The unexpected decision of the Federal Reserve to once again reduce the refinancing rate, this time as much as from 1.25% to 0.25%, put the market in a stupor. Investors really don't know what to do or what to expect. After all, the decision was made not just over the weekend, but just three days before the regular meeting of the Federal Open Market Committee. In this situation, there is nothing else to do but assume that the situation is so terrible that emergency measures must be taken immediately. It is clear that this further provokes panic. Investors do not yet understand what is happening. This is the reason why we see a stagnation in the pound, since the major players have not yet decided how to behave. On the other hand, the market was waiting for a reduction in the Fed's refinancing rate in any case. True, on a smaller scale, but still during a scheduled meeting. In addition, such a sharp step forces the Bank of England to reduce the refinancing rate on a much larger scale than previously stated. Consequently, the BoE can reduce the refinancing rate below 0.1%, which is declared the lower acceptable limit.

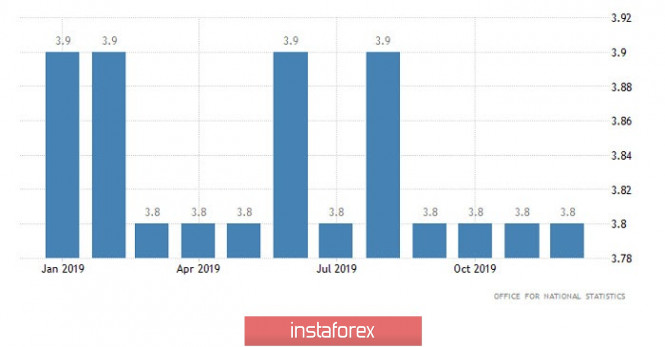

However, today the pound has an opportunity to slightly grow, as in the UK itself, the unemployment rate is expected to fall from 3.8% to 3.7%. Combined with this, the fact that the growth rate of average wages should remain unchanged looks good. The only thing that can disappoint market participants is the increase in the number of applications for unemployment benefits from 5.5 thousand to 24.0 thousand. In addition, employment could grow by 150 thousand against 180 thousand in the previous month. However, the increase in the number of applications, as well as the slowdown in employment growth amid a reduction in the unemployment rate, does not look so terrible.

Unemployment rate (UK):

But if the British macroeconomic statistics can be called moderately optimistic, then the forecasts for the US are definitely negative. In particular, the growth rate of retail sales may slow from 4.4% to 2.7%, which will clearly disappoint many. After all, consumer activity is the main driving force of the American economy. In addition, data on industrial production will also be published, the rate of decline of which should slow down from -0.8% to -0.3%. So to call these data positive is even more perverse, since the decline is not going anywhere, and it has lasted for five consecutive months. And if the forecasts are confirmed, industrial production in the United States will decline for six straight months.

Industrial production (United States):

In terms of technical analysis, we see a continuing downward interest, which managed to expand the quote by more than 800 points in a matter of a week. In fact, we received a breakout of several price levels at once, and the quote fell to the area of October 2019. The subsequent fluctuation occurred in the stagnation phase, where the quote focused on the 1.2200/1.2280 frame.

Looking at the trading chart in general terms, we see a recovery relative to the medium-term upward trend, where the development has already exceeded the 70% mark .

It is likely to assume that the temporary stagnation may be prolonged, and the existing oversold situation may lead to a technical pullback towards the 1.2350 mark. In the medium-term review plan, the top- down perspective is still a priority.

We will concretize all of the above into trading signals:

- We consider long positions if the price is fixed above 1.2280, with the prospect of a move to 1.2350.

- We consider short positions if the price is fixed below 1.2200, with the prospect of a move to 1.2150.

From the point of view of complex indicator analysis, we can see that the indicators of technical instruments indicates a move to sell due to a strong downward move, excluding minute intervals.