The single European currency continues its steady decline, but still behaves rather strangely, which causes more and more concern ...

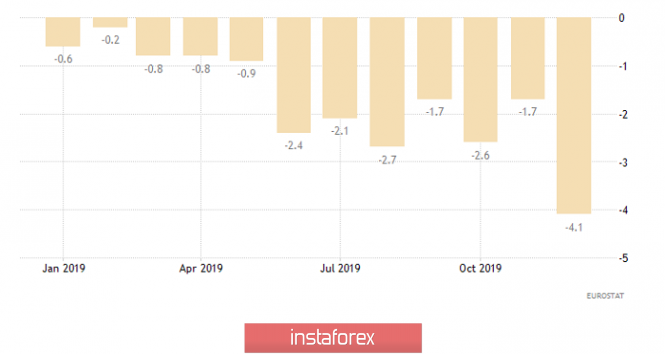

The fact is that the single European currency essentially ignored data on industrial production, which turned out to be significantly worse than forecasts. So they expected a deepening of the recession, but not from -1.7% to -4.1%, but only from -1.5% to -2.8%. So not only did the pace of recession turned out to be much larger, but also the previous results were reviewed for the worse. And do not forget that the decline has been going on for fourteen consecutive months. Nevertheless, despite such terrible results, the euro remained stable. This happened for the simple reason that they were ready for such a development of events from the industrial production data on Germany and France were published. That is, investors have already put all this into the value of the euro.

Industrial Production (Europe):

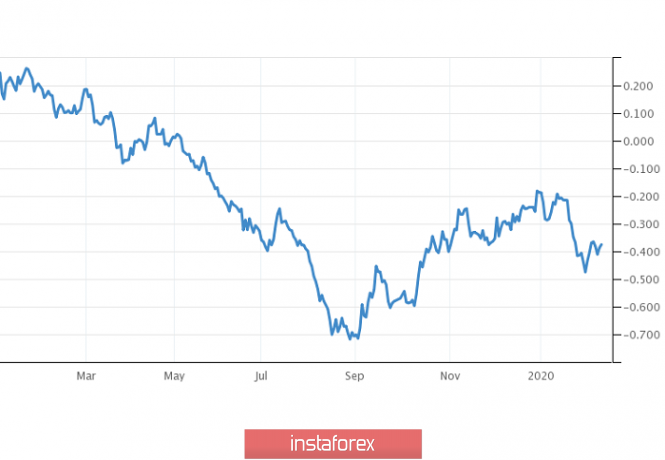

Nevertheless, as soon as the US session opened, the single European currency again began to lose its position. And one gets the feeling that this is just such a belated reaction, since American traders control the market, due to the huge capital that they have. This is partly true, but it is not a matter of industrial production, but of government debt. The fact is that about an hour after the publication of data on industrial production, 10-year bonds were placed in Germany, the yield of which decreased from -0.25% to -0.38%. As soon as US traders saw these results, they immediately began to reduce their European positions. They just start working a little later than Europe.

Yield on 10-year government bonds (Germany):

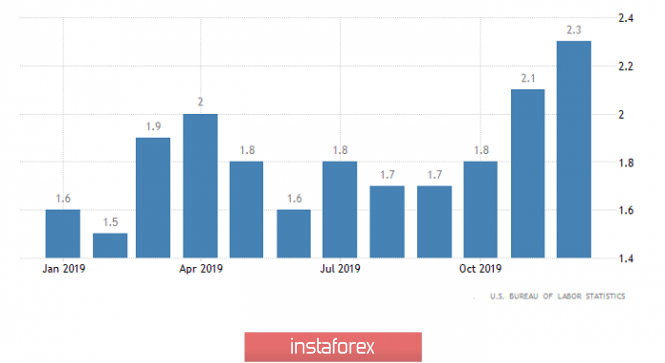

The main event today will be the US inflation data, which is seen to grow from 2.3% to 2.4%. This in itself is not bad, but a few more pieces of the puzzle must be added to this. The fact is that in addition to a steady increase in inflation above the target level of 2.0%, Jerome Powell recently made a statement that the coronavirus does not pose a threat to economic growth. Moreover, this same economic growth looks very, very good, even slightly better than the Federal Reserve predicted. And here it is necessary to recall that at the very end of last week, a number of media actively spread the rumor that, because of the coronavirus, the largest central banks could lower their interest rates just in case. So, Powell's words, combined with rising inflation, may be a signal that the Fed does not exclude the possibility of raising the refinancing rate.

Inflation (United States):

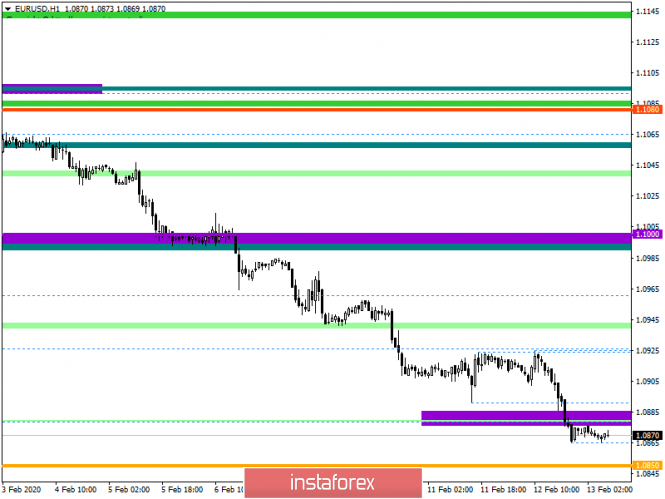

From the point of view of technical analysis, we see price consolidation below the previous year's low of 1.0879, where there is a significant downward movement behind, and ranges of psychological significance are located under the quote. In fact, we have an attempt to resume the initial trend, where the quote is already at the level of 2017 and perhaps this is not the limit.

In terms of a general review of the trading chart, we see that the current downward move has a value of six weeks, where there was only one correction along the route. At the same time, the breakdown of the 1.0879 value became the starting point of new measures, but it is worth considering that pressure from record lows remain.

It is likely to assume that the current consolidation of 1.0865/1.0877 will be broken in the coming hours, having a local increase, possibly in the partial recovery phase. In turn, the overall downward trend is maintained, where the descent towards the level of 1.0850 is not ruled out, where it is worthwhile to carefully analyze the price consolidation points relative to this coordinate.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price consolidation higher than 1.0880, local transactions.

- Short positions, we consider in case of price consolidation lower than 1.0850, the main transaction.

From the point of view of a comprehensive indicator analysis, we see that technical instruments are focused on the downward movement, having a sell signal. It should be noted that due to consolidation, indicators at minute intervals can be variables.