4-hour timeframe

Amplitude of the last 5 days (high-low): 68p - 104p - 108p - 87p - 194p.

Average volatility over the past 5 days: 113p (high).

The British pound spent the first trading day of the week as it should be. Firstly, there were no abrupt and unreasonable movements. Secondly, the British pound traders clearly worked out macroeconomic statistics. Thirdly, there was no panic. And most importantly, what needs to be said right away: the euro currency did not move today on the basis of macroeconomic data. Trading on the pound/dollar pair proved ot. However, first things first. In general, today perfectly fits the definition of correctional Monday. There were few important posts today. Therefore, the volatility remained not too high. We spoke about indexes of business activity in the US manufacturing sector, Markit and ISM, in the article on the euro. In the UK, the index of business activity in the manufacturing sector was slightly lower than experts' forecasts and amounted to 51.7. It was this publication that provoked a slight drop in the British currency in the European trading session. After lunch, when it became known about business activity in the US manufacturing sector, the quotes of the pair rushed up, working out already weak statistics from across the ocean. As a result, everything is logical and reasonable.

In the meantime, delegations of Michel Barnier and David Frost have officially begun negotiations on a trade deal that provides for a turnover of 500 billion euros annually. The first round of negotiations is expected to last three days. The next round of negotiations will also take place in March, each subsequent one will take place in two to three weeks. Both sides express a desire to conclude a trade deal before the end of 2021. It is noted that the European side wants to provide Britain with access to a single market without duties and quotas, but they want to receive guarantees in return that the British government will prevent dumping and ensure fair competition for British and European companies. The European Union also wants to gain access to fishing in British waters. In turn, London wants to completely get out of the jurisdiction of the European Union, not to submit to the European Court. Negotiations have begun, and in the near future we can get the first information on this topic.

We, as before, believe that the probability of a trade deal within the next 3-4 months is extremely low. It is 3-4 months, not ten, since Boris Johnson has already stated that if it is not clear that the deal has prospects before mid-summer, the British delegation will leave the negotiations with the Europeans. Thus, this is not even a year of talks, but just a few months. What are the chances that a huge deal will be agreed in such a short time? The British pound will be, as they say, keep abreast of the negotiations, being in a ready mode at any moment to fall if information is received that the parties cannot come to a common denominator. In recent days, the downward trend seems to have resumed, but so far it cannot be said that it is confident.

We would also like to mention the speeches of Mark Carney and Jerome Powell. Recall that both central bank chairmen said they would respond if necessary to the consequences of the coronavirus epidemic, which, according to Carney, is already negatively affecting the British economy. But his American counterpart also stated high risks of a slowdown in the economy due to the Chinese virus and hinted that the Fed would cut the rate in the near future. In fact, the British pound did not react to any one or the other statement, because they offset each other. Thus, now we can expect a softening of both the British monetary policy and the US one, which will not change the balance of power between the currencies, unless the Fed reduces the rate immediately by 0.5%. Only such a step can provide the British currency with more or less long-term support.

From a technical point of view, the pound/dollar has now begun to adjust, which again is logical after Friday's drop in quoted. The MACD indicator has not yet managed to turn up, but will do so soon. Thus, we recommend now waiting for news from the UK, waiting for new macroeconomic publications, waiting for the completion of the correction. The downward trend continues.

Trading recommendations:

The GBP/USD pair continues the upward correction. Thus, it will be possible to sell the British pound again with targets at 1.2700 and 1.2686 (first support level) after completion of the current correction (MACD indicator turns down or rebounds from the Kijun-sen line). We recommend considering the pair's purchases with targets at the level of 1.2926 and the Senkou Span B line in small lots if the bulls are able to gain a foothold above the Kijun-sen line. In any case, the fundamental background remains not on the side of the pound.

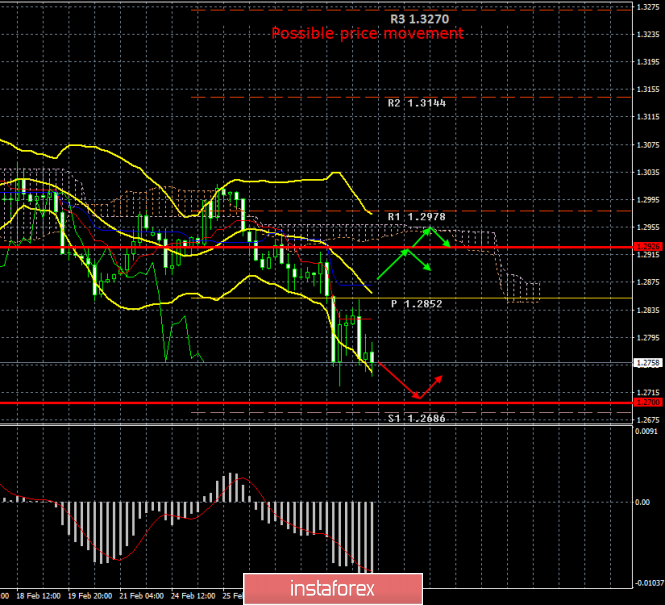

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com