The EUR/USD pair tried to enter the 13th figure today. This attempt was unsuccessful, but at the same time, very indicative: against the background of quite strong nonfarm payrolls data, the dollar failed to show character and showed softness, allowing the EUR/USD bulls to update the weekly high. At the same time, buyers were also confused by their own success – they not only failed to stay within the 13th figure, but did not stay above the resistance level of 1.1260 (the average line of the Bollinger Bands indicator, which coincides with the Tenkan-sen line on the daily chart). Therefore, if you look at the situation from the technical side, the position of bulls and bears has not changed since yesterday: buyers still need to return above 1.1260, and sellers still need to settle below the lower line of the Bollinger Bands, that is, below the target of 1.1160. So far, neither side can achieve the desired result, so from a technical point of view, the pair continues to stay in a wide-range flat. But if we look at the situation from the point of view of fundamental analysis, then we can make broader conclusions. But first, let's sort through today's release.

In general, the US nonfarm payroll report was able to surprise: as a rule, one of the components of a key release is to be out of the general rut of forecast levels, as if emphasizing the ambiguity of the situation. Therefore, the initial reaction of the market is often false: traders evaluate the significance of one or another indicator in the context of other indicators and finally make their verdict, deciding whether the glass is half full or half empty. We have witnessed a similar situation today.

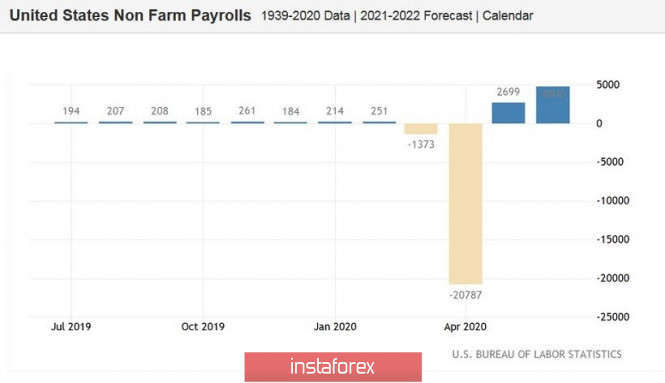

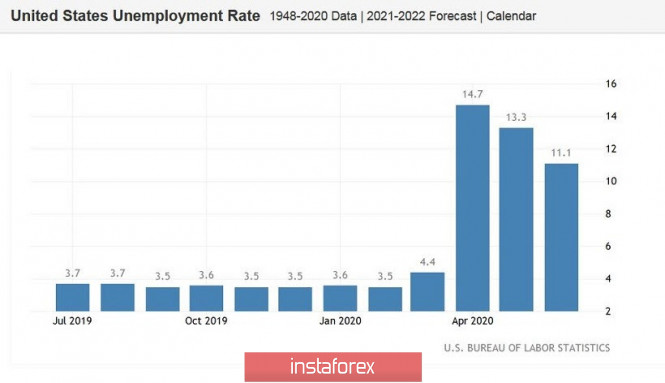

First of all, it should be noted that after a fairly strong report from ADP, which was published the day before, the participants were morally ready to see the official figures in the green zone – especially against the background of a fairly optimistic consensus forecast. And in the end, the US labor market really did not disappoint. The number of people employed in the non-agricultural sector jumped by 4,800,000, while according to data from the Agency ADP, this indicator should have shown a much more modest result – 2,368,000. The increase in the number of employees in the private sector of the economy reached 4,000,767 (with a forecast of growth of 2,900,000), and this figure increased by 356,000 in the manufacturing sector (with a forecast of 311,000). The unemployment rate also came out in the green zone, confirming the downward trend relative to the previous months. With a growth forecast of up to 13.3%, this figure rose only to 11.1%. This is a very dubious achievement, but the trend itself is important here, which is certainly positive.

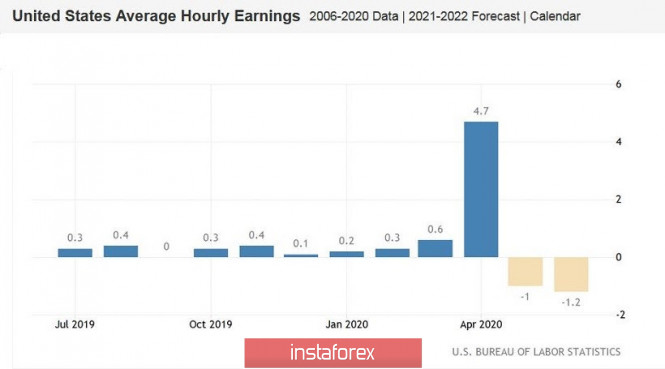

The same cannot be said about salaries, which were much worse than the forecast values. The level of average hourly earnings on a monthly basis, first, remained in the negative area, and secondly, plunged to a multi-year low of -1.2%. This suggests that we should not expect an increase in inflation in the near future. Let me remind you that according to the latest data, the overall consumer price index in monthly terms, with a forecast growth of up to 0.2%, was again in the negative area, falling to -0.1%. In annual terms, experts expected to see the overall CPI at 0.2%, while the indicator came out at 0.1%. Core inflation figures, excluding food and energy prices, also disappointed. In monthly terms, the core index fell to -0.1%, and in annual terms-to 1.2%.

Thus, the inflationary component of nonfarm became the only (but very significant) "fly in the ointment" of today's release. At first, investors focused their attention on this nuance, but then the scales tipped in the direction of the dollar. In part, this was facilitated by US President Donald Trump. Commenting on today's report, Trump said that it is "another proof of the recovery of the US economy." Economic Adviser Larry Kudlow was more reserved in his assessments, but still acknowledged the positive dynamics.

In addition, the dollar reacted to the news from the front of the fight against coronavirus. Let me remind you that the rate of COVID-19 spread is rapidly growing in the United States – if a month ago 15-25,000 cases of infection were registered per day, then yesterday a daily anti-record was recorded: more than 50,000 cases of infection. However, a report was published in the health sciences website medRxiv today, according to which American molecular biologists have made significant progress in developing a vaccine. It is noted that antibodies to coronavirus were formed from all study participants, even at minimal doses, their number is two to three times the number of antibodies in humans who recover from COVID-19. The Americans have successfully passed two stages of testing and are now starting the third. However, similar news has appeared before – but none of the pharmacists has yet completed the third, final stage of testing, after which the drug can be prepared for mass use. Therefore, the above fundamental factor will have a short-term impact.

US trading platforms will be closed on July 4: the United States will celebrate Independence Day. Therefore, the main news of a fundamental nature will come from Europe – there will be published PMI indices in the production and services sectors. However, they are unlikely to be able to reverse the situation for the pair – only if the final estimates differ from the initial ones.

To sum up, it should be noted that the EUR/USD bears were only able to repel a bullish attack today, but at the same time they were not able to organize a downward rally. This suggests that the dollar is still a vulnerable currency. In the near future, traders will again switch to the topic of the spread of coronavirus in the United States, which means that buyers of EUR/USD will have another chance to win the 13th figure. The situation has not changed from a technical point of view: if the bulls consolidate above the resistance level of 1.1260 (the middle line of the Bollinger Bands indicator coincides with the Tenkan-sen line on the daily chart), the Ichimoku indicator will form a bullish Parade of Lines signal, which will open the way for them to 1.1360 (the upper line of the Bollinger Bands indicator on the same timeframe). Long positions to this price barrier should be considered only after consolidating above the 1.1260 mark.

The material has been provided by InstaForex Company - www.instaforex.com