Hello, dear colleagues!

Well, the first summer week was spent on a wave of risk sentiment and ended with a weakening of the US dollar across a wide range of the market. Investors' appetite for risk is indicated by the fact that safe-haven currencies such as the Swiss franc and Japanese yen were unclaimed and ended trading with losses against the US dollar. All other major currencies have strengthened quite decently. This is especially true for New Zealand and Australian dollars, which only further emphasizes the risk-taking mood of market participants.

The main currency pair EUR/USD closed trading on June 1-5 with strong growth, adding 1.74%. Before we go to the price charts, let's remember Friday's data on the US labor market.

According to the United States Department of Labor, the number of newly created jobs in non-agricultural sectors of the economy (Nonfarm Payrolls) increased by 2.509 million in May. Let me remind you that, according to the forecasts of economists, a further decline in employment was expected by eight million. The unemployment rate in the US also turned out to be better than expected at 15% and actually amounted to 13.3%. It is worth noting that the April figure was 14.7%. Can we assume that the labor market is recovering? Most likely, due to the resumption of business operations, this is exactly what is happening.

A fly in the ointment turned out to be an increase in average hourly wages, which did not meet expectations (forecast 1%) and reached the level of minus 1%. However, this indicator has always been the Achilles heel in labor reports and did not allow inflation to reach the target level of the US Federal Reserve System (FRS) of 2%.

Nevertheless, the May statistics on the labor market can be considered surprisingly strong. After all, nonfarm payrolls and the unemployment rate are the most important indicators of the American labor market. However, the surprise was caused not only by the good indicators for NFP and unemployment but also by the reaction of market participants to them.

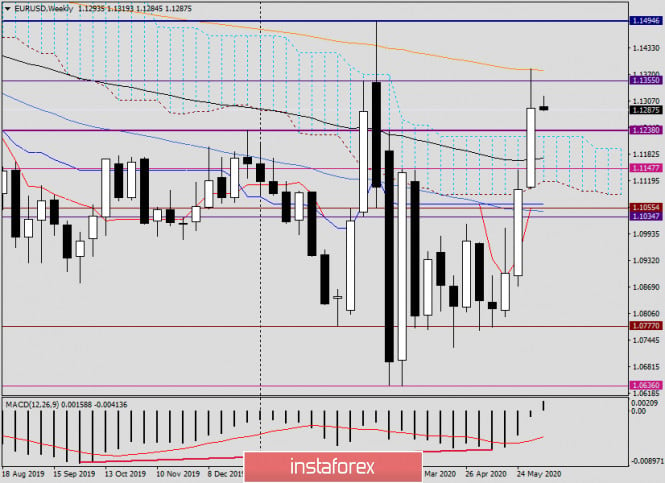

Weekly

Since weekly trading closed on Friday, the technical part of this article will traditionally start with the corresponding timeframe.

As can be clearly seen on the chart, a fairly strong growth of the pair was stopped by the 200 exponential moving average, which passes at 1.13081. The pair tested this move for a breakout, but bounced back from it and ended the week trading below the important level of 1.1300, at 1.1289. In no small part, this was also helped by good labor statistics from the United States, although it did not seem to make a proper impression on investors and, by and large, was again ignored.

From a technical point of view, a negative moment can be considered the closing of trading on June 1-5 below the significant level of 1.1300. And the positive was a confident exit up from the cloud of the Ichimoku indicator. It is possible that market participants have not yet fully realized the fact of the recovery of the US labor market and will continue to playback Friday's statistics. At least, the probability of a rollback to the broken upper border of the Ichimoku cloud, which passes at 1.1224, remains. The breakout of 200 EMA and the closing of weekly trading above the most important psychological and technical level of 1.1500 will finally convince you of the bullish scenario.

