The CFTC report released on Friday showed a steady increase in positivity. All commodity currencies, without exception, significantly reduced their net short positions, and on the contrary, the franc and yen lost significant volumes in long positions. The long position on gold and the total position on the dollar also declined, which can be regarded as the intention of the players to follow the current dominant idea that the world economy is starting to recover after the coronavirus pandemic.

At the same time, it should be noted that the data reflected in the CFTC report were collected before June 9, while Friday and Monday's opening look very negative. Japanese Nikkei is losing more than 2.5% as of 5:00 Universal time, and stock exchanges in China, Australia, and New Zealand are trading in the red zone. A strong growth in demand for government bonds was noted again, and oil lost more than 10% of recent highs overnight after several weeks of seemingly steady growth .

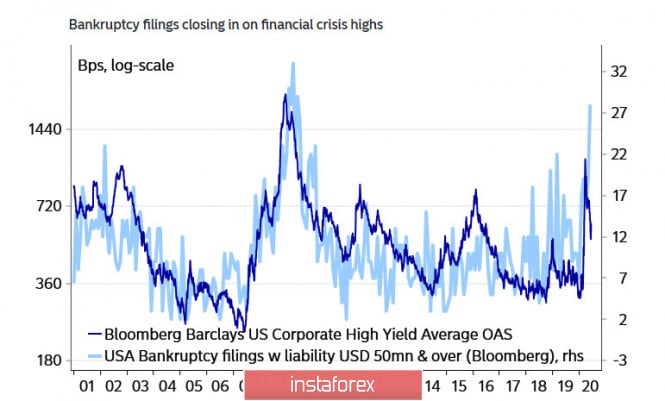

Formally, the markets started to decline after the head of the Fed, Powell, evaded the question of whether the stock market in the US is overvalued, but it is probably not just about the position of Powell or the Fed as a whole. The macroeconomic reports of recent weeks in most countries were better than expected, but this positivity is still clearly not enough. Obviously, there are other, more compelling reasons for the new wave of panic. For example, the US Bureau of Labor Statistics warns of huge discrepancies in the latest employment report, and it is likely that 4.7 million people were classified as employed while they are still virtually unemployed. This discrepancy completely destroys all the positivity from the report.

The World Bank warns that more than 90% of the countries in the world are currently in a state of recession, which is the highest in history.

It turns out that the markets, assessing the deepest recession, flooded with large-scale printing of new money, interpret it as bullish events. Such a discrepancy cannot, of course, cannot be delayed for a long time. The week opened negatively, and everything indicates that risk aversion will receive a new impulse in the coming days. There is essentially nothing to support the positivity, and so, protective assets will be in favor again.

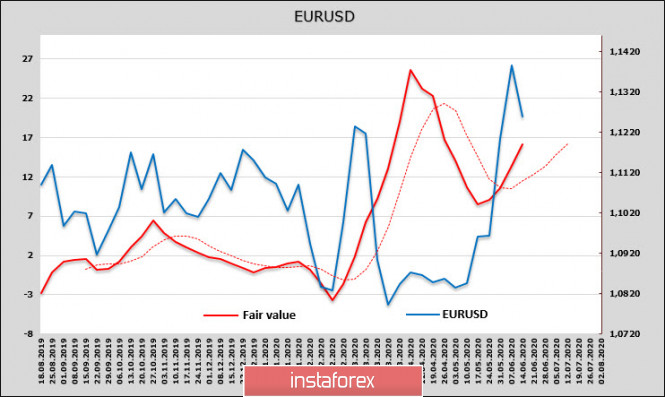

EUR/USD

After a short period of slowdown, the net long position on the Euro has grown steadily again and is 13.558 billion as of the time of the CFTC report formation. No other currency has come close to the euro levels, which makes the European currency a favorite of the currency market.

Optimism regarding the euro is supported by rising expectations for a new-generation EU debt agreement that could significantly support business activity in the eurozone.

The EUR/USD corrected after a prolonged 3-week growth, but the correction promises to be shallow. The key support is 1.1150, where a local bottom can be formed and growth can resume.

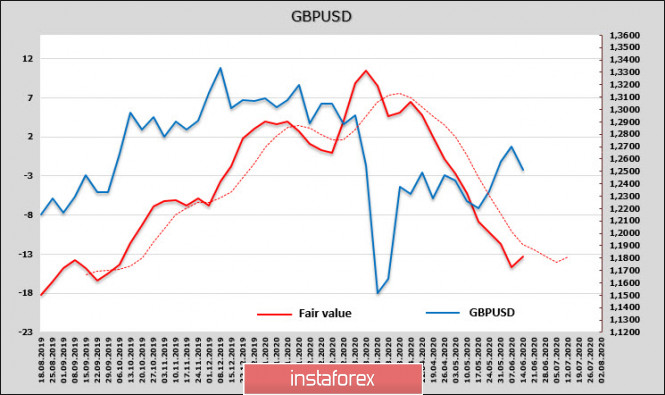

GBP/USD

The data on the state of the UK economy published on Friday turned out to be quite worse than expected - industrial production declined in April by more than 20%, and an estimate of GDP growth from NIESR in May at -17.6% does not give reason to expect a resumption of growth in the coming month.

The pound reduced its short position by 914 million, which is an almost quite strong reduction, which allowed to stop the decline in the estimated fair price.

Britain remains split in two over Brexit's prospects and related local issues. To ask for an extension by the end of June, or to leave the EU as soon as possible – this is a dilemma that puts the strongest pressure on investors. The pound will continue to be under pressure, and there is a high probability of going below the nearest support zone of 1.2430/50. If this happens, then from a technical point of view, the pound will get a new negative impulse, and the goal will shift to the zone of 1.2230/50.

The material has been provided by InstaForex Company - www.instaforex.com