Good evening, dear traders! Congratulations on the start of a new trading week. The most discussed news last weekend was the new data on the dynamics of the spread of coronavirus in China and other countries. There are already thousands of people who are infected. Therefore, the head of the PRC, Xi Jinping himself, gave comments, and they were joyless: "The spread of the new coronavirus in China is accelerating..." And so, emergency mode was introduced in 25 regions including Shanghai and Beijing. There were 41 deaths, while more than 1300 people were infected.

The peak of news declined on the weekend, when they showed falling people right on the streets on the television channels. I remind you that it is New Year's holidays in China.

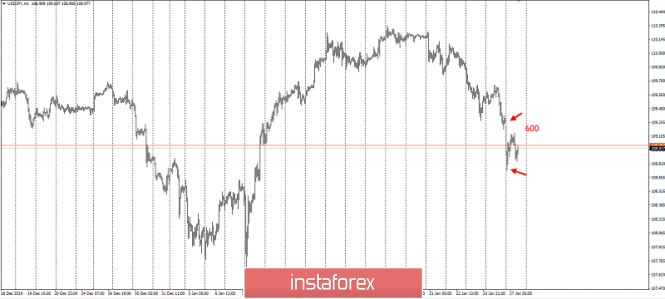

In the currency exchange market, the most affected pair was USD/JPY, which lost half a dollar in the declining market over the weekend, opening upside down and so on in the falling market. This movement is caused by the departure of investors in the yen amid fears of the uncertainty of the Chinese economy in connection with a new bacteriological threat.

Gold on fears is always in demand. Over the weekend, a troy ounce added 1750 p:

At the same time, impressive losses were suffered by the declining oil. China is the largest energy consumer. Over the weekend, the barrel also lost another $ 2 and is now trading at around $ 52:

The SNP500 index lost an incredible 10,000 points in two days:

In these conditions, I recommend that you refrain from opening large positions, as no one knows how the situation will develop. Moreover, staying at your own in such a market is far from the worst option.

Have a successful trading and control risks!

The material has been provided by InstaForex Company - www.instaforex.com