The Board of the European Central Bank has not only left all its interest rates unchanged, but also expects them to remain at current low levels, and possibly lower, until inflation forecasts show steady growth to 2.0%. To simply put it, the policy of the European Central Bank has not changed, which means that it remains possible to reduce the refinancing rate to negative values. It is for this reason that the single European currency began to decline. Although this is not just a decline, it is the resumption of the gradual weakening of the single European currency, which has been going on for almost a decade, during which the European Central Bank, softens the parameters of its monetary policy step by step.

At the same time, Christine Lagarde made an extremely important statement during her press conference, which remained completely without attention. The reason for this is because of the general disappointment of investors due to the preservation of the current policy of the European Central Bank, as well as the incredible hype about the pneumonia epidemic caused by the new coronavirus. However, Christine Lagarde said that the European Central Bank is not just considering the possibility, but is already embarking on a review of the ongoing monetary policy. It is expected that this process will be completed before the end of this year. And in theory, this alone should have been enough for the explosive growth of the single European currency, since reducing interest rates constantly can be revised only in one direction - their gradual increase. However, the European Central Bank does not give any specifics on this issue.

Refinancing Rate (Europe):

Today, a single European currency may be able to complete the week on a major note. Preliminary data on business activity indexes in Europe are likely to show the growth of all indices. In particular, the index should grow from 46.3 to 46.9 in the manufacturing sector, and in the service sector, from 52.8 to 52.9. As a result, the composite index of business activity can grow from 50.9 to 51.1.

Composite Business Activity Index (Europe):

However, the composite business activity index in the United States, where similar data is published, should decline from 52.7 to 52.5. This can happen due to a decrease in the index of business activity in the services sector, from 52.8 to 52.7, as well as a decrease from 52.4 to 52.2, in the production index of business activity. Thus, if in Europe all indices should increase, then it should decline in the United States.

Composite Business Activity Index (United States):

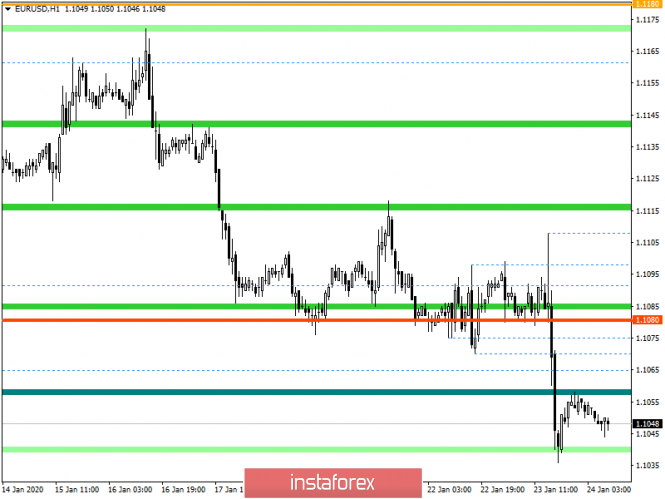

From the point of view of technical analysis, we see a pulsed stroke, which led to a breakdown of the lower boundary of the time range 1.1070 / 1.1100. In fact, the three-day stagnation has accumulated a lot of intrigue and doubt, where, the situation with a narrow amplitude was discharged against the backdrop of the ECB meeting, locally redrawing the downward movement.

In terms of a general review of the trading chart, we see that the value of 1.1036 played a point of variable support relative to the past impulse, where a pullback was formed against the background of local oversold, followed by stagnation. The main point of support is located below in the face of the psychological level of 1.1000.

It is likely to assume that the quote has a chance of a more significant rollback after the recent jump. In this case, the price is considered to return back to the lower border of the previously passed flat 1.1070 / 1.1100. In view of alternative positions, it is worth considering yesterday's minimum of 1.1036, where the path to the control level of 1.1000 will open, in case the price is fixed lower.

Concretizing all of the above into trading signals:

- Long positions are considered in case of price fixing higher than 1.1060.

- Short positions are considered in case of price fixing lower than 1.1036.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments have turned in a downward direction, holding a sell signal due to the recent impulse move.