In the oil market in early November, what was supposed to happen began to happen. Prices went up and reached a weekly high. When the growth rate of US production of black gold is reduced, and OPEC+ adheres to the conditions of the Vienna agreement, the prospects of Brent and WTI begin to depend on the dynamics of global demand. At the same time, progress in trade relations between the US and China was supposed to lead to an increase in futures quotes in October. But it didn't. Investors were worried not only about the world, but also about US oil demand.

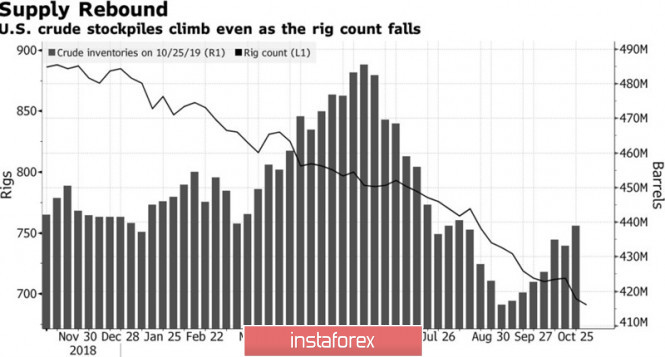

When supply of black gold in the United States increased over seven of the last eight weeks, and macroeconomic statistics indicate a slowdown in GDP, think about the decline in US interest in oil. As soon as the understanding comes that not everything is as bad as is commonly believed, the bulls go on the attack. So it was after the publication of the report on the state of the US labor market in October. Employment outside the agricultural sector increased by more than 120 thousand with a forecast of +89 thousand, data for August and September were revised upward. The consumer in the United States is still strong and will show a high demand for oil products, which, with the number of drilling rigs from Baker Hughes falling to the lowest level since April 2017, allowed Brent and WTI to add more than 3.5% to their value per day.

The dynamics of US oil reserves and the number of rigs

According to the latest OPEC forecasts, the cartel will gradually lose its market share. Its production in 2024 will be 32.8 million bpd. The indicator is not far from current levels, so it can be assumed that the Vienna agreement to reduce production will be prolonged not only in 2020, but also in subsequent years. OPEC believes that the US indicator over the next five years will grow from 12 million b/d to 16.9 million b/d and will peak at 17.4 million b/d in 2029. In my opinion, these estimates look too high. If in 2019, investments and the associated increase in the number of drilling rigs restrained the uncertainty surrounding the trade wars, then in 2020 the uncertainty will be associated with the presidential election in the United States. Despite a preventive cut in federal funds rates, a recession can still become a reality.

The situation with global demand, by contrast, will improve. The worst dynamics of Chinese GDP in three decades in the third quarter is forcing Beijing to increase fiscal and monetary stimulus. For the first time since 2016, Halyk Bank has reduced the medium-term lending rate from 3.3% to 3.25%, which should have a positive effect on both domestic demand and commodity prices.

Technically, on the Brent daily chart, the implementation of the Wolfe Wave and Double Bottom pattern continues. A breakthrough of resistance by $63.75 per barrel will increase the likelihood of continuing the rally to $71 and $73.3. Bulls will continue to control the situation on the North Sea oil market, at least until the futures quotes hold above $62 per barrel.

The material has been provided by InstaForex Company - www.instaforex.com