Forecast for December 19:

Analytical review of currency pairs on the scale of H1:

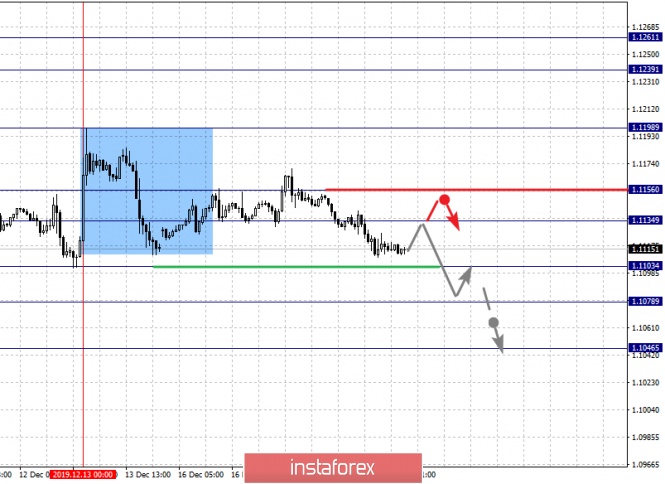

For the euro / dollar pair, the key levels on the H1 scale are: 1.1261, 1.1239, 1.1198, 1.1156, 1.1134, 1.1103, 1.1078 and 1.1046. Here, the price is in the correction zone from the ascending structure on November 29. Meanwhile, consolidated movement is expected in the range of 1.1134 - 1.1156. The breakdown of the latter value will lead to movement to the level of 1.1198. Price consolidation is near this level. The breakdown of the level of 1.1200 will allow you to count on movement towards a potential target - 1.1261, upon reaching this level, we expect consolidation in the range of 1.1261 - 1.1239.

Short-term downward movement is expected in the range 1.1103 - 1.1078. The breakdown of the latter value will have the downward structure development on December 13. In this case, the potential target is 1.1046.

The main trend is the upward structure of November 29, the correction stage

Trading recommendations:

Buy: 1.1134 Take profit: 1.1154

Buy: 1.1158 Take profit: 1.1196

Sell: 1.1103 Take profit: 1.1080

Sell: 1.1076 Take profit: 1.1046

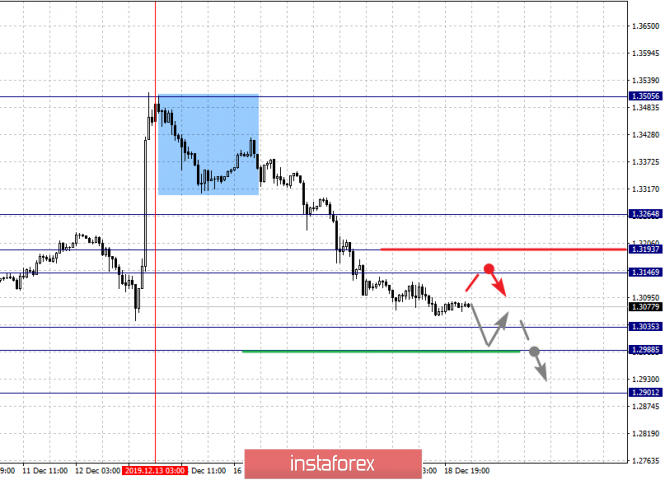

For the pound / dollar pair, the key levels on the H1 scale are: 1.3264, 1.3193, 1.3146, 1.3035, 1.2988 and 1.2901. Here, we are following the development of the downward cycle of December 13. Short-term downward movement is expected in the range 1.3035 - 1.2988. The breakdown of the latter value will allow us to count on movement to a potential target - 1.2901, when this level is reached, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 1.3146 - 1.3193. The breakdown of the last value will lead to a long correction. Here, the target is 1.3264. This level is a key support for the downward structure.

The main trend is the descending cycle of December 13

Trading recommendations:

Buy: 1.3146 Take profit: 1.3190

Buy: 1.3195 Take profit: 1.3264

Sell: 1.3035 Take profit: 1.2990

Sell: 1.2986 Take profit: 1.2903

For the dollar / franc pair, the key levels on the H1 scale are: 0.9915, 0.9870, 0.9845, 0.9789 and 0.9745. Here, we are following the development of the downward structure of November 29. The continuation of movement to the bottom is expected after the breakdown of the level of 0.9789. In this case, the potential target is 0.9745. We expect a rollback to correction from this level.

Short-term upward movement is possibly in the range of 0.9845 - 0.9870. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9915. This level is the key support for the downward structure of November 29.

