Trading recommendations for the EUR / USD pair on September 30

Analysis of transactions

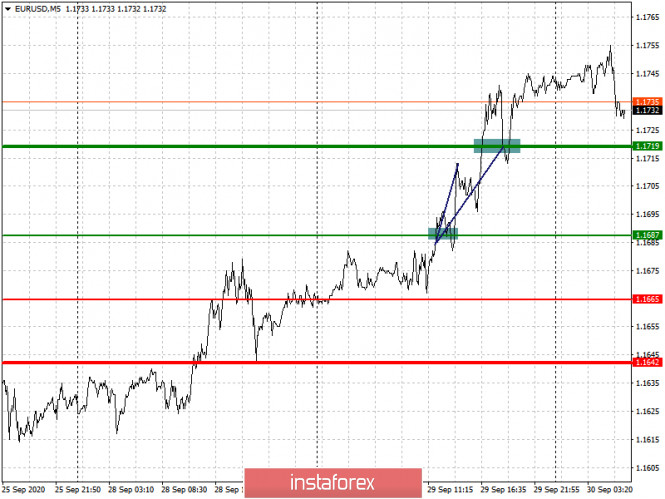

Good data on the Eurozone economy led to a rather decent growth in the European currency, during which the quote rose about 25 pips from the level of 1.1687.

Key indicators, despite the recent surge in coronavirus infections, have shown promising improvements, signaling good economic recovery.

Today, more economic data are due to be published, and they may more or less support the euro on rising in the markets. However, ECB president Christine Lagarde will also discuss today the EU monetary policy, and whatever stance she delivers, it could impact demand in the market as well.

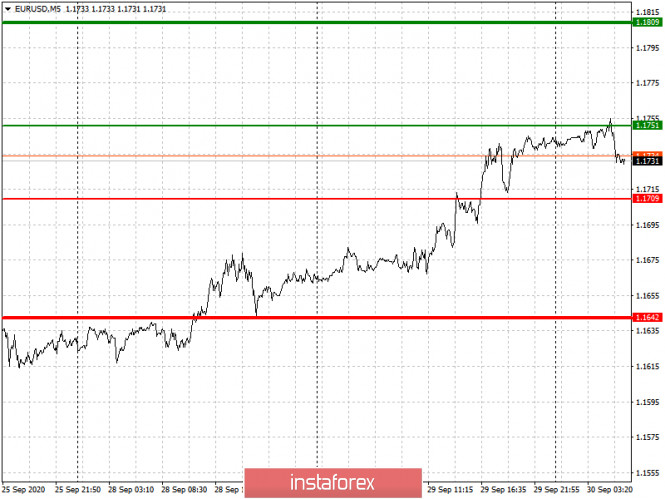

- Buy positions when the euro reaches a price of 1.1751 (green line on the chart), and take profit at the level of 1.1810. If Lagarde does not announce future changes in the monetary policy, the euro will continue to climb up in the markets.

- Sell positions after the quote reaches the level of 1.1709 (red line on the chart), and take profit at the level of 1.1642. If Lagarde talks about easing the monetary policy, pressure on the euro will return.

Trading recommendations for the GBP / USD pair on September 30

Analysis of transactions

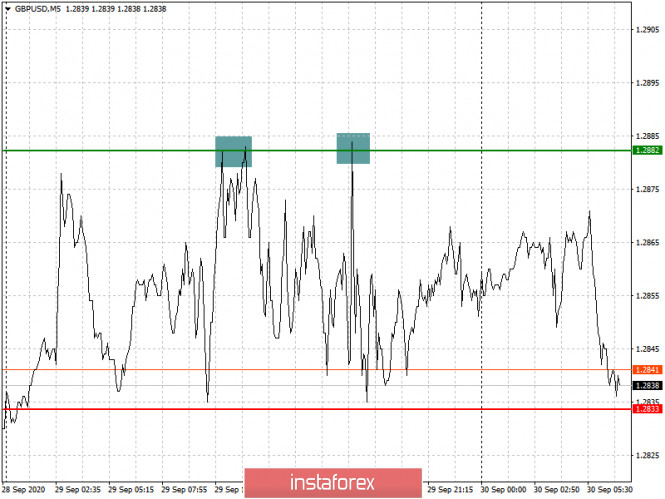

The pound, trading in a flat yesterday, brought losses to traders regardless of the position they were into.

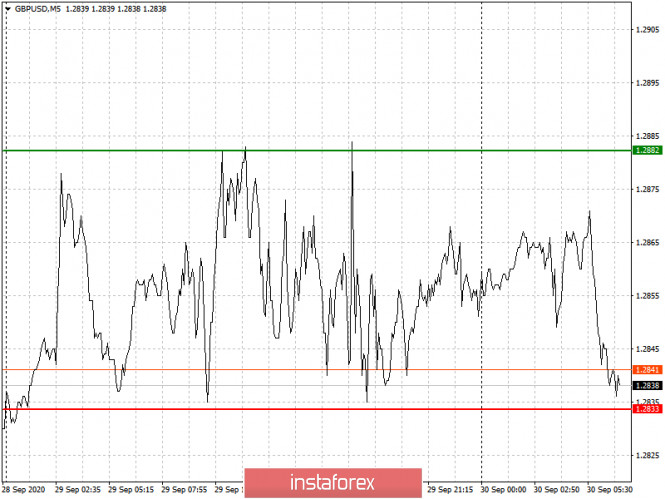

But today, the bears may get ahold of the market, especially since the UK Parliament has approved the controversial internal markets bill proposed by Boris Johnson, which erases all the previously reached agreements between the UK and EU. This may result in more tension between the two countries, and could accordingly bring the pound to a sharp decline.

- Buy positions at a quote of 1.2882 (green line on the chart), and then take profit at the level of 1.2945 (thicker green line on the chart).

- Sell positions after the pound reaches a price of 1.2833, which could happen on the grounds of a tough reaction and retaliatory political sanctions from the EU (red line on the chart). Then, take profit at the level of 1.2763.