Two reports came out in the morning that weighed on the European currency. First of all, the weakness of industrial production, which has been observed throughout the year, continued to pull down the economy into recession. It is impossible not to mention German inflation, which declined in November this year, which creates a number of problems for the European Central Bank to stimulate growth.

Most likely, the measures that were introduced in the early fall of this year, and we are talking about lowering the deposit rate and returning to the bond redemption program, are clearly not enough to renew inflationary pressures. The final meeting of the European Central Bank for this year will take place today, at which, apparently, rates will also remain unchanged at zero. It is unlikely that by the end of the year the European regulator will make any significant changes in the course. However, it is expected that the ECB will be forced to continue lowering rates in the first quarter of 2020 if the measures that were taken in the early fall of this year do not bring a gentle result. So far, no special economic recovery has been observed.

As I noted above, the problems of the industrial sector did not end, and judging by the report, they only worsened. Recent data from the Purchasing Managers Index for the manufacturing sector, which is a leading indicator, only confirmed a further decline in production at the end of this year.

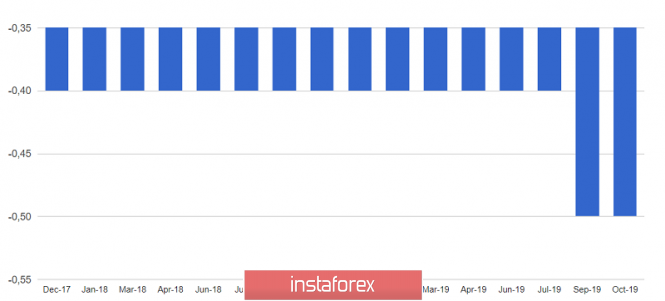

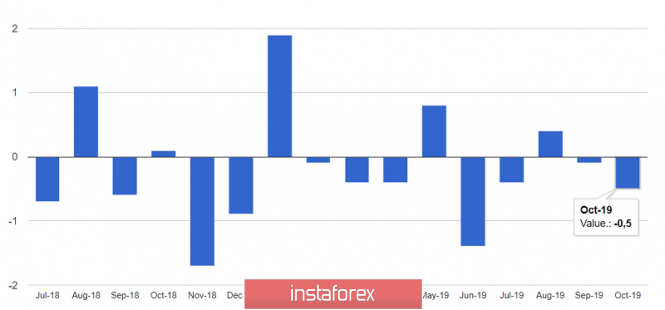

According to a report by the statistics agency Eurostat, industrial production in the eurozone decreased by 0.5% in October of this year compared with September, and immediately fell by 2.2% compared to October last year. The data were slightly worse than economists' forecasts. According to revised data, production also declined in September, but only by 0.1%, completely erasing the expectations of traders for restoration in the future. Production in the eurozone also declined in the second and third quarters of this year, and, most likely, the reduction will be observed in the fourth quarter.

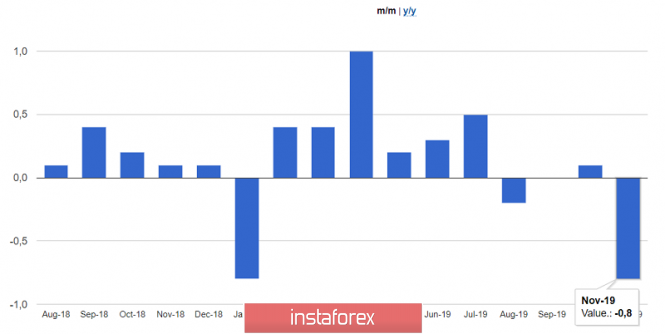

German inflation data did not put much pressure on the euro, as it was completely predicted by economists. According to the report, the final CPI of Germany in November this year decreased by 0.8% compared with October and grew by only 1.1% compared to the same period in 2018, which clearly does not reach the level of about 2.0% established by the European Central Bank. The data completely coincided with the forecasts of economists. As for Germany's consumer price index, harmonized by EU standards, it also decreased by 0.8% in November this year compared with October and grew by only 1.2% compared to last year, which fully coincided with the forecasts of economists.

As for the technical picture of the EURUSD pair, the growth can continue only on condition of positive statements from the new president Christine Lagarde. A break of resistance at 1.1160 will provide risky assets with an upward movement to the highs of 1.1200 and 1260. If the pressure on the euro returns, intermediate support will be in the area of 1.1120, but larger levels are concentrated at the lower boundaries of the channel in the areas of 1.1070 and 1.1030.

The material has been provided by InstaForex Company - www.instaforex.com