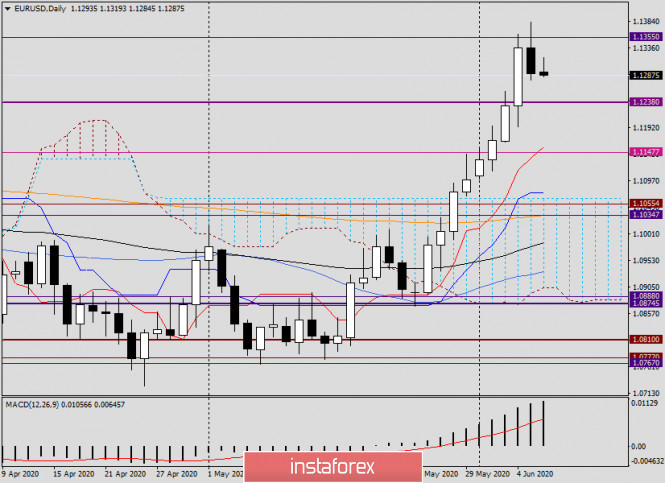

Daily

The candle for June 5 can be considered a reversal. First, it was formed in the form of a "shooting star" candle analysis model. Second, it appeared after an unsuccessful attempt to break through the sellers' resistance at 1.1361. If the market takes these factors into account, the pair will begin to adjust, and the targets of a possible pullback will be the levels of 1.1257, 1.1235. The longer-term goals of the probable EUR/USD adjustment should be expected at 1.1200 and 1.146.

The bullish scenario will only continue if Friday's "shooting star" candle is absorbed and the day's trading closes above Friday's highs of 1.1383.

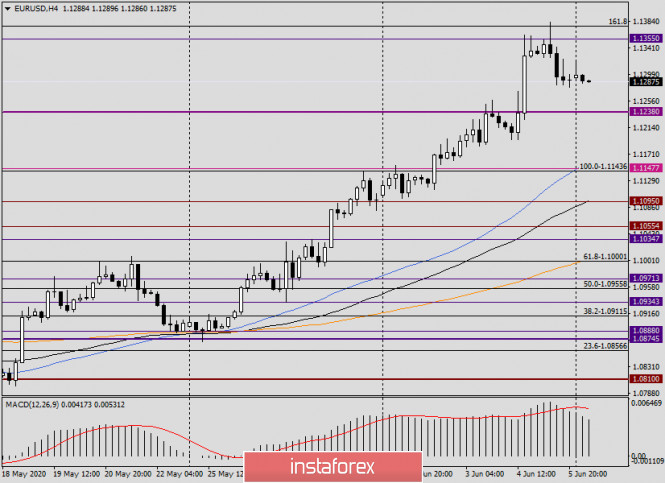

H4

On the four-hour chart, a bearish diver was broken, but there was also a reversal pattern of Japanese candles, which is highlighted, and after which the quote began to decline.

Given the technical picture on the considered timeframes, as well as positive labor statistics from the United States, it is reasonable to assume that the euro/dollar pair may go for a correction. Perhaps before that, the euro bulls will once again try to go on the offensive, which will be unsuccessful. If this happens and we see reversal candlestick signals in the area of 1.1343-1.1383, I recommend selling the euro/dollar with a stop above 1.1383 and goals in the area of 1.1260-1.1200. If it is fixed at 1.1200, the decline will continue to the price zone of 1.146-1.136.

Despite the probability of a corrective pullback, the EUR / USD pair is in an upward trend, so purchases after declines to 1.1250, 1.1220, 1.1200 are still considered the main trading idea at the moment. In the case of a deeper pullback, it is worth looking at the opening of long positions near 1.1165.

If you look at the economic calendar, many interesting and important reports are expected this week. However, the main event of trading on June 8-12 will be the Fed's decision on rates, which will be announced on Wednesday, June 10. In addition to the FOMC decision, updated economic forecasts will also be published, and at 19:30 (London time), the Federal Reserve will hold a press conference, which will be held by the head of the US Central Bank, Jerome Powell. And the main event of the day today will be the speech of ECB President Christine Lagarde, which is scheduled for 14: 45 (London time).

Have a good start to the week!

The material has been provided by InstaForex Company - www.instaforex.com