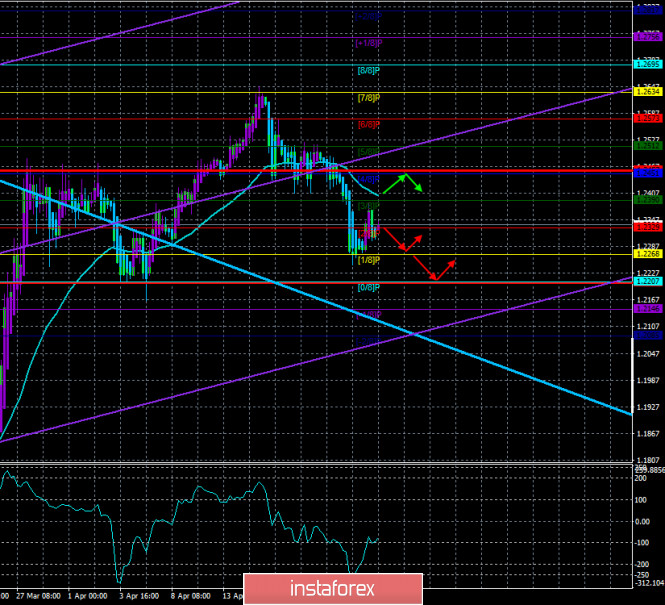

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - downward.

CCI: -82.4678

On April 23, the British pound as a whole continues to adjust against the downward trend that was formed a few days earlier. Although the last bars of the Heiken Ashi indicator is colored blue, we believe that the correction may continue to the moving average line. In general, we can not but note the too sharp decline in the pound the day before yesterday, which even looked like the beginning of a new wave of panic in the currency market. However, yesterday's trading showed that a new panic is still far away, but the US currency can start to rise in price quite freely. Against the background of the same sincere faith of most investors and traders in the dollar. Although we have already said several times that now the British currency is almost waiting for a fall, at least to the level of 1.1900. Both options, with the "correction against a correction" and with the formation of a new downward trend, suggest a decrease in the pair's quotes. And the fundamental background, which could have stopped the fall in normal, calm times and triggered a new upward movement, is not able to do this now. Both fundamental and macroeconomic backgrounds continue to be ignored by traders. This week we have already witnessed this when all reports from the UK were ignored.

On Thursday, April 23, data on business activity for April will be received from the UK. As in the rest of the European Union, business activity in services and manufacturing may significantly decrease compared to March - to 29 and 42 points, respectively. Other more or less important data from Albion is not expected. And these reports are also unlikely to cause any reaction from market participants.

On the other hand, information that is very interesting continues to come from the United States every day. Not even from the United States, but from the White House. At the last press conference, Donald Trump openly stated that he can "terminate the deal" with China if it does not comply with the terms of the agreement, which was signed in January this year. Washington allows an option in which China can refer to a clause in the agreement that involves new trade consultations between the countries in the event of a "natural disaster or unforeseen circumstances." Also, the US President during the press conference did not forget to mention that China has been robbing America for years and expressed outrage at the fact that previous presidents looked "through their fingers" at what is happening. After Trump said that under his rule, the trade deficit with China began to decline. "No one has ever been tougher with China than I have," the US leader said.

However, this is not the only reason for the heating up of relations between the United States and China in recent times. The main one is, of course, the epidemic of "Chinese infection" all over the world. European countries also believe that the actions of WHO and China need to be checked, as there are suspicions of deliberate concealment of information by Beijing, thanks to which it would be possible to avoid the spread of infection around the world. It is difficult for us to say how the EU and the US will be able to conduct an investigation on the territory of China, however, if China's guilt is proven, then its relations may deteriorate not only with the US. The American President continues to insist that "if it was a mistake" and the virus got out of control in a Chinese laboratory by accident, "then fine." But if China deliberately hid the necessary information or deliberately released a virus, then Beijing must answer for it. The main questions now are: did China hide the number of cases on its territory? Why, if the epidemic began to unfold in China in November, did WHO only make an official statement in mid-December, and in the future did not attach the necessary significance to it? According to the charter of the same WHO, each member of the organization must immediately transmit statistical information in the field of health. All events that may pose an international threat must be reported by each country within 24 hours. Late provision of information or inaccurate data (not to mention deliberately false information) is considered an illegal action and in this case, WHO member countries can claim compensation. Thus, it is possible that the whole case will end up in the UN Court.

Well, the prospects for the British pound now depend not on oil, not on China, and not on the scale of the COVID-2019 pandemic. We believe that technical factors still rule the market. More precisely, the reasons for major market players may have their own, this is not a macroeconomic statistics, but we can not predict the actions of major players, of course, we can not. But we can track the trend and trade "according to the trend", not against it. With the help of technical indicators. Thus, in the current conditions, we recommend waiting for signals about the end of the current round of correction and resuming trading on the downside. The senior linear regression channel supports a possible continuation of the downward movement.

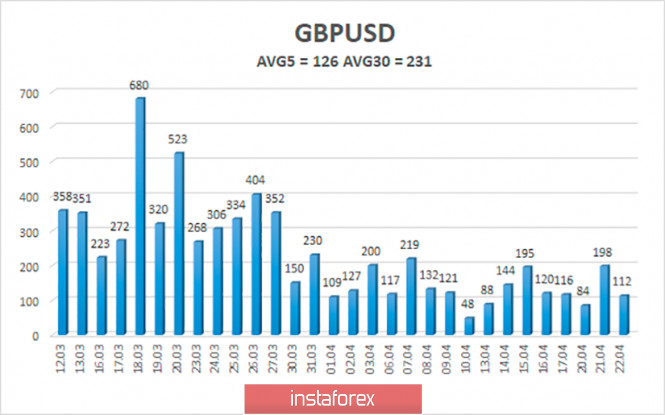

The average volatility of the GBP/USD pair has stopped decreasing and is currently 126 points. In the last 20 trading days, the pair almost every day passes from 100 to 200 points. Therefore, we can say that volatility is now stable. On Thursday, April 23, we expect movement within the channel, limited by the levels of 1.2205 and 1.2457. A downward turn of the Heiken Ashi indicator will indicate the end of the upward correction within the downward trend.

Nearest support levels:

S1 - 1.2268

S2 - 1.2207

S3 - 1.2146

Nearest resistance levels:

R1 - 1.2329

R2 - 1.2390

R3 - 1.2451

Trading recommendations:

The GBP/USD pair started to adjust on the 4-hour timeframe. Thus, it is recommended that traders now consider selling the pound with the goals of 1.2268 and 1.2207, after the reversal of the Heiken Ashi indicator down (a third blue bar is needed). It is recommended to consider purchases of the British currency not before fixing traders above the moving average with the first goal of the Murray level of "4/8"-1.2451.

The material has been provided by InstaForex Company - www.instaforex.com