4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - down.

CCI: -200.5763

The euro/dollar currency pair starts the fifth trading day of the week with a downward movement. Thus, our assumption of a side channel in the area of 1.0850-1.1000 is still valid, but there is a high probability of canceling this assumption. At the moment, traders show their desire is in a trend movement and, most likely, it will be downward. Successful overcoming of the Murray level of "1/8"-1.0864 indirectly signals continued demand for the US currency. Volatility remains moderate in strength in the current environment.

The US dollar is again in demand on the international currency market. Despite the fact that it is the United States that leads the world in the number of "coronavirus" diseases and deaths from the epidemic. Despite the fact that it was the US government and the Fed that had to pour trillions of dollars into the economy to save it from a crushing fall. Despite the fact that the Fed lowered the key rate "almost to zero". Despite the fact that macroeconomic statistics from across the ocean time after time come super negative. Moreover, market participants continue to simply ignore all these fundamental and macroeconomic factors. If you look at the picture of the movement of the euro/dollar pair in the last two months, the naked eye can see a panic wave up (February 20-March 9) and an equally panic wave down (March 10-March 20). That is, two panic waves took just exactly a month. After that, each next turn is weaker than the previous one. That is, since March 20, which also means that for almost a month, traders have been calming down. However, this calm will end either with the pair going flat (as we have already said around 1.0850-1.1000) or a new trend will start. If we try to look at the chart impartially, we can conclude that the trend will be downward. This assumption can be confirmed if the pair successfully overcomes the lows of March 6. It turns out that further downward movement again will not be justified fundamentally. In other words, traders will simply continue to buy the US currency. Based on what? It turns out that again on the basis of a simple and banal belief that anything can happen in the world, but the US dollar will always be there. This means that it is best to keep your savings in it. That's all the logic of the market at the moment.

Only one publication is scheduled for the last trading day of the week. In the European Union, the consumer price index for March will be known. This indicator is likely to slow down to 0.7% in annual terms and is 100% likely to be ignored by the markets. Also tomorrow night, statistics will be published, which is very interesting, and also will not have any meaning for the euro/dollar currency pair. This is a package of data from China for March. Last month was a failure for the Chinese economy, as in February, the "coronavirus" was already raging in the Middle Kingdom. It was only in March that it came to Europe and the United States. In March, a new reduction in the most significant indicators for China is expected. But the rate of decline in indicators will slow down. For example, in industrial production (compared to -13.5% a month earlier) is expected to be -7.3% y/y and -10% in retail sales (in February -20.5%). Also, the Gross Domestic Product for the first quarter will be released and it will make up -6.5% in annual terms, and -9.9% in quarterly terms. Thus, based on these figures, we can understand approximately what to expect from similar indicators of the Eurozone and the United States for March-April 2020. Well, no more publications are planned for Friday, April 17.

At the same time, US President Donald Trump at a regular briefing at the White House, still without a mask, as before, announced that the "peak" of the epidemic in the United States has passed. Already tonight, the US President will publish the principles on which the American economy will be released from quarantine. This process is expected to start in late April or early May. "The battle continues, but the data shows that our country has passed the peak of infection," said Donald Trump. It is expected that Trump will "open" the least affected and infected states of the country and leave in effect the quarantine in the most affected areas of COVID-2019 in the United States. Recall that, according to the latest information, the number of people infected with "coronavirus" has grown to 2.1 million people worldwide. The United States still has the largest number of infected people – 640,000. At the same time, official statistics say that on April 15, the largest number of people died from the pandemic in the United States for all time – 2,569, and newly infected people were added in the amount of almost 30,000. Therefore, it is still difficult to understand what "passing of the peak" Trump is talking about. More and more media, analysts, political scientists and experts in various fields agree that Trump's rush to end the quarantine is due to only one thing – his rapidly falling chances of re-election in November. As many experts note, although Trump's political ratings during the epidemic are the highest for the entire time of the presidency, the Trump team during the election campaigns will need not just to promise a "bright future", as the Democrats can do, but to provide concrete results of their work in recent years. A few months ago, Donald Trump could claim that it was under him that the US economy flourished in a new way, unemployment fell to 50-year lows, and the labor market gained extraordinary strength. However, just a couple of months of quarantine, all three of Trump's main trump cards were destroyed. The unemployment rate may increase by various estimates to 15-20%, the labor market, according to the latest report of NonFarm Payrolls, is in a deplorable state, and the economy in 2020 may decline so much that it will be at "pre-Trump" levels. Of course, the US leader can accuse someone else of all the troubles of the USA in his usual manner. For example, China. In principle, the whole world has long understood that Trump is to blame for everything except America. However, will voters believe this, who, after all, are primarily interested in their own well-being and the availability of work in the country? A $1,200 check with Trump's personal signature is, of course, good, but it won't solve all the problems of every household caused by the epidemic.

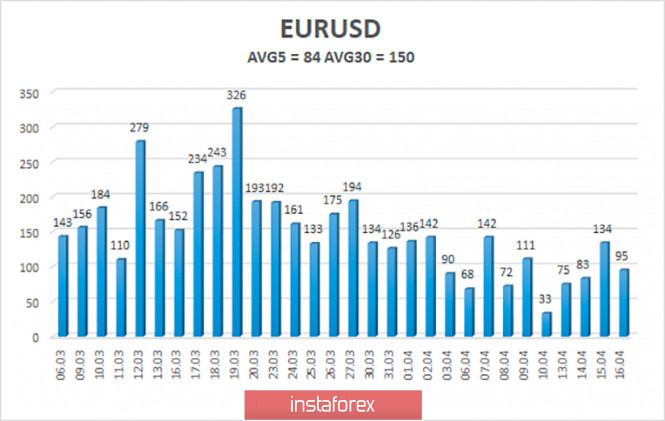

The volatility of the euro/dollar currency pair as a whole continues to decline and is 84 points at the end of the last day. Thus, fears for a new wave of panic in the market are still premature, however, traders continue to behave quite actively. On April 17, we expect the pair's quotes to move between the levels of 1.0764 and 1.0932. A reversal of the Heiken Ashi indicator upwards may indicate a round of upward correction.

Nearest support levels:

S1 - 1,0742

S2 - 1.0620

S3 - 1.0498

Nearest resistance levels:

R1 - 1.0864

R2 - 1,0986

R3 - 1.1108

Trading recommendations:

The euro/dollar pair continues to move down. Thus, traders are recommended to trade down with the targets of the volatility level of 1.0764 and the Murray level of "0/8"-1.0742 before the reversal of the Heiken Ashi indicator to the top. It is recommended to buy the euro/dollar pair again if the price is fixed back above the moving average, with the targets of 1.0932 and 1.0986.

The material has been provided by InstaForex Company - www.instaforex.com