The main trend is the downward structure of November 29

Trading recommendations:

Buy : 0.9845 Take profit: 0.9870

Buy : 0.9872 Take profit: 0.9913

Sell: 0.9786 Take profit: 0.9745

Sell: Take profit:

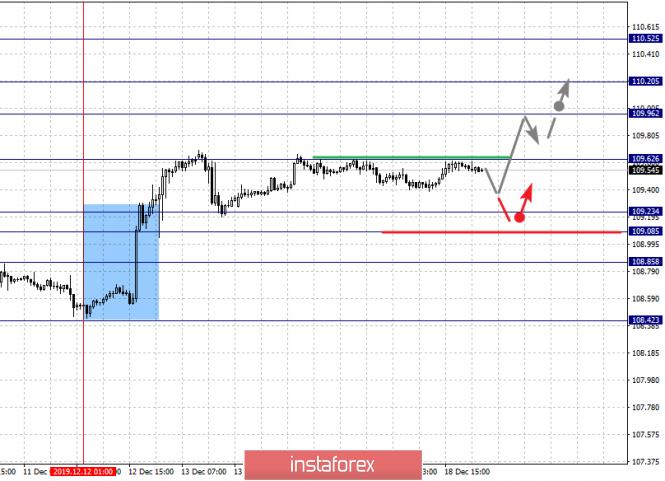

For the dollar / yen pair, the key levels on the scale are : 110.52, 110.20, 109.96, 109.62, 109.23, 109.08 and 108.85. Here, we are following the formation of the initial conditions for the top of December 12. The continuation of the movement to the top is expected after the breakdown of the level of 109.62. In this case, the target is 109.96. We expect a short-term upward movement, as well as consolidation in the range of 109.96 - 110.20. For the potential value for the top, we consider the level of 110.52. Upon reaching which, we expect a rollback to the correction.

Short-term downward movement is expected in the range 109.23 - 109.08. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 108.85. This level is the key support for the upward structure from December 12.

Main trend: initial conditions for the top of December 12

Trading recommendations:

Buy: 109.63 Take profit: 109.96

Buy : 109.98 Take profit: 110.20

Sell: 109.23 Take profit: 109.08

Sell: 109.06 Take profit: 108.85

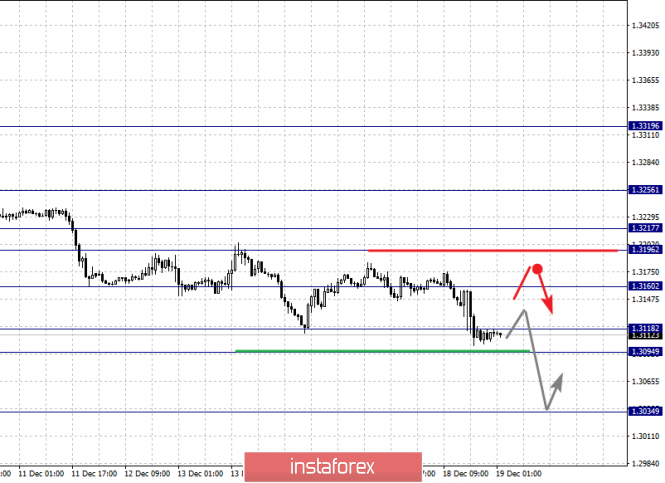

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3256, 1.3217, 1.3196, 1.3146, 1.3118, 1.3094 and 1.3034. Here, we continue to monitor the long-term descending structure of December 3. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3146. Here, the target is 1.3118. Price consolidation is in the range of 1.3118 - 1.3094. For the potential value for the bottom, we consider the level of 1.3034. Upon reaching which, we expect a pullback to the top.

A correction can be possibly made after the breakdown of the level of 1.3160. Here, the target is 1.3196. The range of 1.3196 - 1.3217 is the key support for the downward structure. Its passage at the price will be conducive to the development of the upward movement. Here, the potential goal is 1.3256.

The main trend is the long-term descending structure of December 3

Trading recommendations:

Buy: 1.3160 Take profit: 1.3196

Buy : 1.3218 Take profit: 1.3252

Sell: Take profit:

Sell: 1.3092 Take profit: 1.3040

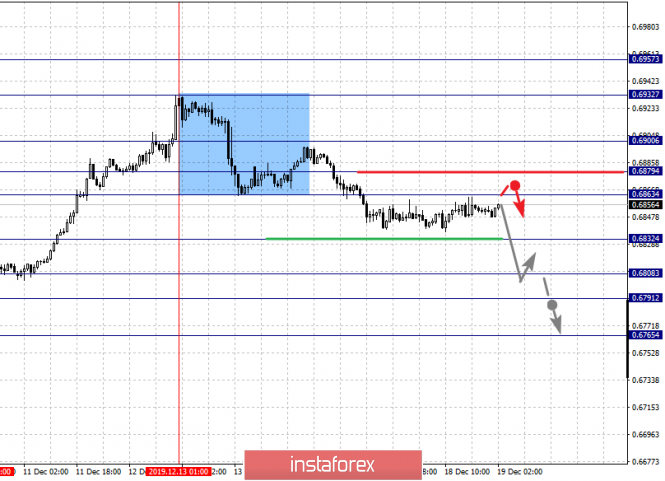

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6957, 0.6932, 0.6900, 0.6879, 0.6863, 0.6832, 0.6808, 0.6791 and 0.6765. Here, the price is in an equilibrium situation: the ascending structure of December 10 and the descending of December 13. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6832. In this case, the target is 0.6808. Short-term downward movement, as well as consolidation is in the range of 0.6808 - 0.6791. For the potential value for the bottom, we consider the level of 0.6765. Upon reaching which, we expect a pullback to the top.

