Macroeconomic statistics disappointed investors and did not contribute to the development of full-fledged corrective sentiment for the Dollar. The number of first time applicants in Americans applying for unemployment benefits unexpectedly rose last week. This is probably due to new restrictions due to the pandemic, which may further slow the recovery of the labor market. It looks like President-elect Joe Biden will inherit a health care crisis and a weak economy.

Meanwhile, another report was better than the forecast. The number of home purchase and sale transactions in the US secondary market in October increased by 4.3% compared to September, to 6.85 million. At the same time, traders expected to see a decline of 1.2%.

In addition to the weak reports published recently, the pressure on the Dollar continues to be exerted by continuing political uncertainty in the United States. Additional risks come from the transfer of power from Donald Trump. The current President does not want to admit defeat and continues to fight for the results of voting in certain states to be declared invalid. Meanwhile, the Republican party did not approve Trump's nominee to the Federal Reserve's Board. The party has probably decided to distance itself from a Republican President who is losing power.

Given the news background and the current situation with the pandemic, investors are likely to bet on a currency with more pronounced protective properties such as the Swiss Franc. An additional factor in the growth of the Swiss currency may be the latest decision of the Central Bank to delay stimulus measures.

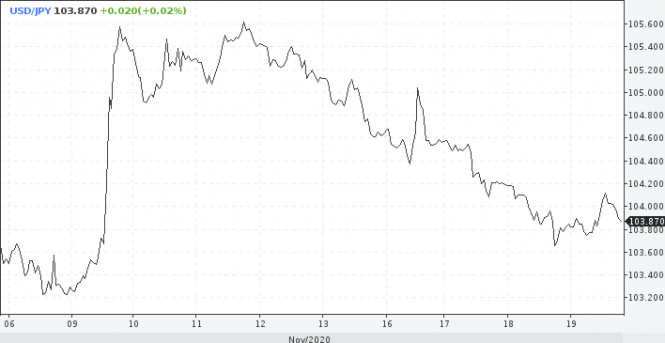

As for the Yen, the background is mixed today. Yes, excessive Dollar liquidity in the global financial system puts pressure on the quotes of the USD/JPY pair. However, it is worth noting that Pfizer must submit documents for registration of the Coronavirus vaccine next week. Earlier, Trump has repeatedly stated that the registration of the drug will take place as soon as possible in order to start vaccinating the population. In this scenario, the vaccine can be expected to appear by the New Year. The US stock market is likely to react with growth which means that the USD/JPY pair will receive support given its correlation with the S&P500 index.

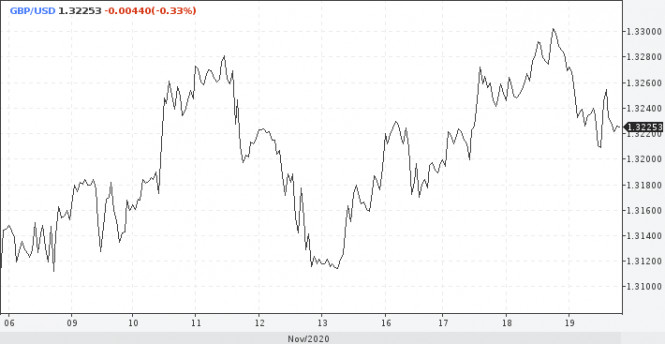

The Pound has every chance of testing a 2-month peak. A significant surplus of Dollar liquidity should play on the side of buyers of the British currency. In addition, the Pound may be supported by a growing energy market. Investors are building up long positions in oil, as Pfizer reported that at the final stage of clinical trials which has the effectiveness of 95%.

The news about Brexit is a deterrent. The Pound sank after it became known that European leaders will urge the EC to publish plans for a no-deal approach to Brexit as the deadline for the end of the year approaches.

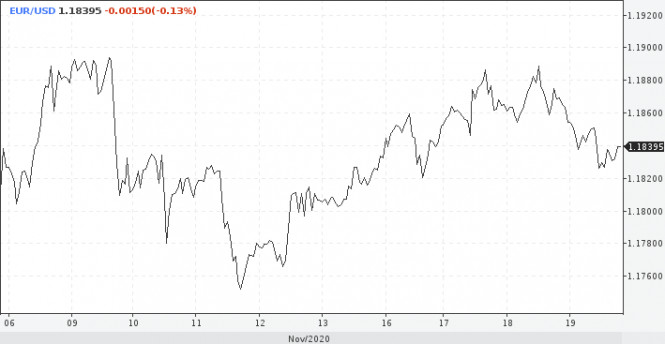

The Euro also has a chance to steal a march on the Dollar. Two factors will influence the balance of power in the EUR/USD pair. First of all, this is an excess of liquidity. Today, the financial system will be provided with five times more liquidity than the day before. The largest volume will arrive tomorrow when the Federal Reserve purchases $12.82 billion worth of treasuries.

The second reason is growing oil. An increase in black gold prices will put additional pressure on the Dollar as these assets have historically traded in different directions.

It is worth noting that now, due to the weakness of the Dollar, it is increasingly about changing leadership. The Euro seems to be taking on this responsibility. In October. The volume of global payments in the single currency increased to 37.8%. This was recorded for the first time in the last 7 years.

The Dollar, which is the world's first reserve currency, has been declining in value for most of this year. If we take into account the March peaks, the US currency has since collapsed by more than 11%. Such changes may help strengthen the Euro's status as the world's second reserve currency.

Citigroup analysts made a bold forecast the day before, predicting a weakening of the Dollar next year by as much as 20%. They explained their expectations with the appearance of a medicine for Coronavirus. Mass vaccination, in their opinion, can revive the world economy and trade.

The material has been provided by InstaForex Company - www.instaforex.com