The euro remained traded in a narrow price range against the US dollar and, after an unsuccessful attempt to break above yesterday's highs, retreated to the support area of 1.0835. The evidence that the German economy cannot gain strength and show good growth in any way did not put serious pressure on risky assets, since after recent fundamental statistics, few expected a good start to this year.

Weak global demand and a decline in domestic investment are key issues for Germany, where industrial production can also be recorded, a recession in which will continue. Small growth in the manufacturing sector is likely to be quickly crossed out by weak demand from Asia, which is slowing amid the negative impact of coronavirus on the global economy.

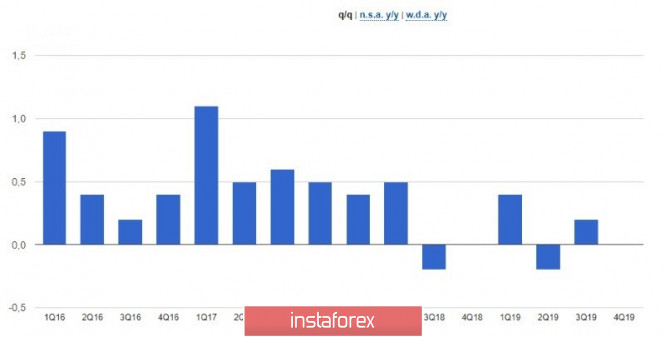

According to a report by the Destati National Bureau of Statistics, Germany's GDP in the fourth quarter of 2019 remained unchanged from the previous quarter. Compared with the same period of the previous year, GDP in the fourth quarter grew by only 0.4%. The data completely coincided with the forecasts of economists. It should be noted that it was possible to count on domestic consumption back in the third quarter, which by the end of the year also significantly decreased, as did external demand. Consumer and government spending also declined. Household expenses in the fourth quarter remained unchanged, while government spending grew by only 0.3%.

The euro managed to maintain its position only because the data coincided with the forecasts of economists, as some experts, after weak December data on manufacturing orders and industrial production in Germany, expected a contraction in the fourth quarter. Let me remind you that Germany's GDP grew by 0.2% in the third quarter, and it fell by 0.2% in the second quarter after increasing by 0.5% in the first quarter. The growth of the German economy was at the level of 0.6% for the entire 2019.

Today's report from Ifo Institute on the mood of German exporters in February this year did not please traders. According to the data, the index of expectations regarding export of the manufacturing sector fell to -0.7 points in February from 0.8 points in January, and a more serious surge of coronavirus on the European continent leaves little room for improvement in the future.

Data on the mood of business circles in France also once again confirmed the complexity of the situation. According to the report, the sentiment index in business circles of France in February of this year remained at the level of 102 points against 102 points in January, while its decline was predicted to reach the level of 99 points.

As for the technical picture, the bulls have not yet managed to renew yesterday's high, while a large resistance was formed in the 1.0870 area, which, although it leaves the market on their side, it is best to look at long positions only after correction to the lower boundary of the ascending channel, which passes the area of 1.0810. A break of the high of 1.0870 will make it possible to maintain a bullish momentum in risky assets, which will lead to an update of the levels of 1.0895 and 1.0930.

GBPUSD

The British pound continues to strengthen against the US dollar. Talk that the new British finance minister, Rishi Sunak, can seriously address the issue of easing fiscal policy, is supporting the pound, which, taking advantage of growing problems in other countries, is gradually regaining its position before the start of important UK-EU negotiations. It should be noted the gradual improvement in economic indicators after the MP elections in the UK in December last year, as well as after Brexit at the end of January this year, which adds confidence to investors and businesses after a long period of uncertainty.

Let me remind you that the plan of government spending will be presented on March 11.

The material has been provided by InstaForex Company - www.instaforex.com