The US currency, after some fluctuations, soared again today: the dollar index jumped to almost 100 points, reflecting the demand for greenback across the entire spectrum of the market. The Fed's dovish decisions did not frighten investors – on the contrary, the actions of the regulator and the White House increased the attractiveness of the US national currency. The US economy is believed to be more resilient to large-scale economic shocks, at least compared to the eurozone economy. Therefore, after a one-day pause, the dollar has again become the favorite – it is used as a defensive asset amid ongoing panic around the pandemic. At the same time, dollar bulls completely ignore US macroeconomic reports, while weak European statistics raise the pressure on the euro. This fundamental background made it possible for EUR/USD bears to test the 9th figure – now the bears are trying to gain a foothold in this price area. If they succeed (and the probability of this scenario is very high), the nearest support level will be 1.0850-this is the lower line of the Bollinger Bands indicator on the weekly chart.

The catalyst for panic is now the stock market. US indexes almost every day set anti-records, thus fueling the excitement. Yesterday, the S&P 500 index fell by 12% (to 2386.13) – out of 500 companies included in the calculation of this index, 491 shares fell in price. The Nasdaq Composite also showed similar dynamics, which fell to 6,904. 59, the sharpest drop in the technology index for one day. During yesterday's trading, shares slightly regained their positions, after one of the US president's advisers promised Americans tax benefits worth $800 billion. But then there was a statement from Trump himself, who did not rule out a recession – according to him, the pandemic will last at least until July-August – "and maybe longer." After these comments, the stock market plunged again.

Today, the situation is no better: the Dow Jones Industrial Average has fallen below 20,000. Exchanges reacted to the statement of the head of the Federal Reserve Bank of Cleveland, Loretta Meester, who said that she supports the idea of restoring the financing program using commercial securities. This program was applied 12 years ago during the 2008 crisis. Later, the Federal Reserve issued a corresponding statement, providing some details. According to Fed members, this program will provide liquidity to issuers of securities (it involves lending for three months at the rate of OIS +20 bps). The program will be supported by ten billion dollars from the US Treasury Department. At the same time, the Fed admitted that the securities market came under "tremendous pressure". As a result, the stock market is again showing volatility, and the dollar, in turn, is growing on a wave of panic, "cream skimming" from the current situation.

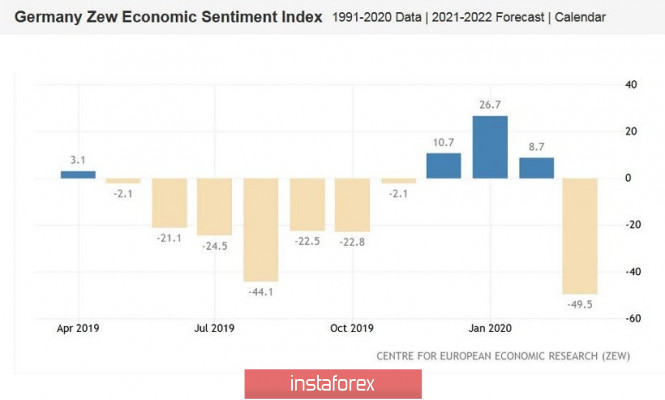

But the European currency today was under additional pressure due to depressingly weak macroeconomic reports. The block of macroeconomic statistics published today confirmed the deplorable forecasts regarding the prospects of the European economy. In particular, the ZEW indices of Germany and the eurozone was not only in the red zone, but also updated multi-year lows. The German index fell to -49 points with the forecast of a decline to -29 points. The pan-European indicator showed similar dynamics, falling to almost -50 points, while the forecast for a decline to -23 points. The indicators fell to their lowest values since 2010, reflecting the pessimism of the European business environment.

As I said above, US data does not shine with success. February retail sales data came out worse than expected. The overall indicator fell into negative territory for the first time since September last year, reaching -0.5% m/m.Excluding car sales, the indicator showed similar dynamics, falling to -0.4% (the worst result since December 2018). Sales also declined excluding auto and fuel sales (the weakest figures since February 2019).

The dollar completely ignored the published data. This suggests that the US currency is growing solely due to panic, which, in turn, is fueled by the fall in stock markets and the COVID-19 epidemic. In general, the dollar is rising due to strong demand for liquidity amid ongoing panic.

According to a number of currency strategists, if buyers manage to "pull" EUR/USD above 1.1050 in the near future (within one or two days), the pair will form a price low - in this case, short positions will look risky. But if the bears still gain a foothold in the ninth figure (in my opinion, this is the base scenario), they will open their way to new price horizons, namely to the support level of 1.0850, which corresponds to the lower line of the Bollinger Bands on the weekly chart.

The material has been provided by InstaForex Company - www.instaforex.com