The quote confidently follows the emotions in the structure of a corrective move, where more than 200 points have already been passed from the support point of 1.0775. The noise set amid rumors of a possible Fed interest rate cut puts pressure on dollar traders who have left their positions, and the growing activity of the coronavirus is increasingly discussed by the heads of state, which also creates an additional background for rash jumps.

In terms of statistics, we had a second preliminary estimate of US GDP for the fourth quarter, where we were waiting for a revision upward to 2.3%, but the level remained unchanged at 2.1%. At the same time, applications for unemployment benefits in the United States were published, which remained virtually unchanged: re-9 thousand; primary +8 thousand. It is worth considering that the previous data on applications have been reviewed for the worse.

Today, the focus of attention will be the publication of preliminary data on inflation in Europe, which can show its slowdown from 1.4% to 1.2%. From that moment, all previous data will be instantly forgotten, and the dollar will again grow rapidly, as well as in relation to all currencies. And it's understandable that amid the market's disappointment over inflation in Europe, as well as the fact that with such inflationary dynamics, one does not have to wait for a tightening of the monetary policy of the ECB.

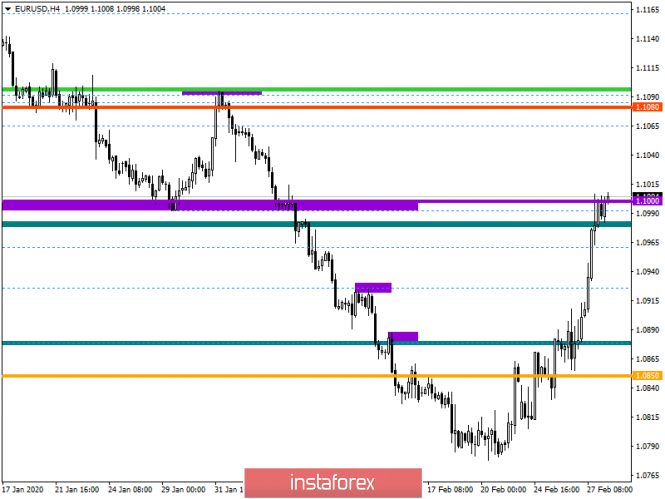

From the point of view of technical analysis, we see that the corrective move turned into an inertial-impulsive one, which led to the convergence of prices with the psychological level of 1.1000. In fact, this is already a significant scale, if we take into account the entire scope of the correction, thereby overheating long positions already exist, which can play into the hands of sellers.

In terms of a general review of the trading chart, we see that the current movement has generated 50% of the entire downward movement since the beginning of February and now the level of 1.1000 plays a kind of stumbling block where the fate of the downward development is decided.

It is likely to assume that an oversold signal was still received, and in combination with a psychological level of 1.1000, we can get the most attractive short positions. There is no need to hurry, first we will fix the slowdown, the structure of which already has the outlines of 1.0980/1.1010. The next step will depend on the price taking points, we are interested in breaking the boundary of 1.0980 with a pass lower than 1.0965. The sell signal is confirmed in this case. An alternative scenario considers a change in the clock component, where the correction move is maintained towards the level of 1.1080.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price taking higher than 1.1030, with the prospect of a move to 1.1065-1.1080.

- Short positions, we consider in the case of price taking lower than 1.0980 and passing the mark of 1.0965.

From the point of view of a comprehensive indicator analysis, we see that technical instruments unanimously signal a purchase due to such a significant inertial move. Minute indicators can be unstable due to turbulence within the psychological level.