You can call yesterday as the most boring trading day. In general, as expected, the single European currency just stood still. After all, the macroeconomic calendar is completely empty, the protests in the United States are steadily declining, and in principle there was no other serious news. So market participants were slowly gathering their strength for today's publication of another estimate of the GDP of the euro zone in the first quarter. You can be sure that due to the relaxed state, it did not pay attention to Germany.

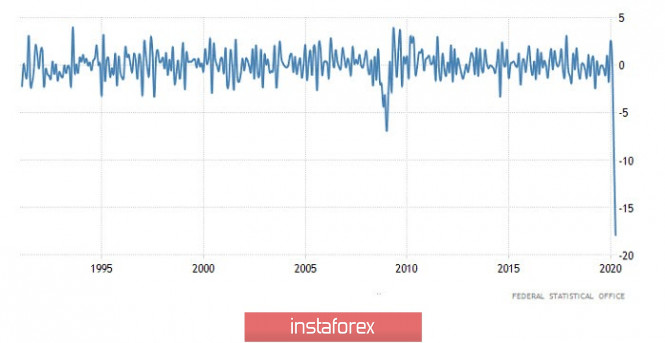

Meanwhile, industry data has been published in Europe's largest economy, giving some insight into the extent of the recession in the European economy as a whole. And not in the first quarter, but already in the second. The decline in industrial production in Germany accelerated from a record -8.9%, to even more terrifying -17.9%. This is the data for April. That is, for the beginning of the second quarter. The restrictive measures introduced because of the coronavirus epidemic have just begun to be removed. In other words, the recession will be incredibly deep.

Industrial production (Germany):

So, today's main event is the publication of the third estimate of European GDP for the first quarter. It should once again show that the growth rate of 1.0%, according to the results of 2019, was replaced by a decline of as much as -3.3%. Here once again I want to draw attention to the fact that the restrictive measures introduced to curb the coronavirus epidemic began to operate only in mid-March. That is, at the very end of this very first quarter and already such a massive decline. So yes, in the end, the global economy will suffer very, very serious losses, which will take a long time to recover. It is noteworthy that the previous estimate showed a decline of -3.2%. So if the forecasts for the third assessment come true, and there is practically no doubt about it, then the final data may turn out to be even slightly worse.

GDP growth rate (Europe):

You can see a sharp slowdown from the point of view of technical analysis. The price touching a variable level of 1.1383 ended with massive consolidations for buyers, where the initial pullback occurred, about a hundred points, returning market participants to the area of 1.1270. The subsequent fluctuation took place within the framework of 1.1270/1.1320, which was and is a process of accumulation.

In terms of a general review of the trading chart, the daily period, it is worth highlighting the inertial movement of May 26, where having a pullback, in the structure of which accumulation occurred, is the first significant adjustment in eight trading days.

We can assume that the process of fluctuating within the framework of 1.1270/1.1320 will not last long, where the method of breaking established boundaries is considered the most optimal tactic for local operations.

Specifying all of the above into trading signals:

- Buy positions are considered higher than 1.1325, with the prospect of a move to 1.1350-1.1380.

- Positions for selling are considered lower than 1.1265, with the prospect of a move to 1.1200-1.1180.

From the point of view of complex indicator analysis, we see that the indicators of technical instruments relative to hourly intervals have changed from ascending interest to descending, while the daily sections still signal purchases.