The markets have been eagerly waiting for the release of important data on US employment over the past week, which could show how deeply the US economy is getting stuck in the coronavirus pandemic and whether it will be able to recover strongly in the near future.

According to the data presented, the US economy received 1,763,000 new jobs in July, which was significantly worse than the June figures. After that, there was a sharp rebound in the growth of new jobs, which, although it was revised downward to 4,791,000 from 4,800,000, still remained noticeably high. At the same time, the released values exceeded the consensus forecast of 1,600,000. In addition, investors were pleased with the unemployment rate, which dropped more than expected by 10.5% to 10.2% from 11.1%.

On Friday, there were also other equally important values for the average hourly wages, which increased by 0.2% in July against the forecast of a decline by 0.5%. In annual terms, the average wage last month fell slightly compared to July 2019, showing a decline to 4.8% from 4.9%, while a decline to 4.1% was expected. The average length of the week in July also slightly decreased to 34.5 from 34.6, already revised downward. The indicator was expected to show a drop to 34.4.

The only noticeable negative was the data on the number of jobs in the manufacturing industry. The drop was significant to 26,000 from 357,000. The number of jobs was expected to decline, but not so much to 253,000.

As a result, global markets reacted ambiguously to the US statistics. The local stock market went into a negative zone after trying to grow up at the opening and the dollar in the currency market began to receive support against all major currencies, without exception. Its rise was supported by the growth of the yield on US Treasury bonds. Thus, the yield on the benchmark of 10-year Treasuries increased by the end of Friday to 0.566%, adding 0.66%.

The ICE dollar index rose 0.67% to 93.39 points. The dynamics of the dollar immediately forced the traders to think about whether it would turn out that further positive in the data of American economic statistics will lead to the fact that the Fed will not keep the current extremely soft monetary rate for a long time without changes.

In our view, this is groundless. The Fed itself, in the person of its leader, J. Powell has repeatedly stated that she will pursue a soft monetary policy for as long as it takes to restore the economy, as well as increase inflation to the 2.0% level, and more importantly. Powell said that the Central Bank will actually target the rate of inflation, and this is something new that has not been in recent years.

We view the current strengthening of the dollar as an overdue correction after its three-month decline against the basket of major currencies, which may transform into consolidation before a new stage in the weakening of the US dollar. We believe that the incoming positive news on the US economy will have a negative impact on it.

Forecast of the day:

The EUR/USD pair is consolidating, probably forming a trend continuation pattern. The prospective breakdown of the level 1.1900 may become the basis for the price rise to the level of 1.2000.

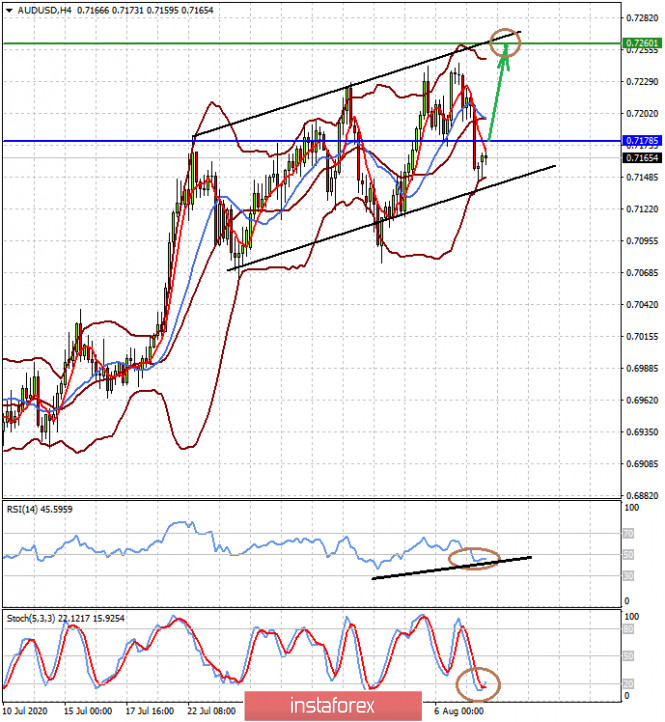

The AUD/USD pair is turning upwards. Now, breaking through the level of 0.7180 will get an opportunity to rise to the level of 0.7260.