The euro-dollar continued the trend on Friday during the Asian session on Monday, rising to the level of 1.1130. Dollar bulls are forced to reckon with rather weak data on the growth of the US labor market in December. Nonfarm unexpectedly came out in the red zone, not reaching the forecast values. On Friday, the EUR/USD bears were able to neutralize the negative effect of this release, however, buyers have reactivated today. However, the main battle between bulls and bears is yet to come - this week is rich in events of a fundamental nature. Let's look at the main ones.

Today - January 13 - the Chinese delegation should arrive in Washington to sign the first phase of the trade deal. The signing ceremony itself may take place a little later, on the 15th. This is the date announced by US President Donald Trump. However, after this, in an interview with ABC, he said that the date of signing the contract could be delayed - but the "base scenario" involves signing the deal this Wednesday. A newsletter on the text of the trade agreement should be published on the same day. In one of his tweets, Trump reported that after signing the first phase of the deal, he would go to China to negotiate the second phase, although the discussion of this stage could drag on to 2021. In general, the signing ceremony can support the US currency, although the fact that the first phase of the deal was agreed upon by the market has long played back (in December). Therefore, the influence of this fundamental factor may be of a short-term nature.

But macroeconomic reports will play a special role for EUR/USD. First of all, we are talking about data on the growth of US inflation, the release of which is scheduled for Tuesday. Let me remind you that Federal Reserve Chairman Jerome Powell has repeatedly hinted that further steps by the US regulator will largely depend on the dynamics of inflation growth. According to him, the Fed "will not even think" of raising the rate until inflation shows steady and stable growth.

It is worth noting that according to the consensus forecast, US inflation indicators should show positive dynamics in December. The general consumer price index should rise to 2.4% on an annualized basis and to 0.3% on a monthly basis. Core inflation, excluding food and energy prices, can also show low growth in monthly terms (up to 0.2%) and remain at the same level (2.3%) in annual terms. If the real numbers fall below enough predicted values, the dollar may again fall under a wave of sales.

Weak inflation will affect Fed members, who are forced to reckon not only with the dynamics of the labor market, but also with inflation dynamics, especially in light of the recent Nonfarms report. Let me remind you that the inflation component - the level of the average hourly wage - significantly disappointed last Friday. This most important indicator for the Fed was at around 0.1% on a monthly basis (the worst result since last September, when it fell to zero) and 2.9% on an annual basis (worst result since July 2018). Such dynamics are also correlated with the uncertain growth of key inflation indicators. Therefore, the disappointing CPI report will in any case put downward pressure on the US currency.

The remaining releases this week will be less significant, but still important for the EUR/USD pair. The US will publish the producer price index on Wednesday, January 15, which is an early signal of changes in inflationary trends. Recently, it has been showing contradictory dynamics - it jumped to 0.4% in October, while it dropped to zero in November. A slight increase is expected again in December - both in monthly and in annual terms. Excluding food and energy prices, this indicator should exceed a zero value in monthly terms and remain at the same level (1.3% year on year).

The United States will publish data on retail sales on Thursday. The overall indicator began to decline again (0.2%) last month, but December figures should demonstrate positive dynamics - both the total retail sales and excluding car sales - all these indicators should go into the green zone (0.3% and 0.5%, respectively). The head of the ECB Christine Lagarde will hold a speech on this day. But it will be ceremonial (she will deliver a speech at the reception), so she is unlikely to touch on the topic of monetary policy prospects.

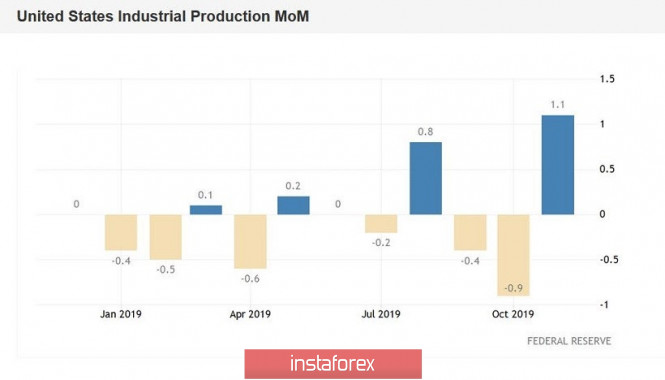

We will find out the final data on the growth of European inflation on Friday (the release should coincide with the initial estimate of 1.3%) and the data on the growth of the Chinese economy (a slight slowdown is expected). During the US session, all the attention of traders of the EUR/USD pair will be focused on the indicator of industrial production in the US. This release is especially important now, in light of the downward trend in the ISM manufacturing index, which recently updated a 10-year low. Unfortunately, (primarily for dollar bulls), this indicator should demonstrate negative dynamics, and quite substantial - from 1.1% to zero. If the indicator plunges into the negative area, the dollar will feel additional pressure on the fundamental background.

Thus, according to the results of the current week, EUR/USD traders should choose a vector of further movement. The pair may exceed the key resistance level of 1.1220 (the upper line of the Bollinger Bands indicator on the daily chart), thereby gaining a foothold in the 12th figure. Or go below the support level of 1.1050 (the upper boundary of the Kumo cloud, which coincides with the lower line of the Bollinger Bands), thereby opening the way for a decline to the ninth figure.

The material has been provided by InstaForex Company - www.instaforex.com