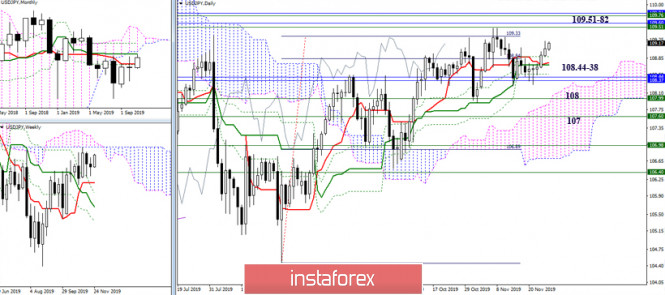

USD / JPY

Earlier, the yen has developed a 100% target for the breakdown of the daily cloud, which was strengthened by the accumulation of very strong and significant levels from different time intervals 109.51 - 109.82 (weekly cloud + monthly medium-term trend + lower border of the monthly cloud). Breaking through the encountered zone of resistance can open up great upward prospects, and thus, players on the upside should not abandon their hopes and desires. The closing of November is approaching, if the bulls manage to maintain and fix their optimism on the monthly candle in November, then attempts to fight for these resistance in December will most likely continue. Now, 108.70-75 (daily cross) and 108.44-38 (monthly Tenkan + Fibo Kijun) should be noted as the supports. Consolidation below will indicate the formation of rebound from the resistance encountered, led by a monthly medium-term trend (109.59), which may lead to a longer change in moods and priorities of the movement. In this case, a downward cloud and a downward correction to the weekly gold cross support (Tenkan 108.00 + Kijun 106.98) will appear in the players' field of interest.

EUR/JPY

The development of the situation with the priority of bullish moods was postponed by the meeting with the zone of influence of the monthly short-term trend (121.65). As a result, all of November, relying on the support of the daily and weekly Ichimoku crosses, the pair is trying to maintain the status quo and hold on to the prevalence of bullish sentiments and priorities. In this case, 121.65 (monthly Tenkan), 122.58 - 123.33 (target for the breakdown of the daily cloud) and 123.71 - 124.10 (lower boundaries of the monthly and weekly clouds) remain the upward reference points. The supports now form a wide area, including the daily cloud and the weekly dead cross Ishimoku (119.58 - 118.65). Consolidation below will serve as a good start for the formation of rebound from the monthly short-term trend (121.65), and the successful implementation of rebound, through the exit from the correction zone (115.84), will help to restore the monthly downward trend.

GBP/JPY

The October activity of the players on the upside supported the pair to break through many significant levels and reach the most important resistance of this area 140.34 - 141.54 (weekly cloud + monthly medium-term trend). The strength and significance of the resistance holds back the development of the current situation throughout November. Thus, the breakdown of the zone and reliable consolidating above promises players to increase good prospects. In this case, the closest reference points will be an increase to the final boundary of the monthly dead cross Ichimoku (145.10) and the formation of an ascending target for the breakdown of the weekly cloud. However, the failure of the bulls and the weakening of their positions can return to the market bearish sentiment very quickly. At first, the players on the downside will seek to take advantage of the monthly short-term thread (138.00), and then they may even be confused by the change in the current situation, for which they implement a downward correction to the support of the weekly cross, now it is 135,80 – 134,03 – 132,28, which will allow them to form a full retreat from the resistances encountered, with good future prospects.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com