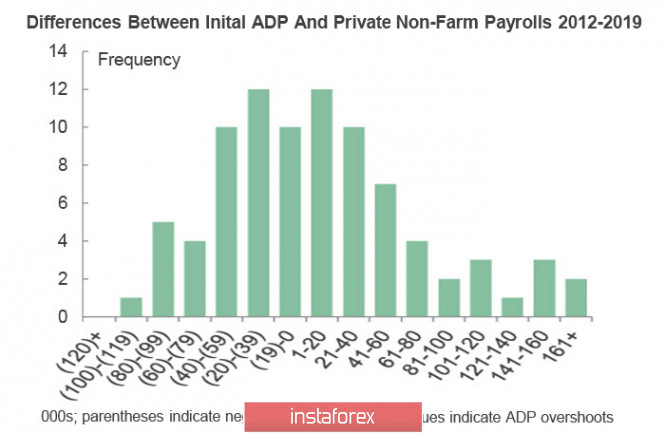

The report on private sector employment from ADP was disappointing, contrary to the forecast of 140 thousand, jobs only increased by 67 thousand, which casts doubt on the attainability of the result of 180 thousand for non-farms, which will be published on Friday. There was only one case when non-farms exceeded the result of ADP by 100 or more thousand Since 2012. Therefore, a high result from non-farms should not be expected.

Moreover there is negativity on the weaker report of ADP which came from a weaker than forecast ISM report on the service sector. In November, 53.9p is higher than the boundary of the expansion zone, but it should be bear in mind that ISM has been slowing for 13 months after the peak reached in October 2018, which, combined with a slowdown in the manufacturing sector, casts doubt on the ability of the US economy to overcome crisis trends without additional incentives.

Stock indices, in turn, closed in positive territory. However, it was quite a technical pullback after a strong decline at the beginning of the week, and the chances of a resumption of the decline look high. Donald Trump also added a little positivity, who announced that negotiations with China are going very well during the NATO summit in London, which he actually canceled his statement last Tuesday regarding the possibility of continuing trade tensions until the next presidential election.

On the other hand, more expensive oil and the decision of the Bank of Canada to leave the rate at the current level also contributed to the increased demand for risk, but there is quite a high probability that the market will forget positive signals quite soon, as problems in the US economy are growing. Nonetheless, an employment report will already confirm this conclusion the next Friday.

EUR/USD

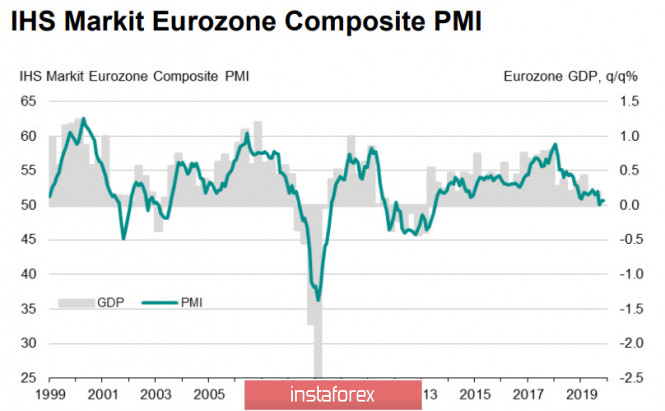

The eurozone economy is attempting to push itself from the bottom, although frankly, it is still far away to the bottom. The Markit index of business activity in the service sector increased in November from 51.5p to 51.9p and composite index from 50.3p to 50.6p. Both indicators were ultimately higher than forecasts and were confirmed by previously published studies from ZEW and Ifo.

At the same time, country data came out mixed and do not give a clear picture of the reversal - if Spain and Germany are making attempts to continue growth, then Italy and France are still slowing down. So far, the euro is trading in the range, and even a weak ISM did not help.

Today, Eurostat will publish the updated data on GDP and employment in the 3rd quarter. In addition, retail sales for October will also be released. Thus, the chances of leaving the range before the publication of the US employment report on Friday are low.

EUR/USD is trading near the level of 1.1100. Breaking above will indicate the next target of 1.1180, although the long-term trend is still negative, and for the forecasts of most banks to confirm the growth of the euro in 2020, it is necessary to exit above 1.12.

GBP/USD

The pound continues to climb and reached a seven-month high, as the markets have firmly established confidence that the conservatives will win a full victory in the December 12 elections.

However, data on business activity in November did not have a noticeable effect on the pound, despite the fact that there was a slight increase in all sectors, including the construction sector, which is in stagnation near 10-year lows.

The pound will also be mainly controlled by surveys in the coming days, since the nearest significant macroeconomic data will be published on December 10 only.

Technically, the pound remains in the upward channel and the forecast is bullish. Closing above 1.30 led to a breakthrough of the "bull flag" pattern. Meanwhile, the closest resistance level is in the zone of 1.3170 / 90, and the target is an annual maximum of 1.3380. Corrective pullback is possible to 1.3050, and thus, attempts to reduce will be used by the market for new aggressive purchases.

The material has been provided by InstaForex Company - www.instaforex.com