Thanksgiving Day celebrations in the United States and the lack of economic data have contributed to a decrease in volatility. On Monday morning, trading was mixed, demand for risk revived a bit after China published a PMI report in manufacturing and services which turned out to be better than expected. Today, a similar index will be published in the eurozone while ISM Manufacturing will be released in the evening. The publication of which can bring markets out of a dormant state. Now, if the US data is also positive, we can expect an increase in demand for risk and generally increase in volatility.

USD/CAD

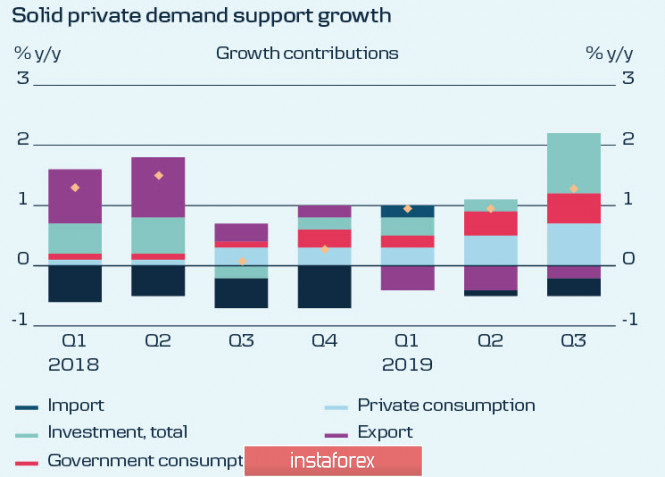

The Canadian dollar continues to trade in the range, having no idea how to exit from it. The GDP in the 3rd quarter recorded a growth 0.3%, which is noticeably lower than 1.0% a quarter earlier, but the recession threat is still far away. Investment in business, in turn, grew by 2.6%, which is the fastest growth in 2 years. At the same time, the growth of household spending also accelerated.

The loonie increased after the announcement of the termination of the strike on the railway was temporary, technically, the Canadian looks neutral. The rapid growth of USD/CAD, which began on October 29, increases the risk of correction, but there are not enough reasons to start it. Meanwhile, China sees Trump's signing of the Hong Kong Riots Act as an interference in internal affairs, which increases the chances that the signing of the first phase of the trade agreement this year may not take place, and this may lead to the end of the rally in the stock markets and an increase in the demand for protective assets.

Thus, the chances of leaving below supports 1.3275 and 1.3258 are small. What is a little more likely is an attempt to test the resistance at 1.3313 / 27 for strength, but in any case, we need new strong introductory indicators to count on pronounced movement.

USD/JPY

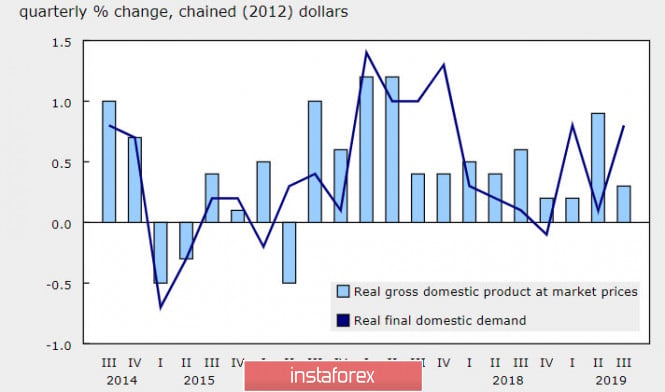

Despite the slowdown in world trade and the difficulties with the growth of manufacturing sectors in most countries, Japan has seen steady growth in domestic demand. Exports declined in October again, which was also due to the strong yen.

From October 1, VAT was increased from 8 to 10%. The last time this happened, the Japanese economy moved straight into recession, so certain measures were taken to reduce threats to private demand. The steady state of the labor market, despite stagnating average wage growth, maintains high incomes and also has an increasing effect on demand.

However, the underlying fears for the government are still strong. Weak global demand, low inflation, fears of an economic downturn after the Olympics and the risks for private domestic demand due to higher VAT create the preconditions for a record budget deficit in fiscal 2020.

On the other hand, the Bank of Japan is still in standby mode. External demand persists, while the yen has not yet reached threatening levels. A strong yen will help reduce inflation. At a meeting in October, the Bank of Japan promised to keep the rate at the current or lower level, and Kuroda assured that the bank would be ready to take mitigation measures at the next meeting, if necessary. The markets are not particularly impressed - the yen continues to strengthen.

Nevertheless, attempts are being made to limit the growth of the yen. In October, the Bank of Japan stopped buying all government bonds with a maturing for more than three years, and will most likely attempt to straighten the yield curve.

In any case, the yen is currently stable, and there is no reason for a sharp decline. Resistance 109.73 will stand if the threat of a renewed tariff war between China and the United States becomes more pronounced. In the meantime, the markets are relatively calm, the move to the next peak at 110.45 / 55 looks more likely.

The material has been provided by InstaForex Company - www.instaforex.com