Markets are waiting for J. Powell's video-conference speech at the Jackson Hole. Most of them consider that it will be a historic speech and that it can change the entire monetary policy of the past 40 years.

What should we expect from Powell's speech?

The speech of Fed's chief, Jerome Powell, is expected to be the highlight of discourse that started two years ago on the need to conduct a broad review of the regulator's strategy, tools and methods of communication.The market participants are very optimistic that the Central Bank will significantly change its outlook about the current inflation rates. There are rumors that the so-called average inflation will be targeted, and that it will be proposed to raise the overall inflation level above the 2.0% mark that was never reached before. Adopting average inflation targeting would be contrary to what the Fed did in the 1980s and early 1990s. But then the regulator initiated high interest rates, which negatively affected the economy. As a result, the necessary decision was reached, aimed at overthrowing high inflation. However, there is a reverse process – high risks of deflation can ruin the economy that has already suffered from COVID-19.

Although it is hard to tell whether Powell will discuss such plans, we can expect him to say that the Central Bank will stick to the most flexible policy until there is an improvement in inflation and employment. Moreover, he will most likely try not to shock the market and thus, not lead to continued growth in the yield of treasuries, which continue to increase. If this process is not stopped, the price of servicing the state dollar will rise in the future and the dollar will strengthen, which will become a problem for the successful competition of American producers in the global market.

Therefore, it can be anticipated that Powell will remain careful with his words and any specific plans.

How will the markets react to the speech of Powell?

Powell's balanced position will let the markets be calm. Yields on treasuries will decline again and positive dynamics will continue in the stock markets. But for the US dollar, in this case, it will be under pressure in the currency markets, since there are a lot more negative factors about its rate than positive ones. Of course, these are significant stimulus measures that have greatly increased the dollar supply in the financial system, which leads to its weakening. In addition, the market has developed stable dynamics of its fall, following the growing demand for risky assets.

Conclusions

In conclusion, Powell's speech will most likely cause the volatility to increase before and during his speech, but the general trend that has prevailed in recent months will continue. But if he still decides to take extreme measures, then his speech will really become "historic".

Forecast of the day:

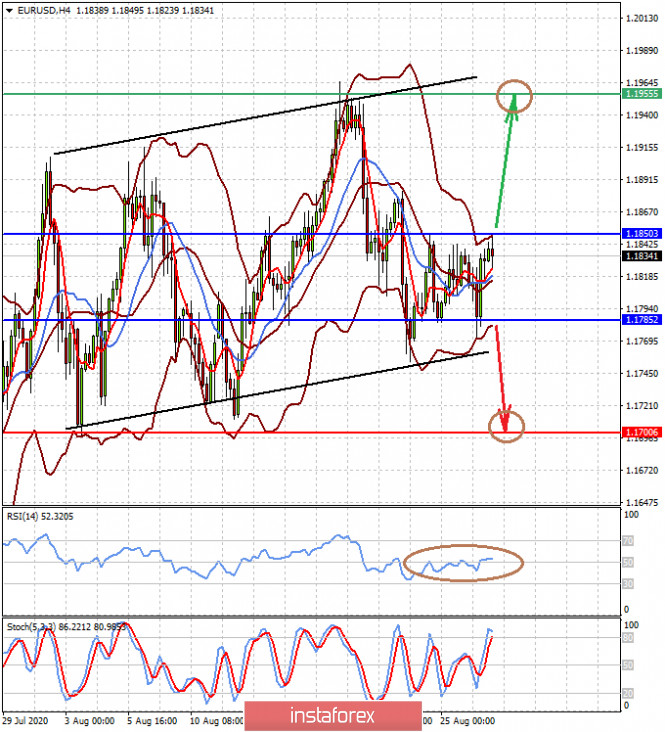

The EUR/USD pair is consolidating in a narrow range of 1.1785-1.1850. If Powell does announce a major change assessing the "average inflation", then this may support the dollar, which can decline to 1.1785 and further below 1.1700. On the contrary, the lack of clear signals on this topic will most likely cause the pair to rise to 1.1955.

The AUD/USD pair gains support amid the continuation of trade deals between the US and China. The price, overcoming the level of 0.7279, will open the way to 0.7320.