The final decision of the Japanese Central Bank was predictable. The central bank kept the monetary policy unchanged. The key interest rate remained unchanged at -0.1%, as well as the target level of return on 10-year government bonds of about 0%. At the same time, everything also remained unchanged regarding the prospects of monetary policy. In a statement, the bank said that the level of interest rates will remain at the current or lower. In general, there were no surprises as expected.

Moreover, the Japanese stock market declined, responding already to the news about Chinese SARS, from which 4 people had already died in the "under heaven". This reaction of the local market, as well as the fall of the Chinese stock market can be explained by the growing fears that a prolonged celebration of the Chinese New Year, and, in general, the New Year's Eve holidays, could cause a massive infection of the population of many Asian countries against the backdrop of the traditional growth of tourism in this period of the year.

The Japanese yen responded to the decision of the Central Bank and the weakening of the local stock market with an increase in the rate, which can be described as a reaction not only to the predictability of the central bank, but also to the fear of the spread of the "Chinese SARS virus."

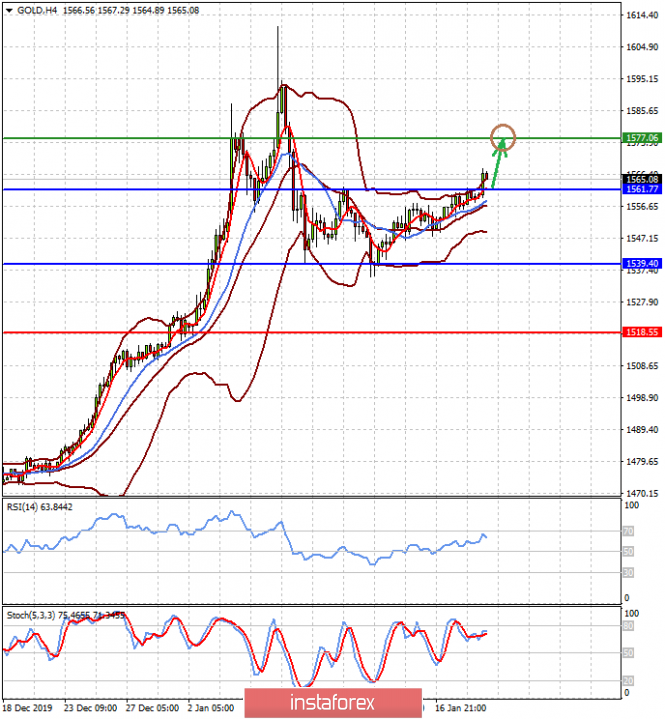

In turn, the negative reaction in Asian stock markets led to an increase in demand for gold, which resumed growth, having previously found support at 1539.40. The single currency paired with the US dollar is growing slightly ahead of the ECB meeting on monetary policy. As expected, it will not bring any changes in rates. As a result, investors are only waiting for the announcement of the new strategic plan of the regulator by its head C. Lagarde.

A similar picture is observed in the dynamics of the British currency, which remains hostage to the denouement of Britain's exit from the EU. A vote on which is scheduled for January 31 this year. Thus, we expect some revival of the sterling movement in the market amid the publication of data on employment and average wages, which will be released today. According to the forecasts, the unemployment rate should remain at around 3.8%, the number of applications should decline to 22,600 from 28,800 while the average wage level should drop from 3.2% to 3.1%.

In general, evaluating the overall picture in the markets, we believe that there will be no noticeable changes in the dynamics of assets today.

Forecast of the day:

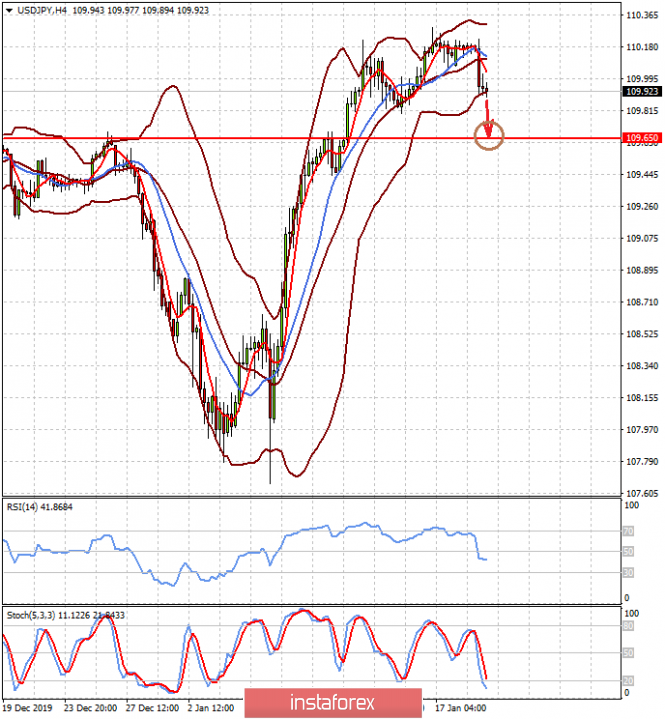

The USD/JPY pair is correcting down amid the outcome of the meeting of the Central Bank of Japan and the decline in the local stock market. Thus, we expect that the pair can adjust to a strong support level of 109.65.

Gold on the spot continues to climb after a recent correction. We expect that moderate demand for the "yellow" metal will continue and it will resume growth by 1577.00 after a slight correction down to 1561.77. But for this to happen, the price should stay above this level.