Short-term downward movement is expected in the range of 0.6863 - 0.6879. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6900. This level is a key support for the downward structure. Its breakdown will lead to a pronounced movement. Here, the first goal is 0.6932.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 0.6863 Take profit: 0.6876

Buy: 0.6880 Take profit: 0.6900

Sell : 0.6832 Take profit : 0.6808

Sell: 0.6807 Take profit: 0.6793

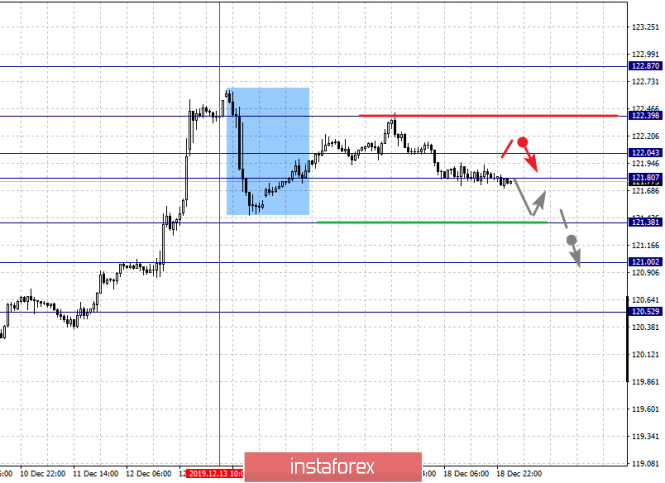

For the euro / yen pair, the key levels on the H1 scale are: 122.87, 122.39, 122.04, 121.80, 121.38, 121.00 and 120.52. Here, the price is in correction from the rising structure on December 9 and forms the potential for the bottom of December 13. The continuation of the movement to the bottom is possibly after the breakdown of the level of 121.38. Here, the first goal is 121.00. Price consolidation is near this level. The breakdown of the level of 121.00 will lead to a pronounced downward movement. Here, the potential target is 120.52.

Consolidated movement is possibly in the range of 121.80 - 122.04. The breakdown of the last value will have the subsequent development of an upward trend, where the first goal is 122.39. This level is the key resistance for the top.

The main trend is the upward structure of December 9, the correction stage

Trading recommendations:

Buy: 122.41 Take profit: 122.85

Buy: Take profit:

Sell: 121.38 Take profit: 121.05

Sell: 121.00 Take profit: 120.60

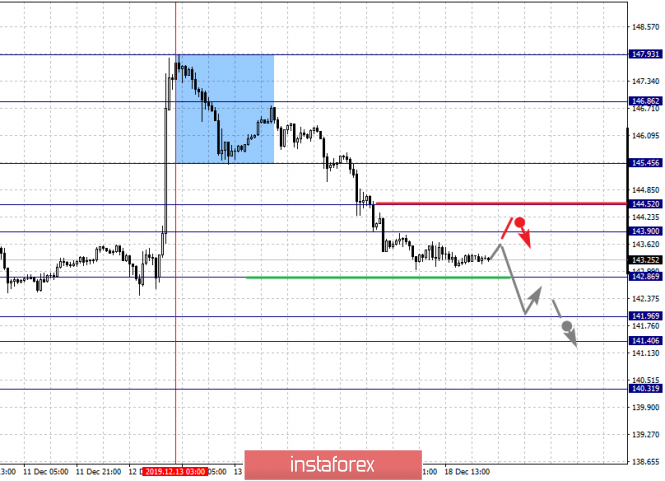

For the pound / yen pair, the key levels on the H1 scale are : 145.45, 144.52, 143.90, 142.86, 141.96, 141.40 and 140.31. Here, we are following the development of the downward cycle of December 13. The continuation of the movement to the bottom is expected after the breakdown of the level of 142.86. In this case, the goal is 141.96. Short-term downward movement, as well as consolidation is in the range of 141.96 - 141.40. For the potential value for the bottom, we consider the level of 140.31. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 143.90 - 144.52. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 145.45. This level is a key support for the descending cycle of December 13.

The main trend is the descending cycle of December 13

Trading recommendations:

Buy: 143.90 Take profit: 144.50

Buy: 144.60 Take profit: 145.40

Sell: 142.84 Take profit: 142.00

Sell: 141.40 Take profit: 140.35

The material has been provided by InstaForex Company - www.instaforex.com