GBP/USD 1H

The GBP/USD currency pair, unlike the EUR/US, simply continued its downward movement and worked out the first support level of 1.2250 on Monday. Thus, the bears continue to use any chance in order to continue to get rid of the British currency. The descending channel clearly shows the current trend and as long as the quotes do not get out of it, buyers will remain in the shadows. However, the British currency's next fall is not surprising, given the general fundamental background. However, more on that below, and in this section we can only say that there are several important supports below the pound/dollar pair, which could be difficult for bears to overcome.

GBP/USD 15M

Both linear regression channels continue to be downward on the 15-minute timeframe, so the overall trend remains downward in the short term. Quotes of the pair are also located below the moving average line, so for the time being we are not even talking about an upward correction in the short term.

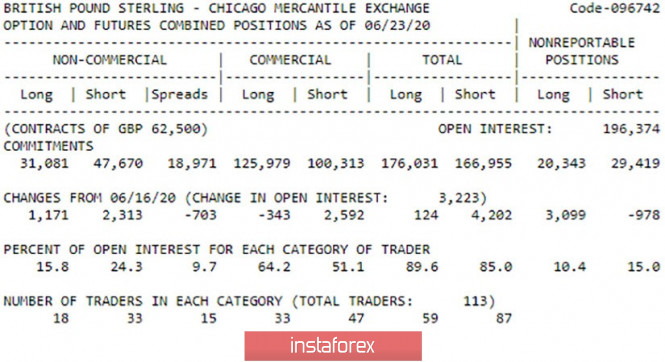

COT Report

The latest COT report, which covers dates June 17-23, shows minimal changes. A group of professional traders were extremely inactive in the indicated period of time and only opened 3,500 new transactions. Of these, 1,200 for purchase and 2,300 for sale. At the same time, the group of hedgers were even less active and closed 343 contracts for the purchase and opened 2,500 contracts for the sale. This is very small. However, this was enough for the pound to resume its decline. This happened after June 23, a time period that is not covered by the latest COT report. Thus, no conclusions can be drawn from the latest report. The mood of traders has not changed, and the total number of open positions opened by a group of professional traders remains with an advantage in short positions. Despite the rather low activity of professional traders, the British currency will have a tendency to decline further.

The fundamental background for the GBP/USD pair was negative again on Tuesday. The head of the Bank of England Andrew Bailey is set to give a speech on this day. However, traders were not interested in his speech. On the same day, British Prime Minister Boris Johnson made a speech, saying the following: "This (coronavirus crisis) was a disaster. Let's not downplay our words, I mean, it was an absolute nightmare for the country, and the country experienced a deep shock." After these words, the British pound resumed its decline, as traders quite reasonably interpreted Johnson's words in a negative context. Obviously, the British economy, which had problems even before the coronavirus crisis due to Brexit, experienced a real shock thanks to the pandemic and quarantine. Accordingly, recovery can be much more difficult and longer than in Europe or the United States. The UK is set to publish GDP for the first quarter on Wednesday, June 30, which, according to forecasts, could lose only 1.6% in annual terms and 2.0% in quarterly terms. These figures are much smaller than in America or the European Union, however, they are unlikely to support the British currency.

There are two main scenarios as of June 30:

1) Since the support area of 1.2403-1.2423 was passed, the downward movement resumed. The trend remains downward, however, a price rebound from the first target of 1.2250 triggered a round of corrective movement. Thus, traders need to wait for it to end and only after that should they resume selling the pair with goals 1.2168 and 1.2022. Potential Take Profit in this case will be from 130 to 260 points.

2) Buyers need to wait until the price consolidates above the Kijun-sen line and above the downward channel, which will give them a chance to resume moving upward with targets at resistance levels 1.2478 and 1.2624. Potential Take Profit in this case will be from 40 to 190 points.

The material has been provided by InstaForex Company - www.instaforex.com