4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - upward.

CCI: 159.1110

The EUR/USD currency pair spent the third trading day of the week in absolutely calm trading. The pair's quotes fell to the moving average line the day before, so yesterday there was a question: will the moving average be overcome or will there be a rebound? Second option. Thus, the pair can now return to the Murray level of "5/8"-1.1353, which it has tested for strength three times already and which remains the approximate upper limit of the side channel in which the pair has been trading for several weeks. We believe that until this level is overcome, it will be difficult for buyers and the euro currency to expect anything more than they have now. At the same time, the fundamental background remains extremely contradictory. There are a lot of important topics now, but it is unclear what traders are paying attention to, and whether they are paying attention at all. Thus, as before, we recommend that you first pay attention to technical factors.

On Wednesday, July 8, no important macroeconomic statistics were published either in the United States or in the European Union. Thus, absolutely nothing affected the movement of the currency pair. However, the huge mass of important topics that can potentially affect the currency market and the entire world economy, does not allow traders to relax and trade on pure "technology". One of these topics is the confrontation between China and the United States. Superpowers, like ordinary states, constantly compete with each other. This principle is the basis of the entire universe. It is a competition that provokes growth and development. This is not surprising. It is not surprising that the government of each country is always guided by its interests in foreign policy. Thus, even the absurd decisions of Donald Trump, of which we have seen a huge number over the past 4 years, are by and large absolutely "normal" for the United States. There was always only one problem. If a particular power, its government, or its leader was too much "buried" in the promotion of their interests and spat on the interests of others, then there was almost always a counteracting force. If we were living in the 18th or 19th century, there would probably be a war between the United States and China. However, now the 21st century and everyone understands perfectly well that there are no winners in any war, and while there will be recovery from destruction, other states will take the first roles in the world. Therefore, the war is simply not profitable for anyone, and there are no good reasons for it to start. But there is a constant conflict of interests. Donald Trump started a trade war with China, as a result, it was from China that the "coronavirus" broke out, which easily brought the world economy to its knees. While European countries managed to stop the spread of the epidemic and localize the foci, that is, to bring COVID-2019 under relative control, the situation in the United States does not change much. And now, who can say with confidence that "coronavirus" is not China's response to the US or personally to Donald Trump in the two-year trade war? Who can say for sure that the virus was not released intentionally? Who can say that the infected Chinese were not sent specifically to the United States with a very clear purpose? After all, in any country, there are special services, secret departments, state security departments, espionage departments, and so on. Everything for conducting secret activities in the international arena. Thus, as soon as there is a conflict between the major players, everyone immediately needs to strain, since everyone can get it.

Now, a new conflict is growing between China and the United States. This time because of Hong Kong. America's interests in Hong Kong are obvious. For America, Hong Kong is a window into China through which you can operate more covertly and freely, which is less monitored by the Chinese authorities. Beijing also understands this. Amid another trade conflict that could turn into a cold war, Beijing does not want Washington to have the ability to influence China from within. Thus, since July 1, the resonant law "on national security in Hong Kong" came into force, which deprives the district of autonomy from China and cancels the principle of "one country – two systems". Everything would even be good for everyone except Hong Kong, which will lose a lot of American trade preferences and become just "part of China", if half of Europe and, most importantly, the United Kingdom, which has an agreement with Beijing dated 1984, according to which Hong Kong should remain an independent state until at least 2047, and Beijing is delegated only defense and foreign affairs issues. Thus, Beijing violates the Joint Sino-British Declaration on the transfer of Hong Kong, and London immediately responded that it would make it easier for Hong Kong citizens to obtain British citizenship. Thus, in theory, up to half of the population of Hong Kong can freely leave the no longer autonomous district and move to live and work in Britain. Of course, if Beijing does not "close" the district. Naturally, such a step will cause a new storm of indignation from the world community, but Beijing has long been acting regardless of what others say, that is, it is guided solely by its interests. The United States, the United Kingdom, and others can only threaten Beijing with sanctions. However, it is not profitable for Washington to escalate relations with Beijing. This is two years ago, Trump easily started a trade war with China, now, a few months before the presidential election, it is not necessary for Trump, as retaliatory sanctions will follow or even the January trade agreement will be terminated, which will further hurt the American economy and bury the chances of Trump's re-election. In fact, in most cases, the President of the United States, who wants to stay for a second term, was re-elected. There have only been a few cases in the history of the United States where this has not happened. But Trump, who has turned half the world and half the United States against him, may just fall into the category of exceptions. But while he has not lost all chances, we believe that he will not escalate the situation in the confrontation with China.

No important macroeconomic publications are scheduled for the last two trading days of the week in the US and the European Union. The EU will only hold a meeting of the Eurogroup, in which the economic recovery fund can theoretically be discussed. Nothing else interesting is planned for the last days of the week.

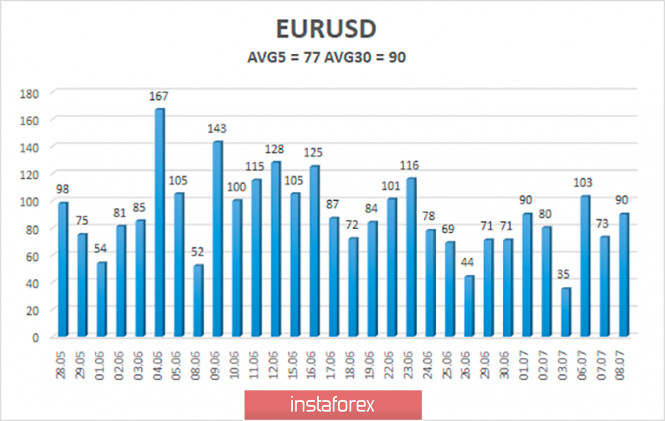

The volatility of the euro/dollar currency pair as of July 9 is 77 points and is characterized as "average". We expect the pair to move between the levels of 1.1247 and 1.1427 today. A new reversal of the Heiken Ashi indicator downwards will signal a new round of downward movement within the side channel if the level of 1.1353 is not overcome before this.

Nearest support levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading recommendations:

The EUR/USD pair continues to trade near the moving average line, inside the side channel. Thus, at this time, it is recommended to trade down if traders manage to overcome the level of 1.1200, which is the approximate lower limit of the channel, with the goal of 1.1108. It is recommended to open buy orders not earlier than the Murray level of "5/8" - 1.1353 with a target of 1.1475.

The material has been provided by InstaForex Company - www.instaforex.com