The coming week will be full of important events, as well as the publication of economic data that will have a direct impact on financial markets.

The most striking event is expected to be the UK's announcement of its withdrawal from the European Union. It is expected that January 31 will be officially announced. It seems that this quite annoying soap opera is finally ending after the three and a half years that have passed since the referendum on the so-called Brexit, as well as the long and difficult confrontation between the parties for the country's exit from the EU and against it. However, it will be difficult to say how the British economy and sterling will feel after that. All the emotional movements in connection with this topic have long since passed. But it's hard to say how the real picture will turn out.

The second most important meeting will be the Fed and the Bank of England on monetary policy, which will be held on Wednesday and Thursday, respectively. From which, in fact, they do not expect anything special, but they can simply confirm the current monetary rates with their decisions, which will either have a supportive effect on the US dollar and the British currency, or not. Thus, everything will depend on the general alignment of forces in the currency exchange markets, where the dollar is currently receiving support against major currencies in the wake of a fall in demand for risky assets due to the Chinese "snake flu" epidemic, or coronavirus. On this wave, there is also an appreciation of the Japanese yen, Swiss franc and gold, which resumed growth again to a local maximum of January 8 of this year.

On the other hand, the publication of the forecast for the US economy from the Congressional Budget Office will be one of the important events this week. This agency faces the challenge of raising funds to pay off America's bloating budget deficit.

From economic data, first of all, it will be necessary to pay attention to the publication of the values of basic orders for durable goods in the States, which are supposed to grow 0.2% in December against a 0.1% decrease in November. You should also pay attention to the data of the Conference Board consumer confidence index. In addition, the values of consumer and industrial inflation in Australia, the report on inflation in Britain and employment data in Germany will attract attention. Of course, you should also pay attention to the press conference of J. Powell and M. Carney and the outgoing figures of US GDP for the 4th quarter of last year and the index of business activity in the manufacturing sector of China, where the indicator is expected to drop to 50 points in January against the December value at 50.2 points.

Forecast of the day:

EUR/USD remains under pressure in the wake of an inarticulate signal from the ECB about the prospects of monetary policy, as well as expectations of Britain's exit from the EU. We believe that the pair still has prospects for continuing the decline to 1.0980 after breaking through the level of 1.1020.

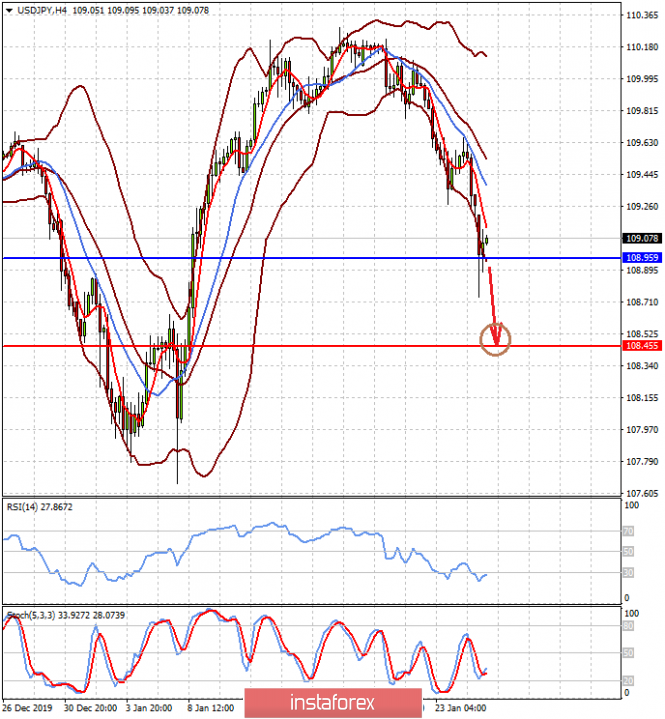

USD/JPY is trading above the level of 108.95. A decrease in risk demand under the influence of fears of the spread of Chinese "snake flu" may continue to put pressure on the pair. We consider it possible to resume its sales after falling below 108.95 with a local target of 108.45.