4-hour timeframe

Technical data:

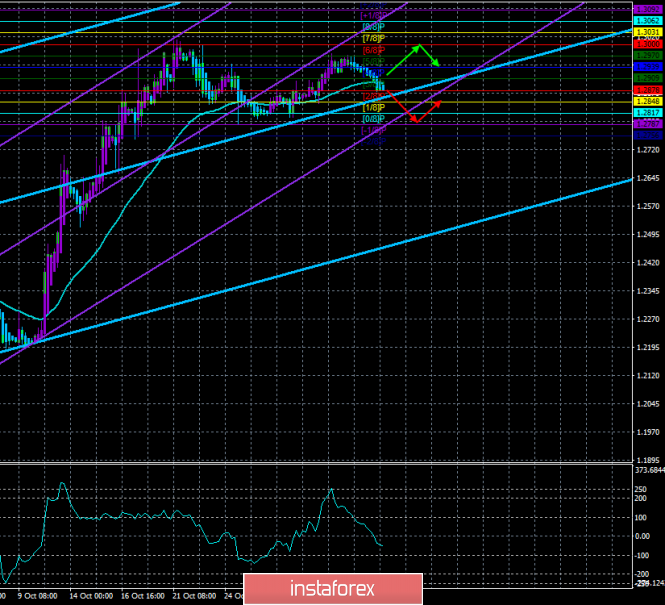

The upper channel of linear regression: direction – upward.

Junior channel of linear regression: direction – upward.

The moving average (20; smoothed) – sideways.

CCI: -54.2849

On Monday, November 4th, the British pound showed its inability and unwillingness to continue the upward movement. We have repeatedly said that the growth of the pound by more than 800 points, and its two-week stay near local highs without a strong downward correction is not fully justified, from a fundamental point of view. As we have repeatedly reported, the growth of 800 points occurred after the foreign exchange market received information from the Prime Minister of Ireland Leo Varadkar and Prime Minister of Great Britain Boris Johnson about the high probability of signing a "deal" between the European Union and Britain. However, what is the practical use of this "deal" if it is blocked by the Parliament for the fourth time? Now, a month later, elections will be held, which is far from the fact that they will bring an unambiguous victory to Boris Johnson, which will allow him, bypassing the Labor and other opposition forces, to implement his Brexit. Moreover, the Labor Party can cooperate with other parties to again prevent the conservatives from the possibility of implementing a "divorce" from the European Union. Thus, if the pound resumes falling now, simply against the background of the absence of favorable changes in the political sphere of Great Britain, not to mention the economic, this will not be at all surprising.

Meanwhile, Boris Johnson is confident of winning the election on December 12. If his expectations are met, he will immediately put to a vote the draft agreement on leaving the EU. This is what he told Labor leader Jeremy Corbyn in a letter. "We will leave the European Union by the end of January on a deal that has already been agreed with Brussels," the letter said. Johnson also asked Corbyn whether the Labor leader would have attempted to sign a new agreement with the EU if he had won the election and whether it would have been put to a national referendum? Also, Johnson is interested in the question of whether the Labor party will support the abolition of Brexit if none of the parties receives the necessary majority in Parliament? Interesting questions, since they are traced precisely to the Prime Minister's uncertainty about the outcome of the December vote.

While the leaders of the Conservatives and the Labor Party have a nice conversation with each other, the new Speaker of the House of Commons elected the representative of the Labor Party, Sir Lindsay Hoyle, who previously served as Deputy Speaker. A rather interesting reshuffle ahead of the new Brexit parliamentary vote. Now the "lead the process" will be the laborer. However, already on November 6, that is tomorrow, the Parliament will be dissolved (the necessary five weeks before the election), so the new speaker will fulfill his duties only two days with the current composition and convocation of the Parliament.

In the UK, the index of business activity in the services sector will be published today. And when we wrote a little above that the economic component is even less likely to support the pound, we had in mind the macroeconomic statistics from the UK. In most countries experiencing problems with business activity in the manufacturing sector, the services sector is fine. This applies to the European Union and America. However, in the UK even this index was in the "red zone" last month, and this, according to experts, is likely to remain there. The forecast is 49.7. Thus, it is not necessary to count on the fundamental support of the British currency today, and the technical picture indicates a change in the direction of the trend to a downward one. However, in recent days, volatility in the pound is frankly weak, so we do not expect a strong decline in the pound/dollar pair today either. Both channels of linear regression retain the likelihood of a resumption of the upward trend.

Nearest support levels:

S1 – 1.2878

S2 – 1.2848

S3 – 1.2817

Nearest resistance levels:

R1 – 1.2909

R2 – 1.2939

R3 – 1.2970

Trading recommendations:

The GBP/USD currency pair settled below the moving average line. So traders can now consider selling the pound with targets of 1.2848, 1.2817, and 1.2787. We would not recommend doing this in large volumes, as both trend channels of linear regression remain directed upwards. At the same time, we believe it is more preferable to the downward movement of the pair in the coming days.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue lines of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com