In general, as expected, while the Americans celebrated Presidents Day, the market stood rooted to the spot. Fortunately, as in the EU, no macroeconomic data was published.

Today, the focus is on UK labor market data, which could cause the pound to decline further. The fact is that forecasts are rather moderately negative. Most indicators should remain unchanged. Especially the unemployment rate itself, which of course inspires some optimism. Moreover, the unemployment rate has been standing still for three months and is at its lowest level in recent years.

Unemployment Rate (UK):

The growth rate of the average wage should remain unchanged, in contrast to salaries taking into account bonuses, the growth rate of which may slow down from 3.2% to 3.1%. And according to some forecasts, even up to 3.0%. Given that this indicator still largely reflects the willingness of employees to work more, since bonuses are mainly meant to be overtime, expectations are negative. This shows investors that the need for hiring additional workers is growing, which significantly increases staff costs. Which means it reduces profits.

Average salary, including bonuses (United Kingdom):

Another negative factor may be data on changes in employment, as it should grow by 120 thousand, against 208 thousand in the previous month. That is, the growth rate of employment is clearly decreasing, which also does not usually please market participants.

Employment Change (UK):

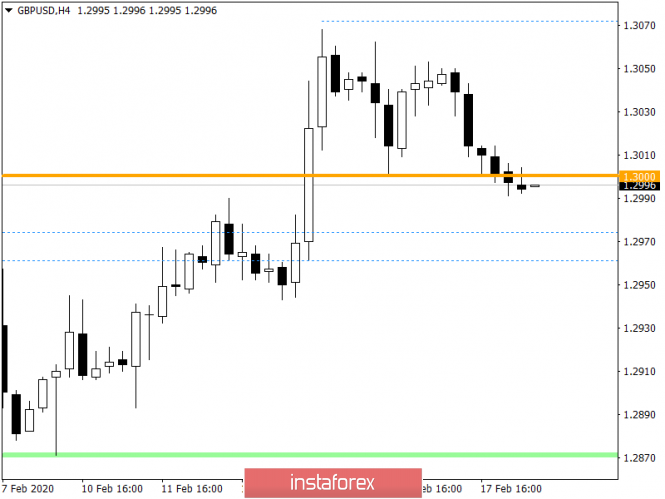

In terms of technical analysis, we see that the the price will return to the area of the psychological level of 1.3000, which was expected in the previous review. In fact, the fluctuation within the boundaries of 1.000/1.3070 comes to an end, where a peculiar accumulation at the peak of correction signals the resumption of the initial move.

Considering the trading chart in general terms, we see that the clock frequency has already changed, and overcoming the mark of 1.3000 is not uncanny. Thus, the main points in this process are the levels of 1.2885 and 1.2770.

It is likely to suggest that downward interest will continue in the market, and price taking will be lower than 1.3000. The prospect of a possible move is presented in the form of steps, where the first platform is located in the region of 1.2960.

From the point of view of a comprehensive indicator analysis, we see a steady downward interest in all major time intervals. In fact, the intersection of the psychological level of 1.3000 was the very starting point in the change of technical indicators.