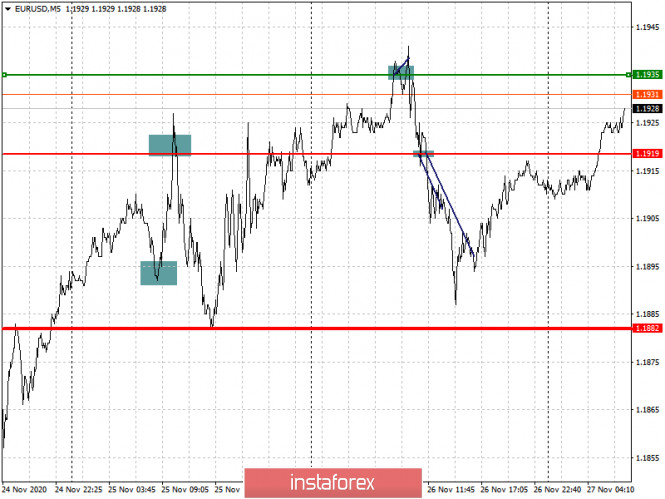

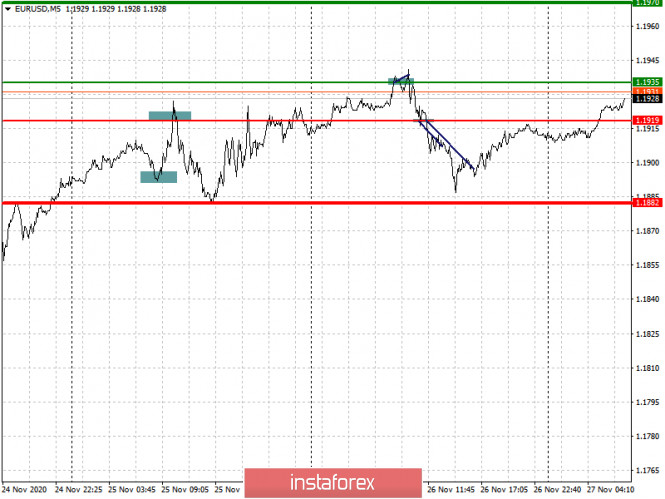

Analysis of transactions in the EUR / USD pair

Euro bulls tested the level of 1.1935, which formed a strong buy signal yesterday. But after the second unsuccessful attempt to rise and the return of the euro to the level of 1.1935, it became clear that there would be no further upward movement. To add to that, the latest minutes of the ECB dropped the demand for the euro rather sharply, thus, short positions from 1.1919 were able to decrease the pair by more than 40 pips. However, in reality, the quote only moved about 20 pips from the market, since after the first wave of decline, the bears rested on the level of 1.1905 and could not break it in any way. Only the most persistent managed to sit out the larger movement around 1.1885.

Trading recommendations for November 27

The European Central Bank published its latest protocol yesterday, which did not contain any positive outlook for the EU economy. As a result, demand for the European currency dropped sharply, but the bulls were able to gradually pull the market against the background of low trading volume due to the Thanksgiving Day in the United States.

Today, the picture has not changed, but soon, it may move amid the publication of consumer confidence index in the eurozone. Most likely, the indicator will come out worse than expected, therefore, it is better not to rush when trading this weekend.

- Open a long position when the euro reaches a quote of 1.1935 (green line on the chart) and then take profit at the level of 1.1970. However, growth will occur only if good data comes out on EU consumer confidence. But considering how the coronavirus pandemic is raging in the EU, if there is no bullish activity after the test of 1.1935, in which the pair returns below this level, then, it is better to change positions to break even.

- Open a short position when the euro reaches a quote of 1.1919 (red line on the chart) and then take profit around the level of 1.1882. However, do this only if the data on the EU economy are worse than the forecasts of economists.

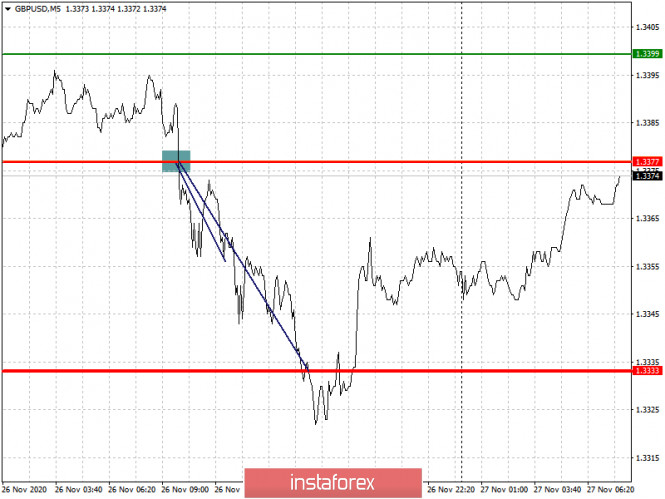

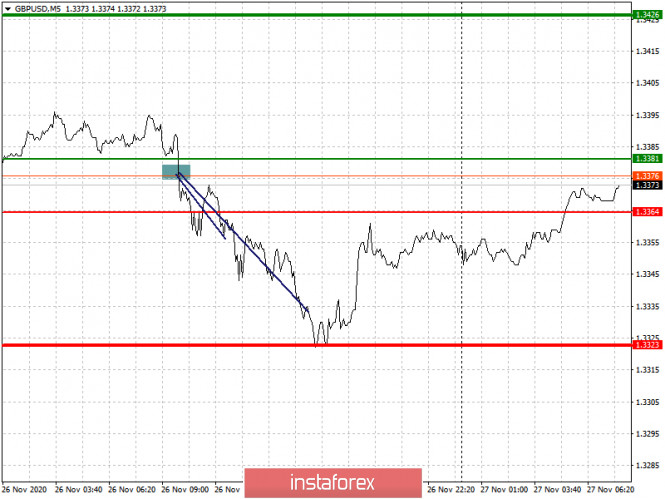

Analysis of transactions in the GBP / USD pair

The pound declined for the second day in a row, after the bears managed to break out of 1.3377, dropping the quote by 45 pips to the level of 1.3332.

Trading recommendations for November 27

Demand for the pound decreased amid news that EU chief negotiator, Michel Barnier, said the bloc may withdraw from the negotiations if the UK does not agree to a number of concessions in the near future. This topic will remain important for the GBP / USD pair in the coming days, in which if positive news arises, that is, a signing of a UK-EU trade deal, the rally in the pound will resume. But if it is announced again that there is no progress on the negotiations, the pressure on the pound could increase.

- Open a long position when the quote reaches the level of 1.3381 (green line on the chart) and then take profit around the level of 1.3426 (thicker green line on the chart). Good news on Brexit may strengthen the British pound.

- Open a short position when the quote reaches the level of 1.3364 (red line on the chart) and then take profit around the level of 1.3323. Bad news on Brexit will resume the downward trend in the GBP/USD pair.