The positional struggle between bulls and bears continues – buyers are trying to gain a foothold above the 1.0850 mark, sellers refuse to give up and hope to return the price to the area of the seventh figure. April Nonfarm extinguished the downward momentum, which was caused by negative fundamental factors relative to the euro. The pessimistic report of the European Commission, the similar rhetoric of the head of the European Central Bank, the resonant decision of the German constitutional court, the disastrous figures of the PMI indices - all these circumstances put significant pressure on the single currency, as a result of which the EUR/USD pair declined without much effort on the part of dollar bulls.

But when the dollar stumbled on Nonfarms, buyers of the pair were able to seize the initiative, developing a corrective movement. However, bulls are content with only a correction so far – to change the situation, they should at least go above $1,0870 (middle line of Bollinger Bands, which coincides with the Kijun-sen on the daily chart) and gain a foothold above 1,0880 (Tenkan-sen at the same timeframe) – in this case, it will open the way to the ninth figure, where the pair can attract more buyers. And until this "minimum program" is completed, there is a risk of falling back to the bottom of the eighth figure, and below. Tomorrow's release may push the pair above or below the designated target levels.

Take note that the economic calendar is almost empty today – no macroeconomic reports are scheduled for Monday, but the representatives of regulators are expected to speak. So, during the European session, the head of the central bank of Luxembourg and at the same time a member of the ECB Board Yves Mersch will speak, and we will learn more about the opinions of Federal Reserve representatives Raphael Bostic and Charles Evans during the US session. The latter do not have voting rights this year, so their position will have a weak impact on the market. But Yves Mersch can provoke volatility in the pair, especially in light of the recent decision of the German court. If it allows the option of excluding the Bundesbank from the QE program, then the euro will be under extreme pressure. But this scenario is unlikely, given Mersh's caution in his statements.

And if Monday is likely to be wasted for the pair, then price turbulence is expected on Tuesday. The most important release for the dollar will be published on May 12. We are talking about the publication of data on the growth of US inflation for April. In March, US inflation figures already reflected the presence of coronavirus in the US – on a monthly basis, the overall CPI index fell into negative territory (-0.4%), and in annual terms – fell to one and a half percent. In April, the negative trend is likely to continue. According to preliminary forecasts, the overall consumer price index should go deeper into the negative area and reach -0.7% (m/m). In annual terms, the indicator should fall to 0.4%.

Core inflation, excluding food and energy prices, showed relative stability in March, especially on an annualized basis (-0.1% m/m 2.1% y/y). But April figures are unlikely to please dollar bulls - according to most experts, in monthly terms the indicator will drop to -0.3%, in annual terms - to 1.7%. If real numbers fall below forecast values, the dollar may fall under a sell-off. Weak inflation will affect Fed members, who are forced to reckon not only with the dynamics of the labor market, but also with inflation dynamics, especially in light of Powell's rhetoric following the results of the last meeting of the Fed. Therefore, the disappointing CPI report will in any case put downward pressure on the US currency.

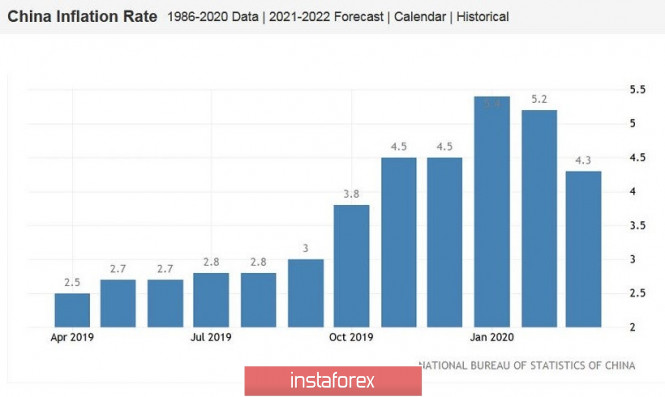

Important Chinese data will have a significant influence on the pair, which will also be published on Tuesday. We are talking about inflation indicators - we will learn the dynamics of the consumer price index and producer price index. Chinese inflation dropped to 4.3% in March (for comparison - the indicator was at the level of 5.6% in January), and negative dynamics is also forecast in April - a decline to 3.7%. The same goes for the producer price index, which is an early signal of changes in inflationary trends - it could collapse to -2.6% (many years of anti-record). These macroeconomic reports will have an indirect effect on the pair, in the context of growth or decline in anti-risk sentiment. If the indicators come out in the green zone, the overall risk appetite may increase, and accordingly the pair will get an additional reason for their growth. Otherwise, demand for the dollar may increase (as a safe asset), after which it will be more difficult for the bulls to resist the bears.

Thus, at the moment the situation for the pair is uncertain. Long positions can be considered if buyers can gain a foothold above target 1.0880 (Tenkan-sen line on the daily chart) - the next resistance level is located at 1.0970 (the lower border of the Kumo cloud, which coincides with the upper line of the Bollinger Bands on that same timeframe). If the bulls cannot overcome 1.0880, then the probability of a downward pullback with the main target of 1.0750 (the lower line of the Bollinger Bands indicator) will increase.

The material has been provided by InstaForex Company - www.instaforex.com