The Chinese manufacturing PMI data released today from Caixin, as well as yesterday's values of the manufacturing PMI, turned out to be higher than expected, but, but in contrast, they failed to give the markets a positive impulse.

The presented indicator managed to grow above the important level of 50 points to 50.1 points in March against a February decline of 40.3 points and a forecast of an increase of 45.5 points. But in general, the stock market both in China itself and in Asia did not respond to them, still focusing on the situation with coronavirus in the world.

In addition to Chinese statistics, retail sales in Germany in February was released today. They are at their best, having demonstrated growth in monthly terms by 1.2%, and in annual terms by 6.4%. But we expect that the March figures will be much lower, since the peak of COVID-19's influence declined on the FRG in particular and on the whole of Europe as a whole in March, when strict quarantine measures were put in place to limit the spread of this infection.

The currency market in conditions of high uncertainty of the consequences of the impact of COVID-19 continues to swing from side to side. The ICE dollar index is currently consolidating in a narrow range below 100.00 points after falling last week on the wave of demand for risky assets. Again, such dynamics can be explained by the factor of uncertainty of the effects of this infection on the world economy. Investors understand that this scourge will not last indefinitely, but the longer the economies of the leading countries are quarantined, the stronger the blow. We, as before, believe that the coming month of April will be decisive in this matter. If the infection rates decline this month, we can hope that the European and American economies will begin to recover actively.

With this scenario, we expect growth in demand for highly profitable currencies, which will begin to receive support against the US dollar. The recovery in demand for Chinese products will push Australian and New Zealand dollars to rise. The increase in the cost of oil will have a beneficial effect on the Canadian currency. On the general wave of growth in demand for risk, the euro will grow, and after it, the pound. At the same time, we expect a depreciation of the yen and the Swiss franc.

Regarding the general dynamics this week, it can be argued that markets can get another stress after the publication of data on employment in the States, which will be released on Friday and will be expected to be extremely negative. But again, we note that in general the markets are already accustomed to all kinds of shocks and, looking at the situation around the coronavirus, they are waiting with tension for the first positive signals in order to start the post-coronavirus rally.

Forecast of the day:

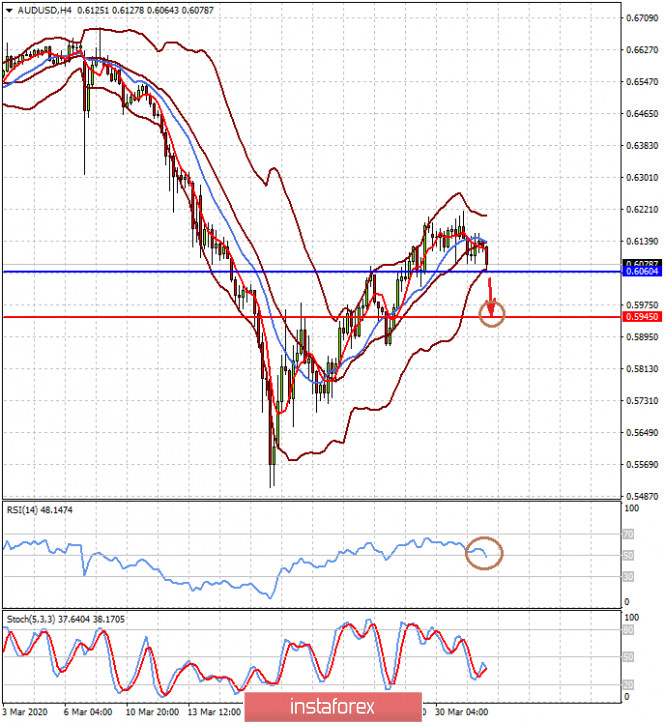

The AUD/USD pair is turning down on the wave of expectation of negative data on employment in the States, which will be released today from ADP and Friday from the US Department of Labor. Price reduction below the level of 0.6060 will lead to a local decline of the pair to the level of 0.5945.

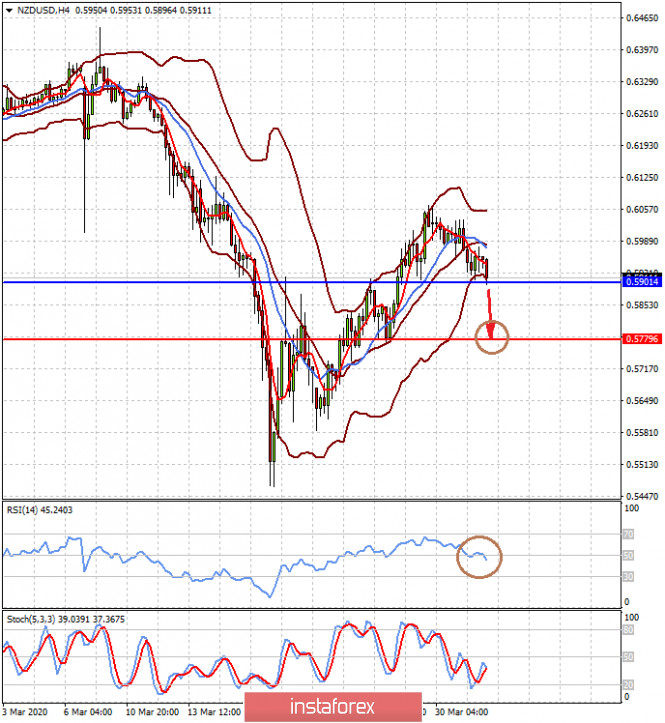

We expect a similar dynamics in the NZD/USD pair, which can be directed to the level of 0.5780 if it crosses the level of 0.5900.