You look at quotes, and you just want to wipe the sweat from your forehead and exclaim that, they say, finally all this horror is now in the past. The market ceased to be in a state of free fall and a reversal began. The single European currency has been growing for two days in a row and continues to grow. Meanwhile, the pound rather stands still, but also shows signs of growth. Most importantly, they stopped falling. However, volatility is, of course, just crazy. But that's nothing. It happens. Now, everyone will calm down, the market will stabilize and everything will return to normal. I do not want to be upset, but, apparently, this is not about a reversal, but only a temporary respite.

The fact that the fall of the markets is still far from complete, most clearly demonstrates what is happening in the debt market. For example, the French government debt securities were placed yesterday, the yield on which is just a wonderful illustration of everything that is happening. In particular, the yield on 3-month bills rose from -0.608% to -0.528%. The yield on 6-month bonds rose from -0.615% to -0.535% while the yield of 12-month bills increased from -0.625% to -0.534%. Here, yields are still negative, but we can see a significant increase. And this is amid the fact that the European Central Bank introduces new stimulus measures almost every day amounting to hundreds of billions of euros. This is only possible if investors simply get rid of European debt securities.

It's ridiculous, but judging by American debt securities, these same investors are shifting to the United States. Money cannot just lie around and do nothing. So, the yield on 3-month bills literally collapsed from 0.29% to 0.00% while the yield of 6-month bills decreased from 0.30% to 0.08%. In other words, we see the very capital flight from Europe to the United States, In this regard, major players are getting rid of European debt securities and buying American ones. Moreover, judging by the dynamics of profitability, American securities are being bought up. And this is happening right now, which means the dollar will continue to grow. And the current slowdown in the currency market is nothing more than a banal respite.

Today, we are waiting for a whole lot of extremely interesting statistics that can shed light on the damage that the coronavirus epidemic will cause to the world economy. The fact is that the rapid and victorious procession of the coronavirus around the world began in March. Moreover, it was also this month that Europe and North America faced this scourge, due to which various shopping centers, cinemas, bars and so on were massively closed. People sit at home and do not go anywhere, since the entire region ends up in the quarantine zone. It is clear that the economic damage will be simply terrifying. Many businesses will not survive this. But while we do not have any statistics, it is extremely difficult to talk about the magnitude of the consequences. So, today, preliminary data on business activity indices will be published, and with all the respect for them, they can at least approximately show what we should expect. And frankly, the forecasts are just frightening. For example, in France, the index of business activity in the services sector should decrease from 52.5 to 41.0, and in the manufacturing sector, it should collapse from 49.8 to 39.8. At the same time, the composite index of business activity may decrease from 52.0 to 40.6. Things may be even worse in Germany, where the index of business activity in the services sector should be reduced from 52.5 to 41.7 as the index of business activity in the manufacturing sector should decline from 48.0 to 38.5. The forecasts for the composite business activity index are completely terrifying, since a decrease from 50.7 to 39.8 is expected. If we talk about the euro area in general the index of business activity in the services sector may decrease from 52.6 to 37.5, while the production index is from 49.2 to 39.6. It is clear that the composite index of business activity will inevitably decrease from 51.6 to 38.5. In this case, we are talking about new historical lows for almost all indicators. In addition, the scale of the decrease in pan-European indices is slightly larger than separately for Germany and France. It turns out that in other countries things are much worse. Moreover, it is in economic terms. And this means that everyone will soon remember the catastrophic problems with the debts of European countries again. On the other hand, the demand for their debt securities continues to decline, which means it is becoming more and more difficult for them to finance not only budget expenditures, but also payments on previous debts.

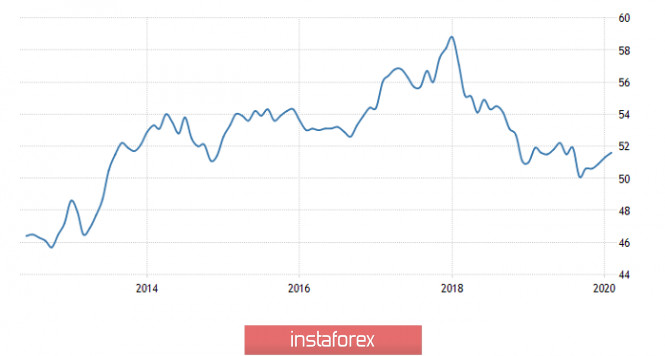

Composite Business Activity Index (Europe):

Things are not the best in the UK, where a terrible collapse in business activity indices is also expected. In particular, the index of business activity in the services sector should decrease from 53.2 to 44.0. The manufacturing business activity index is expected to decline to 51.7 to 45.0. So it is not surprising that they expect a reduction in the composite index of business activity from 53.0 to 44.4. The scale of the decline may be even greater than the one that was after the Brexit referendum. And of course, we are talking about new historical lows.

Composite Business Activity Index (UK):

Do not be surprised that the general decline in the single European currency and the pound will resume during the European session. However, it will be temporary, since we are waiting for some appearance of a rebound already with the opening of the American session. Indeed, the collapse of business activity indices is expected in the United States. In particular, the index of business activity in the service sector may decline from 49.4 to 40.0, while the manufacturing business activity index may decline from 50.7 to 42.0. Therefore, it is quite reasonable to predict a decrease in the composite index of business activity from 49.6 to 40.8. Nevertheless, it is clear that the scale of the decline in the United States is expected to be slightly less than in Europe. Thus, the rebound clearly does not block the decline that will follow after the publication of European data. In addition to this, new home sales data are published, which may be reduced by 3.7%. However, this is the data for February, and the market is now interested in what is happening in March. As a result, only few people pay attention to home sales.

Composite Business Activity Index (United States):

The euro / dollar currency pair found a resistance point in the face of the upper boundary of the variable flat 1.0830 (1.0650 / 1.0830) once again, where it slowed down and formed a stagnation of 1.0775 / 1.0830. It is likely to assume that the stagnation will not last long, where in the case of fixing prices lower than 1.0765, we will open the direction to the levels of 1.0700-1.0650.

The pound / dollar currency pair moved to the lower part of the flat 1.1450 // 1.1660 // 1.1850 during yesterday's swing, where the movement was looped in relation to the periods earlier. It is likely to assume that the stagnation within 1.1595 / 1.1680 will not last long, where in case the price is fixed lower than 1.1590, the direction to the levels of 1.1500-1.1450 will open for us.