Suddenly and unexpectedly, the market mood dramatically changed, and instead of weakening the dollar, we saw a banal standstill. Of course, this is partly due to the rather strange content of the ADP employment report, which does not beat the growth in the number of applications for unemployment benefits too much. But do not write off the continuing panic about the coronavirus. As yesterday it became known that the number of confirmed cases of infection in Spain has exceeded 100,000. Spain epidemics came in third place, ahead of China. Although in Europe, there are suggestions that the peak of the epidemic has passed and is about to begin to decline.

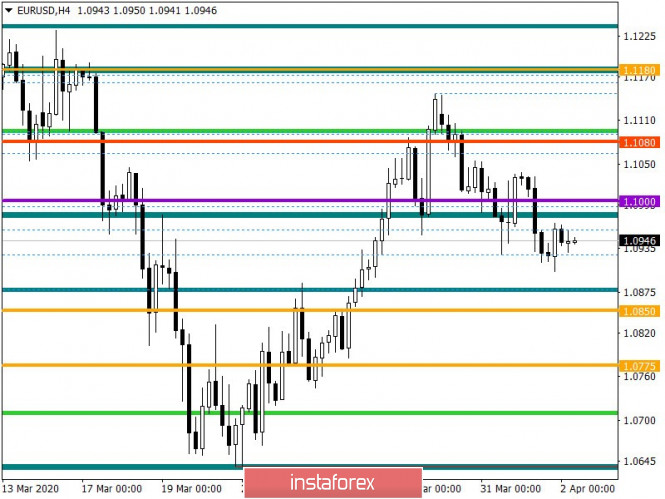

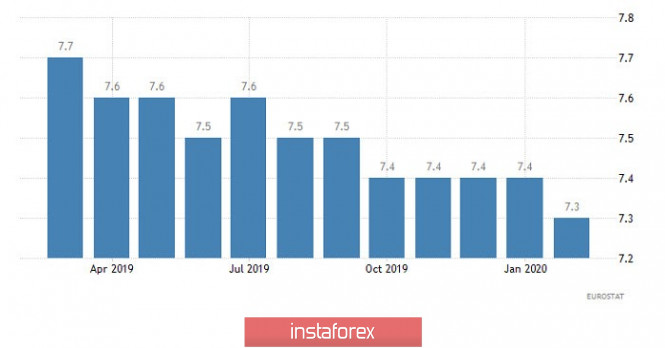

At the same time, to be honest, the single European currency had every reason to grow, at least during the first half of the trading day. Contrary to all forecasts, the unemployment rate in Europe fell from 7.4% to 7.3%. However, this is data for February, and not yet clear as to what happened in March. Nevertheless, there is hope that the decline in the unemployment rate in February will ensure that its growth will not be so terrible in March. After all, Europe is known for its social policy, and perhaps the eurozone countries will be able to smooth things over. However, the final data on the index of business activity in the manufacturing sector was slightly worse than the preliminary estimate, which showed a decrease from 49.2 to 44.8. This same index fell to 44.5. But this did not impress anyone at all, since the decline is still quite significant.

Unemployment rate (Europe):

But the US data really confused the market. After seeing more than three million initial applications for unemployment benefits last week, everyone was waiting with a clear conscience for an unprecedented drop in employment from ADP. It was predicted that it should decrease by 170,000, but it turned out that it decreased by only 27,000, and this is a little strange. This can only happen because the coronavirus epidemic hit the United States around the middle of March. But before that, employment was expected to grow at an all-time high. This picture does not look so plausible. So the results raise a lot of questions. Nevertheless, this was enough to make market participants forget about selling the dollar in confusion.

Employment change from ADP (United States):

The first thing you should pay attention to today is producer prices in Europe, the decline rate of which should accelerate from -0.5% to -0.7%. And of course, in Europe they can talk a lot about the peak of the spread of the coronavirus epidemic, but economic problems do not go far from this. A further decline in producer prices will clearly put pressure on inflation. So the European Central Bank has every reason to be worried.

Producer Prices (Europe):

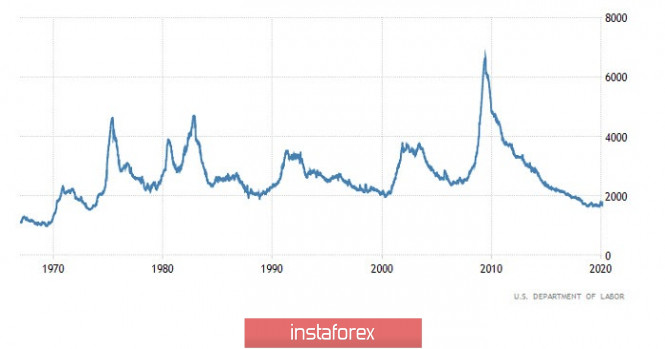

But data on producer prices in Europe today will act as a kind of warm-up, as investors are much more concerned about applications for unemployment benefits in the United States. But they can throw everyone into shock. Not only can the number of initial applications for unemployment benefits reach 3,180 thousand, but the number of repeat applications should jump to 4,920 thousand, meaning that for the second week in a row, the number of initial applications will be near the record high set just last week. And it is clear that such an increase in unemployment should affect the duration of unemployment. The labor market can't digest so many people so quickly. However, in terms of repeated applications, the situation is still far from a disaster, since in 2009 their number sometimes approached the level of seven million. However, there were no such number of initial applications, and it is difficult to say how events will develop further. You can only be sure that nothing good is worth waiting for.

Number of repeated applications for unemployment benefits (United States):

From the point of view of technical analysis, we see that during the corrective movement from last week's peak of 1.1150, the quote managed to fall to the area of 1.0900, where a variable support was found. In fact, activity is still at high levels, where daily volatility consistently exceeds the 100-point mark.

In terms of general analysis of the trading chart, we see successive inertial fluctuations that are in the structure of a global downward trend.

We can assume a temporary fluctuation within the values of 1.0930/1.0970, where a local acceleration may occur, on the basis of which it will be possible to enter the market. Working within a range doesn't make much sense.

Concretizing all of the above into trading signals:

- We consider long positions if the price is consolidated higher than 1.0970 with the prospect of a move to 1.1030-1.1065.

- We consider short positions if the price is consolidated below 1.0930 with a move towards the 1.0900 level. The main positions will occur after the price is consolidated below 1.0885.

From the point of view of complex indicator analysis, we see that due to the existing correction course, the indicators of technical instruments on the daily periods have changed their interest to neutral. At the same time, hourly segments indicate selling.