The rout of global stock exchanges continues, but stabilization is observed for a number of assets. The price of gold began to adjust downward, it is obvious that this is the result of the work of 6 leading Central Banks, which already conducted a similar operation in 2011 and stopped the growth of gold.

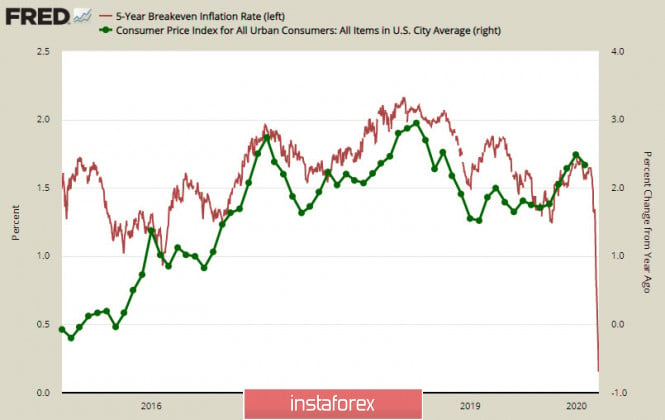

The sale of bonds looks strange against the background of falling stock markets, and the reason is probably due to expectations of a significant bond issue, since governments increase incentive measures, as well as increasing forced sales related to losses incurred by some bond funds. The dynamics of Tips bonds indicate a strong drop in inflation expectations, which means a drop in consumer demand in the current conditions and, as a result, a growing probability of a global recession.

Moreover, measures to save the US securities market continue to multiply. Congress has passed a bill that raises the stimulus package to 1.3 trillion dollars, which is the largest step in history to save the economy. In turn, the Fed will launch a line of credit for primary dealers on Friday, in which not only bonds, but also shares can be collateral. Such a measure is likely to lead to a halt in the decline of stock indices, since the price of the shares will be determined by the Bank of New York Mellon, and not the market, which opens up absolutely fantastic prospects for stock speculators.

Former Fed chairman Bernanke and Yellen wrote an article on the FT that recommended that the Fed request Congressional approval for the direct purchase of corporate bonds, as the Bank of England and the ECB already do. Obviously, if it weren't for the coronavirus, it should have been invented, because under the guise of combating it, it becomes possible to legitimize any, even the most transcendental steps.

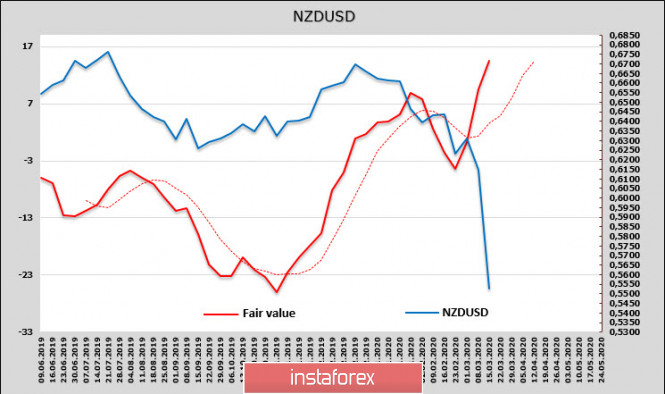

NZD/USD

On Monday morning, The RBNZ lowered the rate immediately by 0.75% at an emergency meeting, committing itself to maintaining it at 0.25% for at least a year.

Further incentive steps will somehow rely on money management and facilitating access to it since it is impossible to lower the rate further without going into the negative area, and the RBNZ assumes that the financial system is absolutely not ready for operations with a rate below 0.25%. In this regard, the next step is a large-scale asset purchase, which will be carried out jointly with the Government of New Zealand.

The purpose of the next steps is to reduce bond yields to a level corresponding to the current key rate, as well as to fill in a liquidity shortage. The government took a number of measures on Wednesday, in particular, it intends to buy back assets in the amount of $ 12.1 billion (4% of GDP). Half of this amount will be spent until June.

The NZD/USD rate in the wake of the panic declined significantly below the estimated fair price. In calm times, such a gap would mean a high probability of NZD/USD turning up, but since the depth of the fall in world markets is still unknown to anyone, it is still too early to wait for normalization.

The current level of the New Zealand currency is fundamentally unjustified, so the decline should be considered only as a result of panic. According to estimates of ANZ Bank, economic activity in China will be normalized by mid-April, and if the forecast is true, then the kiwi will receive reasons for growth.

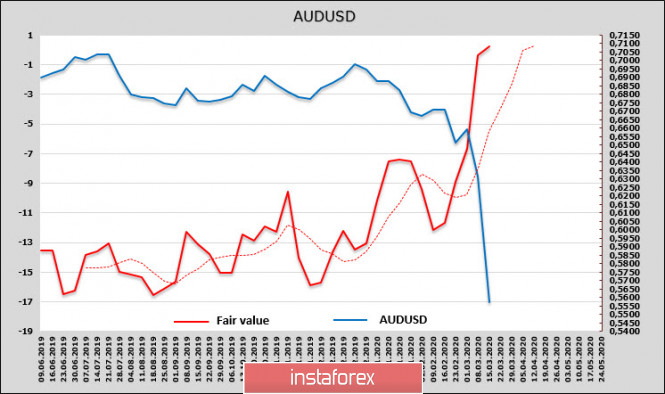

AUD/USD

This morning, the RBA, following the same scenario with other central banks, lowered the rate to 0.25%. The rate will be kept at a low level until inflation returns to the target range of 2-3% and there is obvious progress towards full employment.

Moreover, the RBA will begin to buy back government bonds in the secondary market starting March 20 and will include an urgent financing mechanism for the banking system with special support for small and medium-sized businesses.

In fact, all actions are completely expected. As well as the market's reaction to them - until the disaster in the stock and commodity markets is finished, the AUD recovery will not begin despite the fact that there is no fundamental justification for such a deep fall for the Kiwi. At the same time, demand from China will decrease, well, so it will decline everywhere. Oil prices will decline, and prices along the entire product chain, down to the high-tech sectors, will also decrease.

For the time being, only one thing can definitely be said - the Australian currency is deeply oversold, but it will only go up when the decline in stock markets ends.

The material has been provided by InstaForex Company - www.instaforex.com