicator of 1.2000, where there was already a quote in the period of September 1, will be at risk.

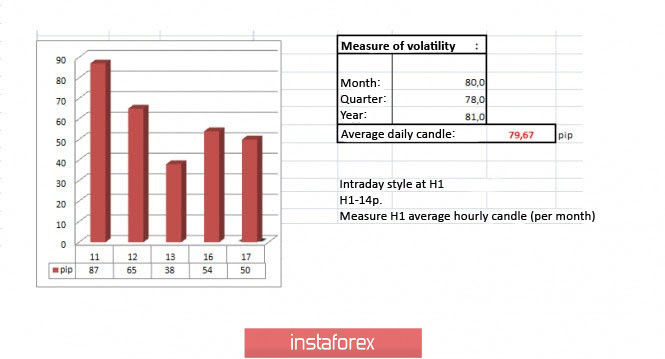

As for the market dynamics for November 16, low activity continues to be recorded, which is considered abnormal. So since November 12, there has been a decline in volatility, which on November 13 was only 38 points. Yesterday, the market accelerated slightly to 54 points, but it is still 32% below the average level.

Such a long-term restraint of trade forces, with such a stable information noise, indicates the accumulation process, which can eventually lead to a sharp acceleration in the market.

At the trading chart in general terms (daily period), the sideways trend is still considered mainly in the medium term. However, if the psychological level of 1.2000 falls, then everything may change.

In terms of the economic calendar today, we received data on retail sales, where the previous data was revised in favor of growth from 5.4% to 5.9%, and the current indicator reflected 5.7%, which coincides with market expectations.

Data on the volume of industrial production was published after that, which came out better than the forecast. The previous indicator was revised for the better -7.3 - - - > -6.7%, and the current indicator reflected an even greater slowdown in the rate of decline to -5.3%.

In the current trading chart, it is visible that the rapid upward movement led to almost complete recovery of the euro relative to the decline over the past week. Only time will tell whether this will be a new stage of upward development—it is too early to draw conclusions. In order to minimize the volume of short positions, the quote must be kept higher than 1.1920, preferably on a four-hour period. In this case, the movement to the psychological level of 1.2000 should be talked about.

Until the above scenario comes true, it is advisable not to exclude the natural basis of the price rebound from the area of 1.1900/1.1920, for it has repeatedly happened in history.

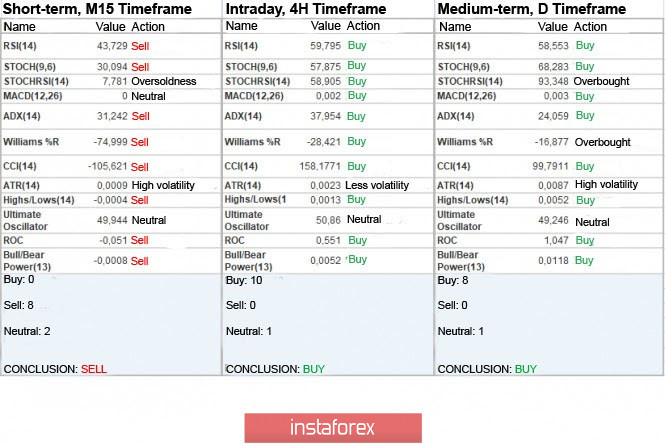

Indicator analysis

Analyzing a different sector of timeframes (TF), it is clear that the indicators of technical instruments at minute intervals signal a sale due to the initial fixation of long positions after an intensive upward move. The hourly and daily intervals are still on an upward wave, signaling a purchase.

Weekly volatility / Volatility measurement: Month; Quarter; Year

Measurement reflects the average daily fluctuation, based on the calculation for the Month / Quarter / Year.

(November 17 was based on the time of publication of the article) the

The dynamics of the current time is only 50 points, which is 37% below the average level. The market participants will likely take a pause, as a new round of acceleration is waiting for us with the start of the European session. An exception to the rule may be the information background. For example, a new set of restrictions on the United States will be published, which will give an incentive to speculators.

Key levels

Resistance zones: 1,1900-20**; 1,2000***; 1,2100*; 1,2450**; 1,2550; 1,2825.

Support zones: 1,1810*; 1,1700; 1,1612*;1,1500; 1,1350; 1,1250*;1,1180**; 1,1080; 1,1000***.

*Periodic level

**Range level

***Psychological level

The material has been provided by InstaForex Company - www.instaforex.com