The dollar index continues to weaken. Despite the fact that many macroeconomic reports are published in the green zone, thus demonstrating recovery processes, the dollar demonstrates a downward movement, "reconstructing" the picture in all dollar pairs. Yesterday's data were really surprising with their strong growth – the ISM manufacturing index, the index of business activity in the manufacturing sector and the report on the labor market from the ADP Agency were better than forecast values. But the US currency was guided by other fundamental factors. The dollar bulls are focused on the rate of spread of coronavirus in the United States, which can no longer fail to cause alarm. Only earlier, such anxious moods of traders were in favor of the dollar: any spikes in anti-risk sentiment turned in favor of the greenback. To date, the situation seems to have changed dramatically – the risk of a second wave of the epidemic in the US puts significant pressure on the currency.

It is worth recognizing that the market has recently changed its attitude to the greenback. In fact, it is not currently used as a protective asset, although last month investors were fleeing in the usual way. For example, during the escalation of tension on the Korean Peninsula or during the border conflict between India and China, dollar bulls felt confident in all key pairs.

While agreeing with this statement, I also suggest recalling the initial reaction of the US currency to the coronavirus epidemic. As soon as the first mass cases of COVID-19 began to be registered in the United States (this happened in March), the dollar index collapsed from the February level of 99.77 to the March (and annual) low of 94.87. The greenback was sold in almost all dollar pairs. Then, when the panic in the markets turned into general hysteria, the dollar became so much in demand that the Federal Reserve had to open swap lines. But this happened in the second half of March, while the greenback was initially under the impact of the coronavirus crisis.

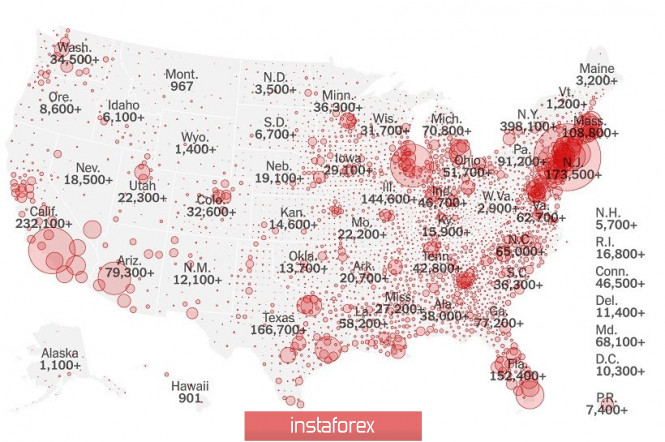

This background suggests that dollar bulls were not always the beneficiaries of the pandemic, so the current situation should not cause much surprise. The countries of the world are unevenly coping with the epidemic, and the United States clearly looks like an outsider in this case – for example, in comparison with China or the EU countries. The situation is getting worse every day. For example, if the daily increase of infected people in the United States fluctuated in the range of 15-25,000 from June 8 to 24 , then this sad figure began to show a stable upward trend from June 24, initially exceeding the 30,000 and then the 40,000 mark. Over the past day, 51,097 (!) cases of COVID-19 infection was registered in the United States – this is the highest daily increase since the beginning of the pandemic. The new epicenters of the disease are California, Texas and Arizona.

The White House is still phlegmatically reacting to the above dynamics. Trump attributes the increase in the number of identified patients to the increase in the number of tests performed, while promising the imminent appearance of a vaccine. It is worth noting that pharmacists in many countries around the world are developing more than ten versions of vaccines – but no company has yet passed the third stage of clinical trials. So far, only the Chinese have reached the last stage, but they will only start the final tests in the UAE in July. Therefore, it is premature to talk about the appearance of a vaccine - according to the most optimistic estimates, the drug will not appear until October or November.

Meanwhile, the chief US epidemiologist is sounding the alarm: according to him, the country has "lost control" of the epidemic. According to his estimates, if the current dynamics continue, America will soon face a 100,000 per day increase in infection. Given the fact that this figure was at the level of 15-25,000 in early June, and has exceeded the 50,000 mark just yesterday, then the forecasts of the epidemiologist sound plausible.

It is obvious that the increase in the number of infected people will continue to put pressure on the dollar, given the current attitude of investors to the US currency. Additional pressure on the greenback was exerted by the Federal Reserve, which recently published the minutes of its June meeting. Let me remind you that as a result of this meeting, the regulator left all the parameters of monetary policy unchanged, thus meeting market expectations. At the same time, members of the Fed said that they do not expect a rate hike until the end of 2022. Also, the regulator did not discuss the topic of negative rates, and Jerome Powell did not talk about plans to introduce control of the bond yield curve.

But, as it became known from the minutes of the June meeting, members of the Fed still discussed limiting yields. They noted that this mechanism was used by the central bank during and after World War II, and is now used by the Bank of Japan and the Reserve Bank of Australia. According to the participants of the meeting, "such an approach can control the yield of government bonds and may not require large purchases of government securities by the central bank, although under certain circumstances such a need may arise." The other wording of the Fed's minutes is also worrisome: "the probability of a negative development of the situation with coronavirus, the possibility of strengthening the dynamics of the recession, and tensions in US-Chinese relations may pose short-term risks for financial markets."

Similar theses were voiced by members of the Fed earlier, but the documented position of the regulator exerted additional pressure on the dollar, thus offsetting the positive effect of yesterday's macroeconomic releases.

Thus, the downward dynamics of the dollar index is now fully justified, and if the market does not significantly change its attitude to the US currency (as it did in March), the greenback will continue to be under pressure, following the dynamics of COVID-19 distribution in the US.

If we talk directly about the Euro-dollar pair, then, oddly enough, the situation has not changed much since yesterday. Buyers of EUR/USD stormed the resistance level of 1.1260 (the average line of the Bollinger Bands indicator coinciding with the Tenkan-sen line on the daily chart), but could not gain a foothold above this target. At the time of writing, the price is located exactly at 1.1260. If the bulls continue to settle higher, the Ichimoku indicator will form a bullish Parade of Lines signal, which will open the way for them to 1.1360 (the upper line of the Bollinger Bands indicator on the same timeframe). But you are advised to only make trading decisions today after the release of the Nonfarm payrolls report, which can either strengthen the positions of EUR/USD buyers or the positions of dollar bulls.

The material has been provided by InstaForex Company - www.instaforex.com