4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 105.4154

Well, the upward movement of the euro/dollar pair has fully resumed. Now we can talk about it in full voice. It remains only to deal with the question, how long can it last? In principle, in recent months, the European currency has clearly dominated the US dollar. There are several reasons for this, starting with the political and social crisis in the United States, ending with an epidemiological crisis that can further worsen the economic one. In Europe, however, everything has been quiet lately. The economic recovery is proceeding as usual, there are no new serious outbreaks of the epidemic, and only the upcoming EU summit, which will decide on a very important issue regarding the formation of a 750 billion euro economic recovery fund, raises concerns. If the issue is resolved positively, the euro currency may receive additional market support and continue its strengthening in pair with the US currency. As we have repeatedly written, in 2020, the US dollar lost its unconditional advantage over its competitors, so we can now expect a prolonged upward trend for the euro.

Macroeconomic statistics on Wednesday, July 15, was the minimum number in the European Union and in the United States. More precisely, only one report – US industrial production for the month of June. However, despite exceeding forecasts (+5.4% vs. +4.3% m/m), the US dollar did not receive any support from market participants, which once again allows us to conclude that macroeconomic statistics are not very important for traders at this time. As we said earlier, the overall fundamental background is much more important now. And it is this fundamental background that pushes and can continue to push the pair north. In principle, there are several current topics.

1) The political crisis, the presidential election, the confrontation between Donald Trump and Joe Biden.

2) The epidemiological crisis, the confrontation between Donald Trump and Anthony Fauci.

3) The crisis in relations with China, the "Hong Kong issue", the crisis in the South China sea.

Any aggravation of any crisis can lead to the fact that the US dollar will continue to fall in price in pair with the euro, and the technical picture very clearly indicates the current trend and its direction, allowing you to work out fundamental data.

Meanwhile, in the European Union, the EU summit will be held this week, which can provide a lot of important and unexpected information. Today, it is also planned to summarize the results of the ECB meeting, as well as the decision of the regulator on rates. However, we believe that the July meeting will be frankly transitory. It is unlikely that the European regulator will change rates or expand the quantitative stimulus program or the program to counter the pandemic (PEPP). Just at the previous meeting, the ECB had already expanded the PEPP program by 600 billion euros and extended its duration. Thus, it is unlikely that the ECB will make such serious decisions for two months in a row. Thus, from our point of view, the most interesting comments may be made by ECB representatives regarding the future possible steps of the regulator. At the same time, we believe that they will limit themselves to general expressions in the style of "the regulator will do whatever it takes to stabilize the situation". In addition to this event, tomorrow the United States will publish a report on retail sales for June, which may grow by 5% compared to May, and another report on applications for unemployment benefits, which is no longer extremely important. However, we believe that data from overseas will again be ignored by market participants.

At the same time, US President Donald Trump returned to one of his mantras, which has not been repeated for a very long time. The leader of the American nation said on July 14 that "the European Union was created to use the United States". According to the US President, "the EU has always used the US, but other presidents had no idea about it". "Our relations with the EU are very good, they just treat us badly in trade. They have been very unfair to us for many, many decades," Trump concluded. Also on Tuesday, July 14, Donald Trump signed the law "on the autonomy of Hong Kong", which provides for the introduction of sanctions against officials and financial institutions that contribute to the abolition of the autonomy of the Hong Kong district. Recall that this is the second package of sanctions against China in the past week. The first concerned the "Uyghur question" - the issue of oppression of Uyghurs in the Xinjiang region. The first time China responded with mirror sanctions, it is likely to be the second time as well. Thus, as we can see, relations between Beijing and Washington are only getting worse.

The topic of future presidential elections in the United States was not left without news. Donald Trump said on July 15 that he has an excellent chance of re-election in November. "We have excellent poll results," Trump said. "We mean real polls, not those published by the false media." The US leader also said that in 2016, "it was the same" - many media outlets published studies according to which Trump should have lost. The US President said that he expects the support of the "silent majority". "We have never had such an election in which such different candidates are represented," Trump summed up, not forgetting to once again criticize his main opponent in the election, Democrat Joe Biden. "Biden, if he wins the election, will return the United States to the Paris climate agreement, which will deal a serious blow to the American energy industry," Trump said. "He wants to destroy the American energy industry!" After such statements, one can't recall the study of The Washington Post, according to which Trump misled or lied in his statements over the entire presidential term more than 20,000 ...

In general, everything is still the same in the United States, and this "everything" prevents the US dollar from getting more expensive. In principle, the dollar has been growing for a long time in pair with the euro, so a change in the global trend would be logical. From a technical point of view, all trend indicators are directed upwards, indicating an upward trend. Thus, before the reversal of the Heiken Ashi indicator, even a correction is quite difficult to count on. The results of the EU summit will be known only at the weekend, so this week we do not expect a strong fall in the euro currency. In any case, we do not expect a strong decline in the European currency until the pair's quotes close below the moving average line.

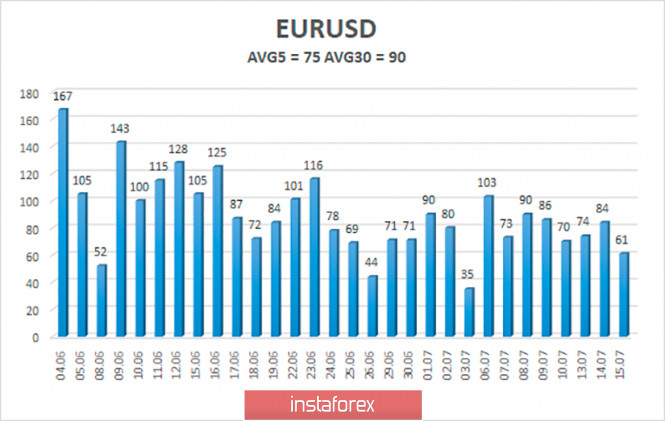

The volatility of the euro/dollar currency pair as of July 16 is 75 points and is characterized as "average". We expect the pair to move today between the levels of 1.1333 and 1.1483. Turning the Heiken Ashi indicator upward will signal the end of the downward correction cycle.

Nearest support levels:

S1 – 1.1353

S2 – 1.1230

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1475

R2 – 1.1597

R3 – 1.1719

Trading recommendations:

The EUR/USD pair resumed the formation of an upward trend. Thus, it is now again recommended to trade for an increase with the goals of 1.1475 and 1.1597. It is recommended to open long positions after the reversal indicator Heiken Ashi upward. Sell orders are recommended to be considered no earlier than fixing the pair below the moving average line with the first goal of 1.1230.

The material has been provided by InstaForex Company - www.instaforex.com