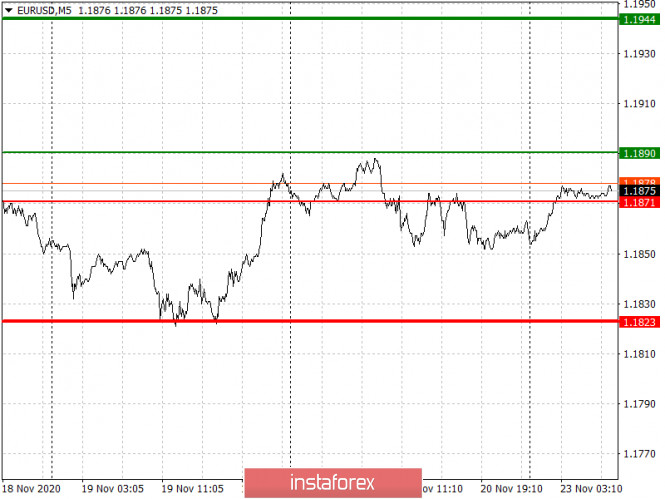

Analysis of transactions in the EUR / USD pair

Low market volatility plus the absence of economic data left the euro with practically no trading signals for today. However, the bullish momentum that was recorded last week remains, thus, the currency still has every chance for further growth. This requires though some progress on the Brexit negotiations, which, up to now, is far from reach, thereby preventing traders from increasing their long positions.

Trading recommendations for November 23

Of great importance is the publication of EU service activity today, which, if comes out worse than the forecasts, will negatively affect the position of the euro in the market. Much will also depend on whether the manufacturing sector, which is now a lifeline for the European economy, remains afloat, because if its data turn out to be better than expected, a rise will be seen in the EUR / USD pair.

- Open a long position when the euro reaches a quote of 1.1890 (green line on the chart) and then take profit at the level of 1.1944. However, growth will occur only in the event of good data on the EU composite PMI.

- Open a short position when the euro reaches a quote of 1.1871 (red line on the chart) and then take profit around the level of 1.1823. However, do this only if the data on EU services sector turn out much worse than the preliminary value for November this year.

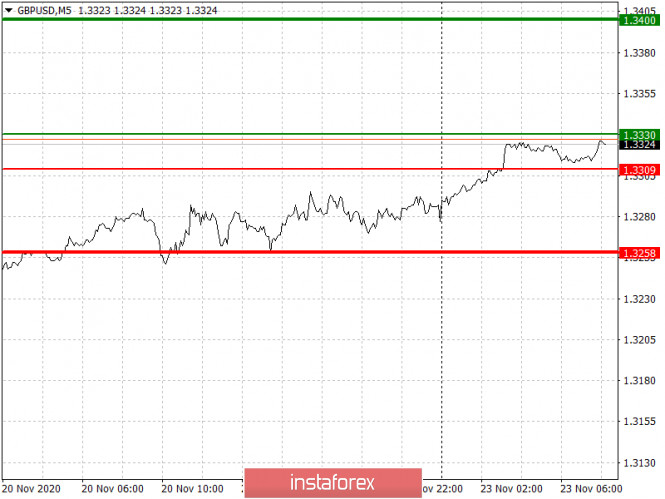

Analysis of transactions in the GBP / USD pair

Low market volatility plus the absence of economic data left the pound with practically no trading signals for today. To add to that, not much progress was seen on Brexit negotiations, which led to the fall of the pound, the amount of which is the same as the growth it had earlier.

Trading recommendations for November 23

Pound bulls are building up long positions in the market, expecting a continued growth in the GBP/USD pair amid a signing of post-Brexit trade agreement. But in the meantime, today, the most influential report is the upcoming data on the UK services and manufacturing PMI, which, if comes out better than the forecasts, will give enough impetus for the pound to form a new wave of growth.

- Open a long position when the quote reaches the level of 1.3330 (green line on the chart) and then take profit around the level of 1.3400 (thicker green line on the chart). Good news on Brexit, as well as on the data on PMI, may raise the pound's position in the market.

- Open a short position when the quote reaches the level of 1.3309 (red line on the chart) and then take profit around the level of 1.3208. Bad news on Brexit will resume the downward trend in the GBP/USD pair.