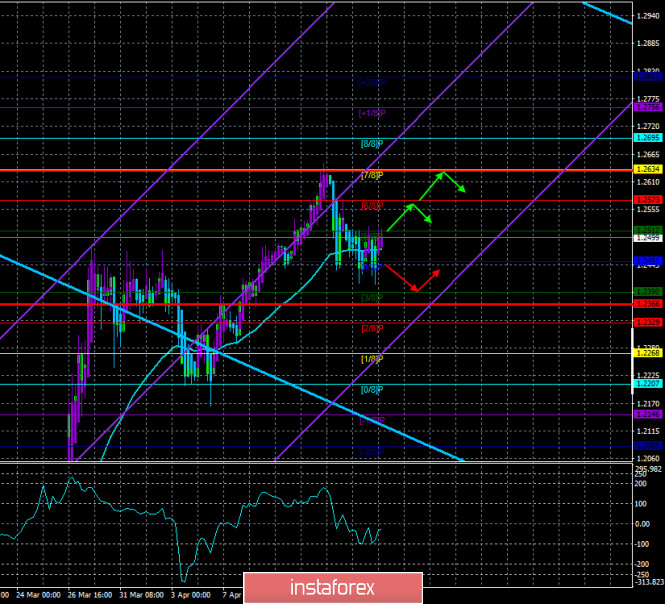

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -25.6825

The British pound paired with the US dollar at the end of last week was firmly stuck between the Murray levels of "4/8" and "5/8", exactly between which the moving average line runs sideways. Thus, according to the "linear regression channels" trading system, it follows that a frank flat has begun. Volatility, however, remains quite high (130-140 points per day), however, in the current conditions, even with such volatility, we can state a flat. Based on this, we can only state attempts now to start a new downward movement. The Ichimoku indicator also confirms the presence of these attempts, as the price has overcome the critical Kijun-sen line. However, the bears now need to gain strength to continue the movement they started. The main problem now is that it is difficult to say what exactly can help the pair in moving in one direction or another. Macroeconomic statistics and the fundamental background continue to be ignored by market participants. Data on "coronavirus", of course, can not be ignored, but they do not cause a reaction from traders. The central banks of all the leading countries of the world did everything they could in the first weeks of the crisis. Now, along with the governments of countries, they simply flood their economies with cheap loans. So, in fact, nothing new is happening in the world right now. The fight against the COVID-2019 virus is underway, scientists are searching for and testing vaccines and medicines, governments are directing quarantine measures and investigating the emergence of the virus. Actually, everything.

However, it is in the UK that the world's first large-scale production of a new vaccine against "coronavirus" begins this week. New, unexplored, unproven in humans. As noted by the Director of the Jenner Institute in Oxford, Adrian Hill, the new vaccine has not passed any clinical trials, but doctors estimate the chances of high effectiveness of the vaccine more than 80%. Thus, British scientists want to play simply ahead of the curve. First, start mass production of the vaccine (it is planned to produce 1 million doses by September), and continue to conduct tests during its production. "While testing continues, we must start production with the risk that the tests may fail," said Adrian Hill.

Meanwhile, the number of people infected with coronavirus reached 2.367 million worldwide. In the UK, there were 121,000 cases of the disease and 16,000 deaths. Thus, it is on Foggy Albion, according to official statistics, that one of the highest mortality rates in the world is more than 10%. Over the past 24 hours, 888 people have died from the virus in the country and the death rate is not decreasing. Given the fact that in Italy and Spain, the disease is slowing its spread, the UK has a chance to get to the first place in Europe in terms of the number of infected in the next two weeks. However, the results of Italy's fight against the epidemic are still not positive. In the last 24 hours, 482 deaths were confirmed in Italy, which is less than a day earlier. The total number of deaths from the pandemic is already 23,000. New 3,500 cases were recorded, which is only slightly less than a day earlier. However, there are 179,000 cases in the country, and this figure continues to grow. Accordingly, there may be a decrease in the rate of morbidity growth, but this can hardly be considered a positive point if people continue to get sick and die. Approximately the same situation is observed in Spain. Over the past day, about 400 deaths and 4,200 new cases of infection were registered. The total number of infections is selected to the number of 200,000 and is the highest among all the countries of the Eurozone. However, doctors also note a slight decline in the rate of death growth.

There are no major events scheduled for Monday in the United States and the UK, so trading on this day can be boring and weakly volatile. The pair will have to decide on the direction of movement, but this will be difficult to achieve on the first trading day of the week.

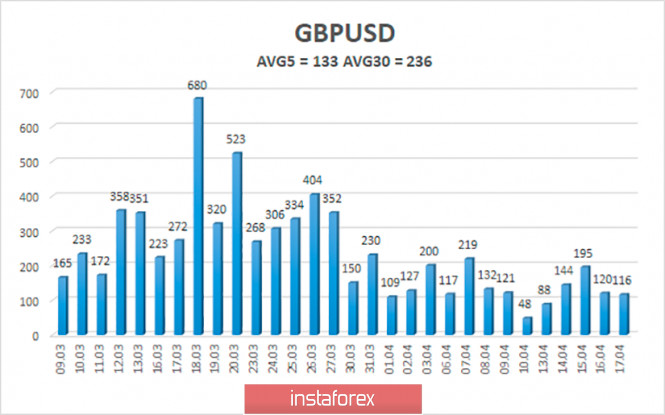

The average volatility of the pound/dollar pair has stopped decreasing and is currently 133 points. In the last 17 trading days, the pair almost every day passes from 100 to 200 points. Therefore, we can say that volatility is now stable. On Monday, April 20, we expect movement within the channel, limited by the levels of 1.2366 and 1.2633. The reversal of the Heiken Ashi indicator downwards indicates a possible continuation of the downward movement.

Nearest support levels:

S1 - 1.2451

S2 - 1.2390

S3 - 1.2329

Nearest resistance levels:

R1 - 1.2512

R2 - 1.2573

R3 - 1.2634

Trading recommendations:

The pound/dollar pair is currently trading just above the moving average line on the 4-hour timeframe. Thus, formally, long positions with the targets of 1.2573 and 1.2633 are even relevant now. However, we recommend that traders wait for the level of 1.2512 to be overcome before considering buying the pound. It is recommended to sell the British currency not earlier than the reverse fixing of the price below the moving average and the level of 1.2451 with the targets of 1.2390 and 1.2366.

The material has been provided by InstaForex Company - www.instaforex.com